Ethereum and Binance Coin Struggle Against Bitcoin

While the overall cryptocurrency market experienced significant growth in 2023, the performance of altcoins compared to bitcoin has been less impressive. Ethereum, the second-largest cryptocurrency, saw a 24% decrease in value against bitcoin. Binance Coin also suffered, losing 50.55% of its value when measured against bitcoin.

Solana Soars, XRP and Cardano Decline

On the other hand, Solana experienced a remarkable surge of 877% against the dollar and 257% against bitcoin. XRP, however, faced a decline of about 30% against BTC, while Cardano saw a more modest decrease of approximately 6.54%.

Avalanche Emerges as a Contender

Avalanche, another notable cryptocurrency, showed a 43.55% increase against bitcoin over the year. This rise in value positions Avalanche as a potential competitor in the cryptocurrency market.

DOGE and Polkadot Face Setbacks

DOGE, the popular meme cryptocurrency, experienced a significant setback, losing 52.79% of its value against bitcoin. Polkadot also saw a decline of 22% over the same period.

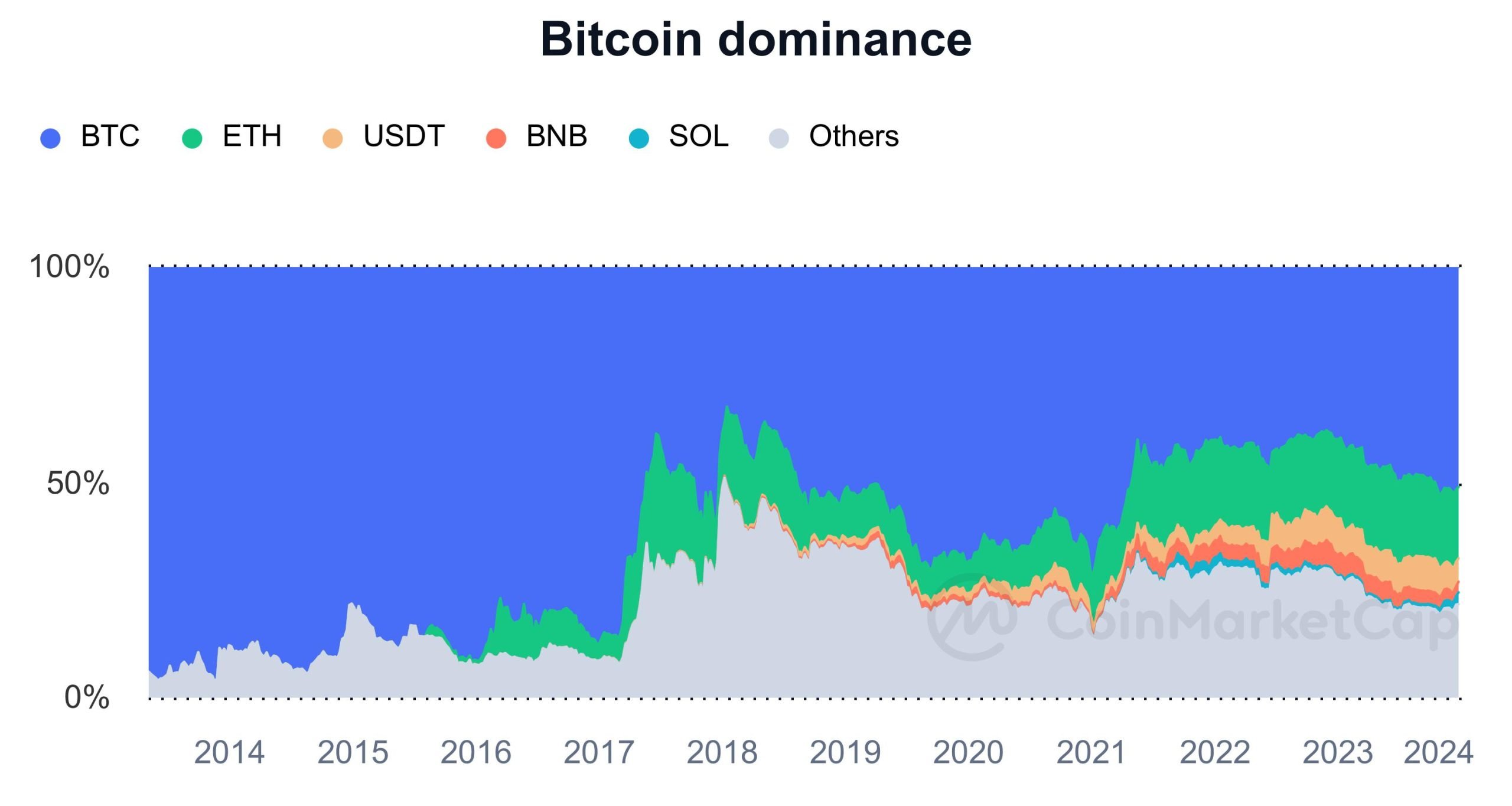

Bitcoin Dominance Increases

Bitcoin's dominance in the cryptocurrency market has risen from 39.9% in December 2022 to around 50% in December 2023. This indicates that bitcoin remains the leading cryptocurrency, despite the growth of altcoins.

Altcoin Season on the Horizon?

According to blockchaincenter.net's Altcoin Season Index, there are indications that an 'Altcoin Season' may be approaching. When the index score exceeds 75, it is officially considered an Altcoin Season. Currently, the score stands at 67, suggesting that altcoins may soon experience a period of growth.

What are your thoughts on the performance of top cryptocurrencies compared to bitcoin over the past year? Share your opinions in the comments section below.

Frequently Asked Questions

How does an IRA with gold or silver work?

An IRA that is gold or silver allows you the opportunity to invest in precious metals without paying tax on any gains. They make a great investment choice for those looking to diversify.

You do not have to pay income tax on interest earned from these accounts if you are over 59 1/2. Capital gains tax is not required for any appreciation in account value. There are limits on the amount of money that you can place into this account. The minimum amount that you can invest is $10,000. Under 59 1/2 years old, you can't make any investments. The maximum annual contribution is $5,000.

Your beneficiaries might not receive the full amount of your account if your death occurs before you retire. Your estate should contain sufficient assets to cover your account's remaining balance after paying any other expenses.

While some banks offer gold and/or silver IRA options to their customers, others require them to open a regular brokerage bank account that allows you to purchase certificates or shares.

What is the best way to make money with a gold IRA?

Yes, but not as much. It all depends on your willingness to take on risk. A $10,000 investment per year for 20 years could lead to $1 million by retirement age. However, if all your eggs are in one basket, then you will lose everything.

You need to diversify your investments. Inflation is a problem for gold. You should invest in an asset that increases with inflation. Stocks can do this well as they rise when profits are increased. This is also true of bonds. They pay interest each and every year. So they're great during times of economic growth.

But what happens if inflation is not present? In deflationary periods stocks and bonds both fall in value. This is why investors should not invest all of their savings in one investment, such a bond mutual fund or stock mutual fund.

Instead, they should invest in a mix of different funds. They could invest both in stocks and bonds, for instance. Or they could invest in both cash and bonds.

By doing so, they are exposed to both the positive and negative sides of the coin. Inflation and deflation. They will still see a return in time.

Can I put gold in my IRA?

The answer is yes! You can add gold to your retirement plan. Because it doesn't lose any value over time, gold is a great investment. It also protects against inflation. And you don't have to pay taxes on it either.

Before you decide to invest in gold, it is important to understand that it isn't like other investments. You cannot buy shares of companies that are gold, like stocks and bonds. Nor can you sell them.

Instead, you should convert your gold to cash. You will have to get rid. It is not possible to keep it.

This makes gold different from other investments. You can always sell other investments later. However, gold is different.

Even worse, you can't use the gold as collateral for loans. For example, if a mortgage is taken out, you may have to sell some of your gold in order for the loan to be paid.

So what does this mean? It's not possible to keep your gold for ever. You will have to sell it at some point.

You don't have to worry about this now. You only need to open an IRA account. Then you can invest your money in gold.

What are the 3 types of IRA?

There are three basic types for IRAs. Each type has its benefits and drawbacks. Each of these types will be described below.

Traditional Individual Retirement Account (IRA).

Traditional IRAs allow you to make pretax contributions to an account that allows you to defer taxes while still earning interest. Once you retire, withdrawals from the account are tax-free.

Roth IRA

Roth IRAs allow for you to make after-tax deposits into an account. The earnings are tax-free. When you withdraw funds from the account for retirement purposes, withdrawals are also exempted from tax.

SEP IRA

This is similar with a Roth IRA, but employees are required to make additional contributions. These extra contributions are subject to income tax but any earnings will grow tax-deferred again. When you leave your company, you may convert the entire amount into a Roth IRA.

What proportion of your portfolio should you have in precious metals

Investing in physical gold is the best way to protect yourself from inflation. You can invest in precious metals to buy into their future value, and not just the current price. You can expect your investment to increase in value with the rise of metal prices.

Any gains you make from investments that you hold onto for at least five year will be tax-free. After that time, capital gains taxes will be due. Our website has more information about how to purchase gold coins.

How do I choose an IRA?

The first step to finding an IRA for you is understanding your account type. This is regardless of whether you are looking to invest in a Roth IRA. You should also know how much money your have available to invest.

The next step is determining which provider fits your situation best. Some providers offer both accounts, while others specialize in just one type.

You should also consider the fees associated each option. Fees vary widely between providers and may include annual maintenance fees and other charges. For example, some providers charge a monthly fee based on the number of shares you own. Others charge only once per quarter.

What precious metals may I allow in my IRA?

The most common precious metal used for IRA accounts is gold. Also available as investments are bars and bullion gold coins.

Precious Metals are safe investments since they don’t lose value over the long-term. They are also an excellent way to diversify your investment portfolio.

Precious metallics include platinum, silver and palladium. These three metals are similar in their properties. Each one has its own uses.

Platinum is used to make jewelry, for example. Palladium is used to create catalysts. Silver is used to producing coins.

When deciding which precious metal to choose, consider how much you expect to spend on your gold. You might be better off buying gold that costs less per ounce.

Also, think about whether or not you wish to keep your investment secret. If you have the desire to keep your investment private, palladium might be the best choice.

Palladium can be more valuable than gold. It is also more rare. It is likely you will need to pay more.

The storage fees of gold and silver are also important factors to consider when making a decision between them. You store gold by weight. For larger quantities of gold, you will be charged a higher storage fee.

Silver can be stored by volume. Therefore, smaller amounts of silver will cost less.

Keep in mind all IRS rules when you store precious metals inside an IRA. This includes keeping track and reporting transactions to the IRS.

Statistics

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Silver must be 99.9% pure • (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

forbes.com

- Gold IRA, Add Some Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

takemetothesite.com

regalassets.com

How To

Precious Metals Approved By the IRA

IRA-approved valuable metals can be great investments. Various options can help diversify your portfolio and protect against inflation from gold bars to silver coins.

There are two types of precious metal investment products. Physical bullion products such bars or coins are considered to be physical assets, as they exist in tangible form. However, exchange-traded fund (ETFs), which are financial instruments, track the price movement of an underlying assets, such as gold, and can be purchased directly from the company issuing them. ETFs work just like stock exchange stocks and can be bought directly by the company issuing them.

There are many types of precious metals that you can purchase. While gold and silver are used in jewelry making and decoration, platinum and palladium are most commonly associated with luxury products. Palladium has a tendency to retain its value longer than platinum making it an ideal choice for industrial uses. While silver can also be useful in industrial applications, it is often preferred for decorative purposes.

Due to the high cost of refining and mining raw materials, physical bullion products are more expensive. But, they are generally more secure than paper currencies and provide buyers greater security. In particular, when the U.S. dollar is less powerful than it once was, consumers might lose confidence in the currency. In contrast, physical bullion products do not rely on trust between countries or companies. Instead, they are backed by governments and central banks, giving customers peace of mind.

The supply and demand for gold affect the price of gold. If demand rises, the price will increase. Conversely, if supply exceeds demands, the price will drop. This dynamic allows investors to profit when the gold price fluctuates. These fluctuations are good for investors who have physical bullion products as they get a better return on their investment.

Precious metals are not affected by interest rate changes or economic recessions, unlike traditional investments. The price of gold will rise as long as there is strong demand. In times of uncertainty, precious metals can be considered safe havens.

The most well-known precious metals are:

- Gold – It is the oldest form of precious metallic and is sometimes called “yellow material”. Gold is a household name but it is rare underground element. Most of the world's gold reserves are in South Africa, Australia, Peru, Canada, Russia, and China.

- Silver – Silver is second most valuable precious metal, after gold. Silver is mined from the earth's natural resources. Unlike gold, however, silver is typically extracted from ore rather than from rock formations. Due to its durability and conductivity as well as its resistance to tarnishing it is widely used for commerce and industry. The United States is responsible for 98% worldwide silver production.

- Platinum – Platinum is the third most valuable precious metal. It can be used to make high-end medical equipment, fuel cells, and catalytic converters. Platinum is also used in dentistry to make dental crowns, fillings, and bridges.

- Palladium – Palladium is fourth most valuable precious metal. Because of its strength as well as stability, its popularity is increasing rapidly among manufacturers. Palladium is also used in electronics, automobiles, aerospace, and military technology.

- Rhodium – Rhodium is the fifth most valuable precious metal. Rhodium is an extremely rare metal. However, its use for automotive catalysts makes it highly desirable.

- Ruthenium: Ruthenium is sixth most valuable precious metallic. There are limited quantities of platinum and palladium. However, ruthenium is abundant. It is used for steel manufacturing, chemical manufacturing, and aircraft engines.

- Iridium – Iridium ranks seventh in the list of most valuable precious metals. Iridium is a key component in satellite technology. It is used to build satellites orbiting that transmit television signals, phone calls, and other communications.

- Osmium (Osmium) – Osmium has the eighth highest value precious metal. Because of its extreme temperature resistance, Osmium is often used in nuclear reactors. Osmium is used in medicine, cutting tools, jewelry, as well as medicine.

- Rhenium – Rhenium has been ranked as the ninth most valuable precious metallic. Rhenium can be used to refine oil and gas, make semiconductors and rocketry.

- Iodine — Iodine has the highest value of all precious metals. Iodine is used in photography, radiography, and pharmaceuticals.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin's Performance Outshines Altcoins in 2023 Despite Market Growth

Sourced From: news.bitcoin.com/altcoin-fortunes-declined-when-paired-against-btc-in-2023-despite-crypto-market-surge/

Published Date: Wed, 27 Dec 2023 20:30:22 +0000