Bitcoin, often dubbed as "exponential gold" by Jurrien Timmer, Fidelity’s Director of Global Macro, is making significant waves as an emerging player in the realm of store of value assets. Timmer's recent statements shed light on Bitcoin's evolving role in the financial ecosystem, emphasizing its unique characteristics and growth potential.

Bitcoin's Unique Position and Growth Trajectory

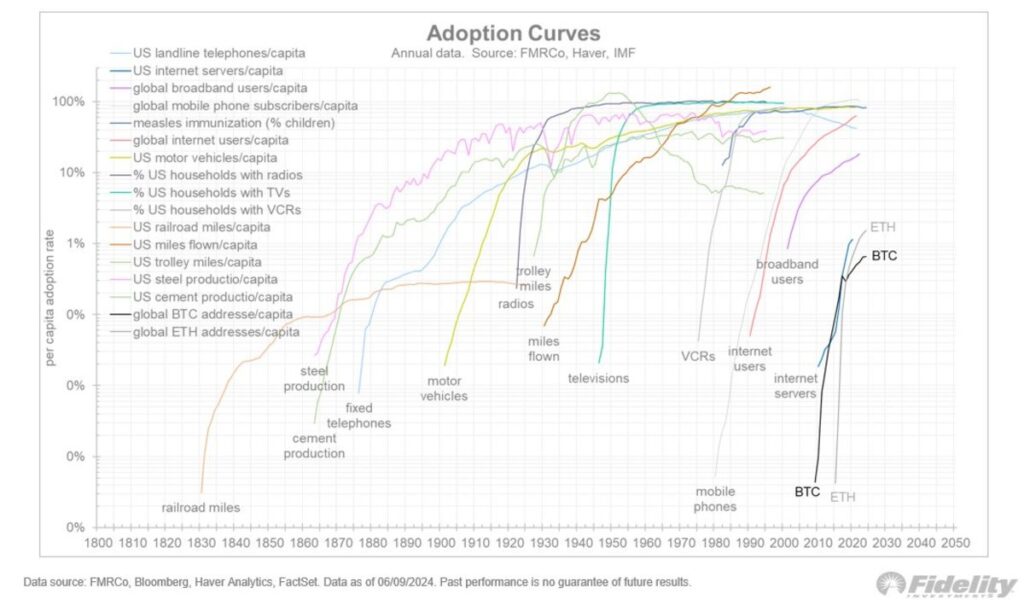

Timmer highlighted Bitcoin's distinctive position in the market, drawing parallels between its growth trajectory and the exponential adoption curves witnessed in revolutionary technologies such as the internet and mobile phones. He underscored the significance of Bitcoin's scarcity and its increasing acceptance as a digital asset, positioning it as a potential long-term store of value comparable to gold.

The Role of Adoption Rate and Network Growth

In his insightful posts, Timmer emphasized the importance of Bitcoin's adoption rate and network growth in determining its valuation. While acknowledging that Bitcoin is still in its nascent stages compared to traditional assets, he noted the accelerating rate of adoption, hinting at Bitcoin's potential to establish itself as a significant store of value in the future.

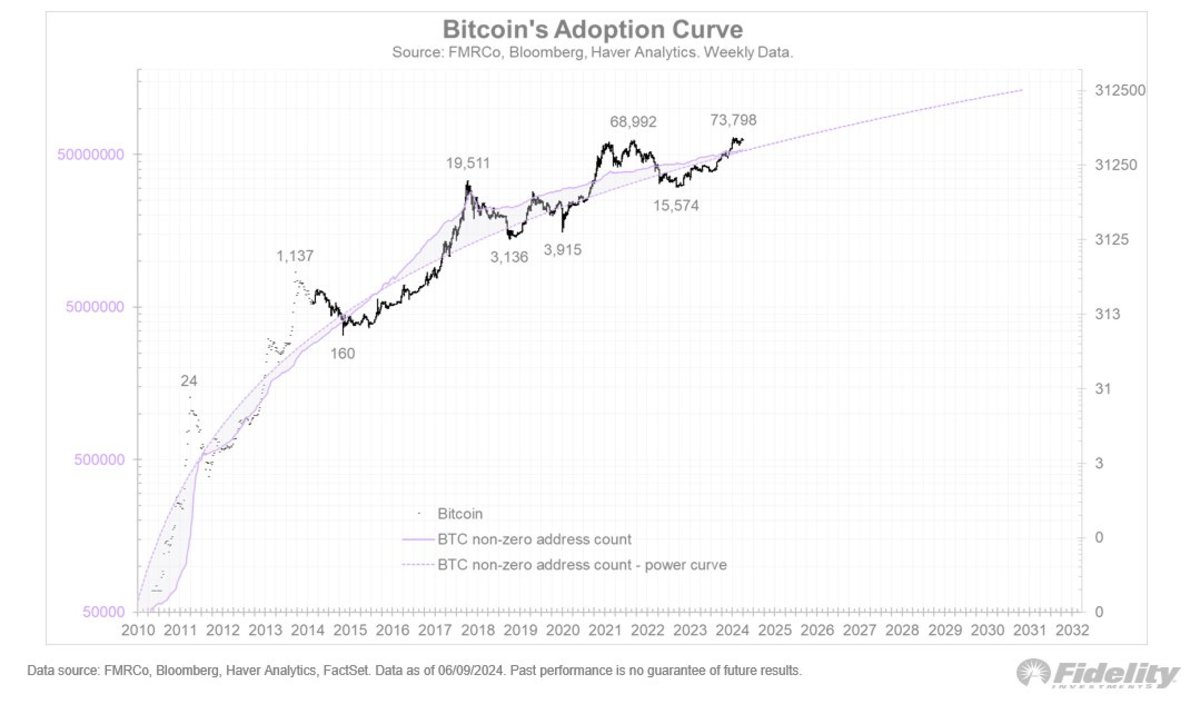

"The chart below illustrates Bitcoin's expanding network following a simple power curve. The increasing number of non-zero addresses aligning with this curve, with Bitcoin's price fluctuating around it akin to a pendulum," Timmer explained. "This pattern showcases Bitcoin's unique series of boom-bust cycles."

Institutional Recognition and Future Investment Strategies

Timmer's endorsement of Bitcoin reflects a broader trend among institutional investors acknowledging the cryptocurrency's potential. His perspective further solidifies Bitcoin's credibility within the financial sector, hinting at its potential to play a pivotal role in future investment strategies.

"While the growth of Bitcoin's network has shown a slowdown in recent months, its price continues to surge," Timmer concluded. "The divergence between price and adoption rates could elucidate why Bitcoin's pace has slightly decelerated on its path to potential new all-time highs. For sustained growth, the network might need to undergo another phase of acceleration."

CFTC

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's not legal – WSJ

How To

The best way to buy gold (or silver) online

You must first understand the workings of gold before you can purchase it. It is a precious metal that is very similar to platinum. It's rare and often used to make money due its resistance and durability to corrosion. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types currently available: legal tender and bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They aren't circulated in any currency exchange systems. For example, a person who buys $100 worth or gold gets 100 grams. This gold has a $100 price. Each dollar spent by the buyer is worth 1 gram.

When you are looking to purchase gold, the next thing to know is where to get it. There are many options for buying gold directly from dealers. First, your local currency shop is a good place to start. You can also go to a reputable website such as eBay. You can also look into buying gold online from private sellers.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. Private sellers typically charge 10% to 15% commission on each transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This is a great option for gold investing because you have more control over the item’s price.

Another option for buying gold is to invest in physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. These are small businesses that let customers borrow money against the items they bring to them. Banks typically charge higher interest rates than pawn shops.

Finally, another way to buy gold is to simply ask someone else to do it! Selling gold is simple too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: Bitcoin: The New Exponential Gold in the Financial Landscape

Sourced From: bitcoinmagazine.com/markets/bitcoin-is-exponential-gold-says-fidelitys-director-of-global-macro

Published Date: Thu, 13 Jun 2024 19:09:57 GMT