Today, Bitcoin mining stocks took a hit as the overall market responded to Bitcoin's third consecutive day of losses.

The Impact on Major Bitcoin Mining Stocks

Bitfarms Leading the Decline

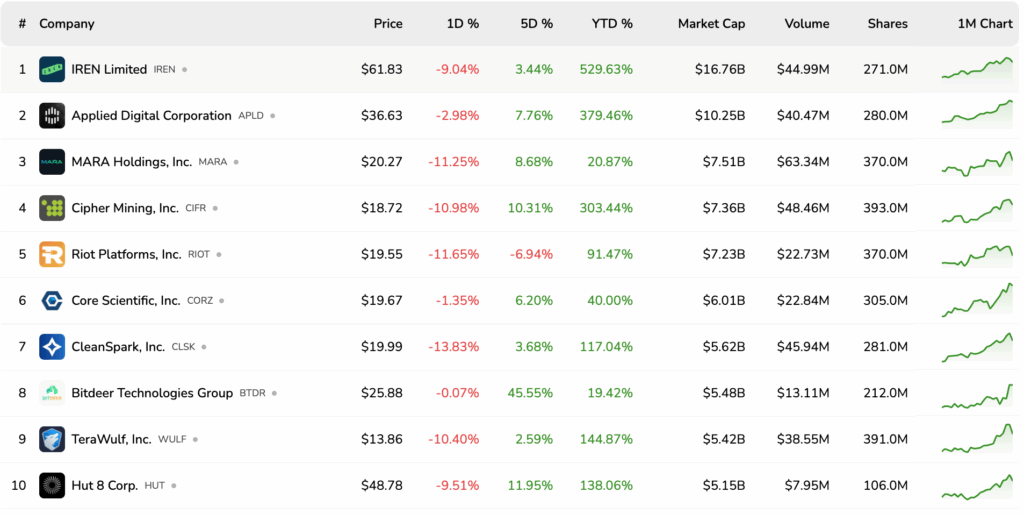

Major mining companies like Bitfarms ($BITF) are experiencing significant double-digit losses, with Bitfarms leading the pack with an over 18% drop. Riot Platforms ($RIOT) and Marathon Digital Holdings ($MARA) also saw sharp declines of 10%–11%, while Hut 8 and Strategy followed suit with smaller decreases.

The Momentum Shift

The recent pullback has disrupted the positive momentum that miners had enjoyed in recent months. The combination of strong BTC prices and expanding hash rates had propelled the sector to multi-year highs.

The Bitcoin Mining Sector Performance

Short-Term Declines Amid Long-Term Growth

Despite the tough day, many Bitcoin mining stocks are still in the green over the week. Companies like Applied Digital and Cipher Mining have seen substantial growth, with jumps of 3-4 times in the last year.

Market Analysis

According to bitcoinminingstocks.io, most of the bitcoin mining industry's stocks ended the day in the red, with some experiencing losses of more than 10%. This price action is closely tied to Bitcoin's direct price movement. As Bitcoin dipped to the $107,000 range today, many BTC mining stocks closed in negative territory.

The Road Ahead

Investors are keeping a close watch to see if miners can stabilize following the recent turbulence or if further weakness in Bitcoin will lead to more challenges in the space. The past two weeks have been rough, resulting in over $19 billion in leveraged positions being liquidated and causing more than 1.6 million traders to exit their positions due to margin calls.

The Recent Surge and Market Capitalization

Bitcoin Mining Sector's Growth

Earlier this week, Bitcoin mining stocks continued their multi-month rally, pushing the sector’s combined market capitalization above $90 billion — more than double the value from just two months ago. Bitdeer Technologies experienced a 30% surge after reporting a 32.9% increase in realized hashrate and mining 452 BTC in September.

Crypto Stocks Under Pressure

Market Trends beyond Bitcoin Mining

Aside from Bitcoin mining stocks, crypto-related equities also faced downward pressure on Thursday. Companies like Coinbase (COIN), Robinhood (HOOD), and Strategy (MSTR) saw declines as selling pressure impacted the broader sector.

The Role of Bitcoin Miners

The Function of Mining Companies

Bitcoin miners are companies that operate large-scale mining operations to validate transactions and earn bitcoin rewards. Their profitability hinges on factors like Bitcoin's price, mining efficiency, and energy costs. Recently, many have started diversifying by using their computing power for artificial intelligence and other high-performance data center services.

As you navigate the dynamic world of Bitcoin mining and related stocks, understanding the market landscape and the factors that influence stock performance is crucial. Stay informed and make data-driven decisions to thrive in this ever-evolving sector.

Frequently Asked Questions

Are gold investments a good idea for an IRA?

If you are looking for a way to save money, gold is a great investment. You can also diversify your portfolio by investing in gold. But gold has more to it than meets the eyes.

It has been used throughout history as currency and it is still a very popular method of payment. It is often called “the most ancient currency in the universe.”

But unlike paper currencies, which governments create, gold is mined out of the earth. Because it is rare and difficult to make, it is extremely valuable.

Gold prices fluctuate based on demand and supply. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. Gold's value rises as a result.

On the flipside, people may save cash rather than spend it when the economy slows. This results in more gold being produced, which drives down its value.

This is why gold investment makes sense for both individuals and businesses. You will benefit from economic growth if you invest in gold.

Additionally, you'll earn interest on your investments which will help you grow your wealth. Additionally, you won't lose cash if the gold price falls.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. There are some disadvantages to this investment.

You could lose all of your accumulated money if you take out too much from your IRA. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do withdraw funds, you'll need to pay a penalty.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management charges ranging anywhere from $10 to $50.

If you prefer your money to be kept out of a bank, then you will need insurance. Most insurers require you to own a minimum amount of gold before making a claim. Some insurers may require you to have insurance that covers losses up $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. Some providers limit the amount of gold that you are allowed to own. Others let you pick your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more expensive than gold futures contracts. However, futures contracts give you flexibility when buying gold. Futures contracts allow you to create a contract with a specified expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. It does include coverage for damage due to natural disasters. If you live near a high-risk region, you might want to consider additional coverage.

Additional to your insurance, you will need to consider how much it costs to store your gold. Storage costs will not be covered by insurance. Banks charge between $25 and $40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians can't sell assets. Instead, they must hold them as long as you request.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. You should also specify how much you want to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After reviewing your application, the company will send you a confirmation mail.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

Do you need to open a Precious Metal IRA

You should be aware that precious metals cannot be covered by insurance. If you lose money in your investment, nothing can be done to recover it. This includes investments that have been damaged by fire, flooding, theft, and so on.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These coins have been around for thousands and represent a real asset that can never be lost. They are likely to fetch more today than the price you paid for them in their original form.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Do not open an account unless you're ready to retire. Remember the future.

How is gold taxed in an IRA?

The tax on the sale of gold is based on its fair market value when sold. When you purchase gold, you don't have to pay any taxes. It's not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

You can use gold as collateral to secure loans. When you borrow against your assets, lenders try to find the highest return possible. Selling gold is usually the best option. The lender might not do this. They might keep it. They might decide to sell it. Either way, you lose potential profit.

If you plan on using your gold as collateral, then you shouldn't lend against it. If you don't plan to use it as collateral, it is better to let it be.

What Does Gold Do as an Investment Option?

Gold's price fluctuates depending on the supply and demand. It is also affected negatively by interest rates.

Because of their limited supply, gold prices can fluctuate. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Can I buy gold with my self-directed IRA?

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contract are financial instruments that depend on the gold price. They let you speculate on future price without having to own the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

How much should precious metals make up your portfolio?

This question can only be answered if we first know what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them valuable in investment and trading. Gold is currently the most widely traded precious metal.

But, there are other types of precious metals available, including platinum and silver. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. That said, they do not always move in lockstep with each other. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

When the economy is healthy, however, the opposite effect occurs. Investors favor safe assets like Treasury Bonds, and less precious metals. They are more rare, so they become more expensive and less valuable.

You must therefore diversify your investments in precious metals to reap the maximum profits. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- You want to keep gold in your IRA at home? It's not exactly legal – WSJ

finance.yahoo.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. You must contribute enough each year to ensure that you have adequate growth.

You can also take advantage of tax-free savings opportunities like a traditional 401k (k), SEP IRA (or SIMPLE IRA). These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. This makes them a great choice for people who don’t have access employer matching funds.

The key is to save regularly and consistently over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Bitcoin Mining Stocks Plunge: Discover Why $BITF, $MARA, and $RIOT Are Seeing Significant Declines

Sourced From: bitcoinmagazine.com/markets/bitcoin-mining-stocks-tumble

Published Date: Thu, 16 Oct 2025 20:42:19 +0000