Cathie Wood: Investors Favor Bitcoin Over Gold Amid Financial Uncertainty

Cathie Wood, CEO of ARK Invest, believes that there is a notable shift in investment trends, with investors increasingly favoring bitcoin over traditional gold investments. This shift has become more apparent since the introduction of spot bitcoin ETFs, which provide investors with easier access to the cryptocurrency.

In a recent video on ARK Invest's Youtube channel, Wood discussed the changing preferences of investors, highlighting the growing preference for bitcoin over gold. She noted that the introduction of spot bitcoin exchange-traded funds (ETFs) has played a significant role in this shift, as it has made investing in bitcoin more streamlined and less cumbersome.

Wood, in a conversation with Brett Winton, ARK's chief futurist, emphasized bitcoin's resilience and growth, particularly during times of financial instability. She recalled the events of March 2023, when a regional bank crisis in the U.S. led to a 40% increase in bitcoin's value while the regional bank index plummeted. "Bitcoin shot up 40% as the KRE, the regional bank index, was imploding. And here again, the regional bank index is acting up, and we are seeing Bitcoin catch a bid again," Wood stated, underscoring bitcoin's emerging role as a "flight to safety" asset.

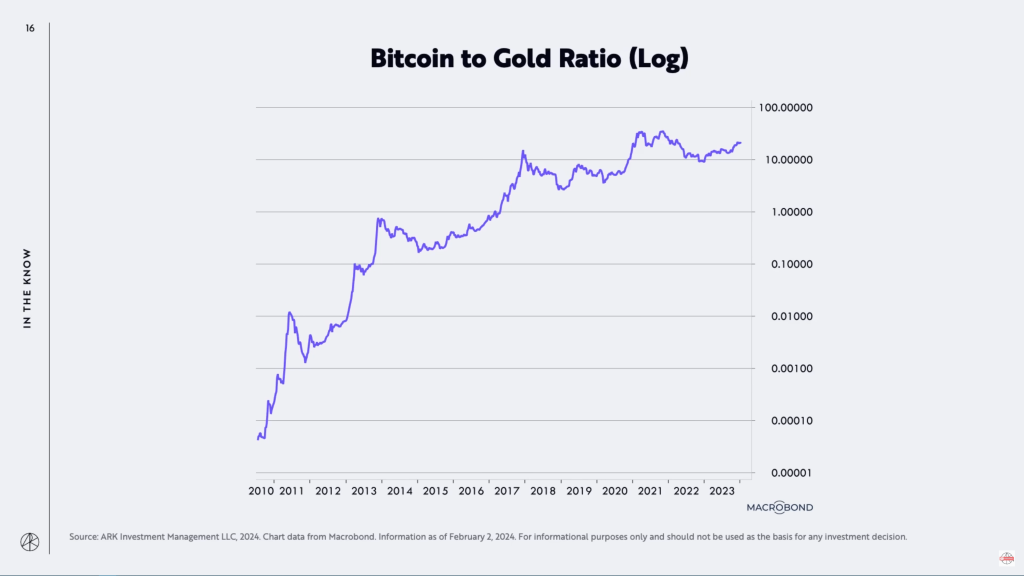

To support her argument, Wood presented a compelling chart that compared bitcoin's price to that of gold, revealing a strong long-term uptrend. She explained that this trend indicates bitcoin's ongoing process of partially replacing gold as a preferred investment choice. "This chart just shows you that even relative to gold, Bitcoin has been rising. There’s now a substitution into Bitcoin, and we think that is going to continue," she remarked.

Addressing the volatility that followed the launch of spot bitcoin ETFs, including ARK 21shares Bitcoin ETF on January 11, Wood acknowledged the anticipated price correction. Despite a 20% drop in bitcoin's price post-launch, Wood remains optimistic, pointing out that 15 million out of the 19.5 million bitcoins currently in circulation have not been moved in over 155 days, indicating strong investor holding patterns.

ARK Invest's involvement in the cryptocurrency space extends beyond bitcoin. The firm has made significant investments in Coinbase stock (COIN), although it has reduced its holdings since June 2023. Currently, ARK holds 7.187 million shares in Coinbase, valued at $843 million, demonstrating its continued bullish stance on the crypto sector despite market fluctuations.

What are your thoughts on Wood's assertion that investors who would typically choose gold as an investment are now shifting towards bitcoin? Feel free to share your opinions in the comments section below.

Frequently Asked Questions

What is the tax on gold in an IRA

The fair value of gold sold to determines the price at which tax is due. When you purchase gold, you don't have to pay any taxes. It is not income. If you sell it later, you'll have a taxable gain if the price goes up.

You can use gold as collateral to secure loans. Lenders will seek the highest return on your assets when you borrow against them. This often means selling gold. This is not always possible. They may just keep it. Or they might decide to resell it themselves. The bottom line is that you could lose potential profit in any case.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. You should leave it alone if you don't intend to lend against it.

How much should precious metals be included in your portfolio?

Before we can answer this question, it is important to understand what precious metals actually are. Precious Metals are elements that have a very high relative value to other commodities. This makes them valuable in investment and trading. Gold is currently the most widely traded precious metal.

There are also many other precious metals such as platinum and silver. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is not affected by inflation or deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. That said, they do not always move in lockstep with each other. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors expect lower interest rate, making bonds less appealing investments.

The opposite effect happens when the economy is strong. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. These precious metals are rare and become more costly.

You must therefore diversify your investments in precious metals to reap the maximum profits. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

What does a gold IRA look like?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical gold bullion coins anytime. To invest in gold, you don't need to wait for retirement.

Owning gold as an IRA has the advantage of allowing you to keep it forever. When you die, your gold assets won't be subjected to taxes.

Your heirs will inherit your gold, and not pay capital gains taxes. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a gold IRA, you will first need to create an individual retirement account (IRA). Once you've done that, you'll receive an IRA custody. This company acts as a middleman between you and the IRS.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit required for gold bullion coins purchase is $1,000 If you make more, however, you will get a higher interest rate.

When you withdraw your gold from your IRA, you'll pay taxes on it. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

Avoid taking out more that 50% of your total IRA assets each year. A violation of this rule can lead to severe financial consequences.

Is gold a good investment IRA option?

For anyone who wants to save some money, gold can be a good investment. You can diversify your portfolio with gold. There is much more to gold than meets your eye.

It has been used throughout history as currency and it is still a very popular method of payment. It is often called “the oldest currency in the world.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It is very valuable, as it is rare and hard to create.

The supply and demand for gold determine the price of gold. The strength of the economy means people spend more, and so, there is less demand for gold. This results in gold prices rising.

On the other hand, people will save cash when the economy slows and not spend it. This causes more gold to be produced, which lowers its value.

This is why both individuals as well as businesses can benefit from investing in gold. You'll reap the benefits of investing in gold when the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

Should You Buy Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

This could be changing, according to some experts. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

These are some important things to remember if your goal is to invest in gold.

- Consider first whether you will need the money to save for retirement. You can save money for retirement even if you don't invest in gold. However, you can still save for retirement without putting your savings into gold.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each account offers different levels of security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. Your gold coins may be lost and you might never get them back.

So, if you're thinking about buying gold, make sure you do your research first. Protect your gold if you already have it.

How much of your IRA should include precious metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don’t need to have a lot of money to invest. In fact, there are many ways to make money from gold and silver investments without spending much money.

You may consider buying physical coins such as bullion bars or rounds. Stocks in companies that produce precious materials could be purchased. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. These metals are not stocks, but they can still provide long-term growth.

And, unlike traditional investments, their prices tend to rise over time. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

How can I withdraw from a Precious metal IRA?

First, decide if it is possible to withdraw funds from an IRA. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, figure out how much money will be taken out of your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. You'll have to weigh the pros of each option before you make a decision.

Bullion bars require less space, as they don't contain individual coins. But you will have to count each coin separately. You can track their value by keeping individual coins.

Some people prefer to keep their coins in a vault. Others prefer to place them in safe deposit boxes. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

investopedia.com

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts