Bitcoin's relationship with the financial advisory industry has always been intriguing yet widely ignored. The wealth management industry, financial advisors, and family offices command trillions of dollars of capital, making it a powerful force within the global financial landscape. This article will explore the relationship between Bitcoin and the wealth management industry and how it might evolve in the near future.

Dissecting the Wealth Management Industry

The wealth management industry is a mammoth entity that oversees assets worth trillions of dollars. As of 2023, family offices manage $15 trillion in assets, the wealth management industry controls $100 trillion, and the global wealth management industry manages a staggering $103 trillion. This industry is abundant with misaligned incentives and often has a skewed understanding of Bitcoin as an asset class. But, this scenario might be on the brink of a change.

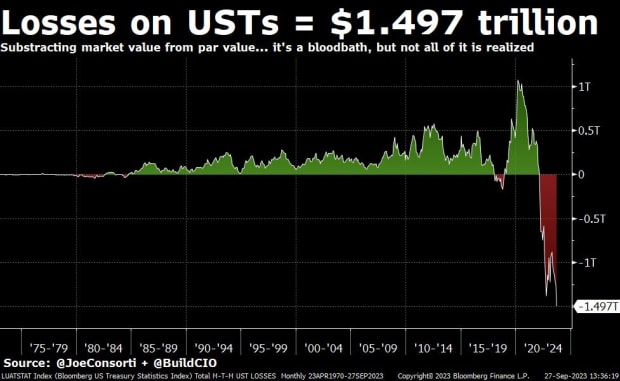

The "Risk-Free Rate" Paradigm: Examined

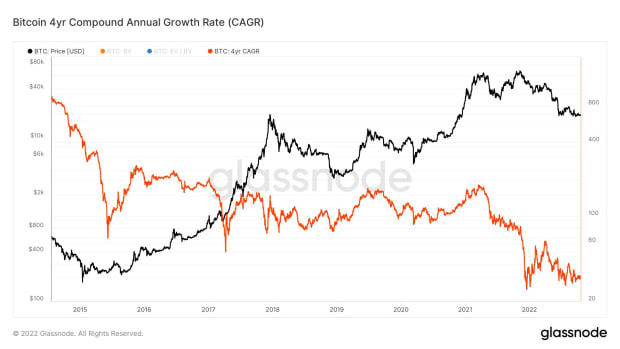

The wealth management industry's entire foundation relies on the "risk-free rate" – a universal benchmark against which all investments are measured. Often, this "risk-free rate" corresponds to the 10-year treasury bond’s current yield. For Bitcoin proponents, the concept of a risk-free rate seems absurd, but to the rest of the world, this is accepted as reality. However, this rate is manipulated by central authorities, resulting in global economies making investment decisions based on a false benchmark. The only genuine "risk-free rate" could be the 4-year CAGR of Bitcoin in self-custody, which takes into account the unmanipulatable monetary policy of the Bitcoin network, the elimination of counterparty risk, and the free market price discovery.

Misunderstanding the CPI and Inflation

Another area of contention in the wealth management industry is the collective misunderstanding of the Consumer Price Index (CPI), which is often seen as the current inflation rate. The basket of goods that the CPI measures is frequently altered to fit narratives. Alternatives to measure inflation, such as the M2 money supply increase or the Chapwood Index, should be considered. If the benchmark everything is measured against is falsely low and the real inflation rate is higher, it means most things are negative yielding in real terms, which is precisely what Bitcoin aims to fix.

The Concept of "Fiduciary Responsibility"

The investment advisory industry is built on the concept of "fiduciary responsibility". A fiduciary acts on behalf of another person or persons, putting their clients’ interests above their own. However, in practical terms, this is often nothing more than an industry term that is not respected or enforced. Herein lies the potential for a fascinating relationship between the wealth management industry and Bitcoin.

Bitcoin and The Wealth Management Industry: A Potential Shift

Investment advisors currently have misaligned incentives concerning Bitcoin. The approval of a spot ETF in the U.S. could catalyze a significant shift. A spot ETF for Bitcoin would make it possible for investment advisors to offer clients Bitcoin exposure in the same way they allocate to equities or mutual funds. This could potentially lead to a shift in the way the entire wealth management industry views Bitcoin as an asset class, especially considering its diversification benefits and hedge against various economic risks.

This transition might take time, but it could lead to a situation where Bitcoin becomes a staple in every client's portfolio. This potential shift in the industry's approach to Bitcoin underscores the need for a better understanding of cryptocurrencies within the wealth management industry.

The relationship between Bitcoin and the wealth management industry is complex and evolving. As we move forward, it will be interesting to see how this dynamic unfolds and what implications it could have for the financial world.

CFTC

irs.gov

How To

Tips to Invest in Gold

Investing in Gold is a popular investment strategy. There are many advantages to investing in Gold. There are many ways you can invest in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

You should consider some things before you decide to purchase any type of gold.

- First, you must check whether your country allows you to own gold. If so, then you can proceed. If not, you may want to consider purchasing gold from overseas.

- You should also know the type of gold coin that you desire. You have options: you can choose from yellow gold, white or rose gold.

- You should also consider the price of gold. Start small and move up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversifying your portfolio includes stocks, bonds, mutual funds, real estate, commodities, and mutual funds.

- Don't forget to keep in mind that gold prices often change. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

By: Dillon Healy

Title: Bitcoin and The Financial Advisory Industry: An Untapped Dynamic

Sourced From: bitcoinmagazine.com/markets/after-an-etf-you-just-need-to-orange-pill-financial-advisors

Published Date: Thu, 19 Oct 2023 15:45:00 GMT