As the Argentine economy grapples with unprecedented levels of inflation, citizens are increasingly embracing Bitcoin as a means to safeguard their financial stability.

Rising Inflation Rates in Argentina

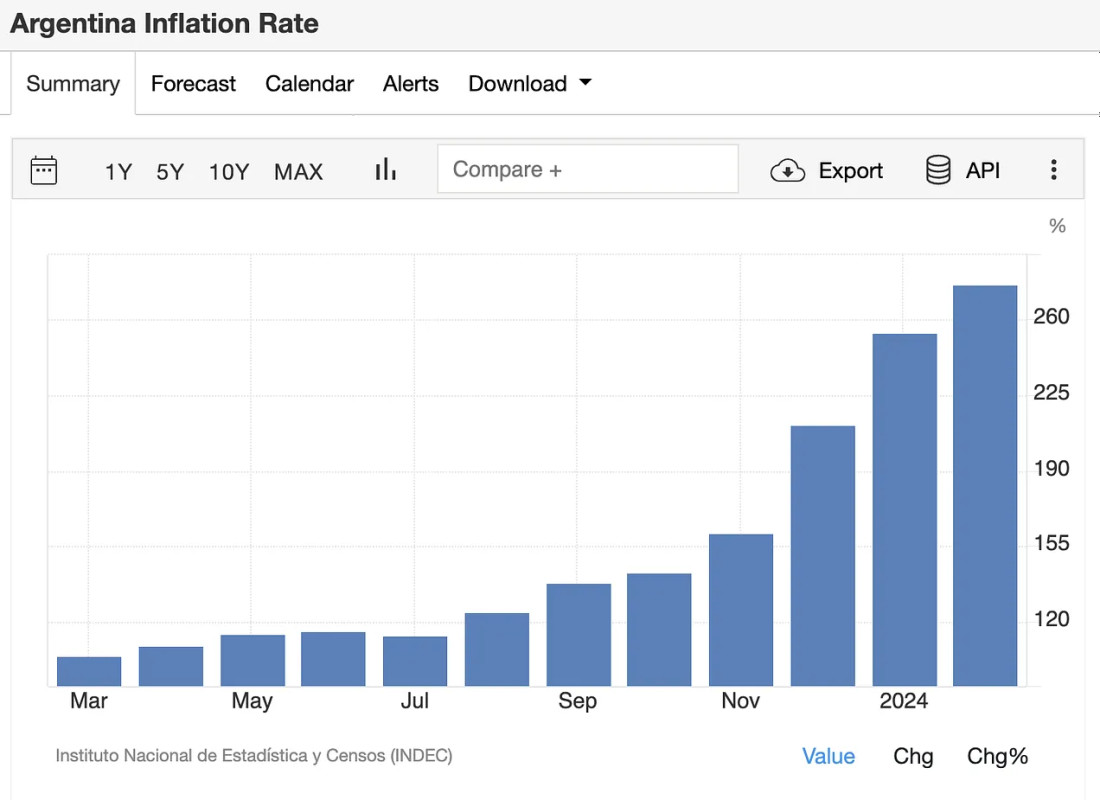

The Argentine Republic is currently facing the highest inflation rates globally. Historically, the nation experienced moderate inflation levels of around 25%; however, the onset of the pandemic exacerbated this trend significantly. In 2022, the inflation rate surged to 70% and further escalated to 100% by February of the following year. The year 2023 proved to be catastrophic for Argentina's economy, with inflation soaring to a staggering 274%. This rapid increase in inflation has led to a dire situation where the wages and savings of ordinary citizens have dwindled rapidly, prompting them to seek alternative measures to secure their financial well-being.

Surge in Bitcoin Adoption

Amidst this economic turmoil, a heartening trend has emerged where ordinary citizens are increasingly turning to Bitcoin as a reliable store of value. Argentina, known for its high acceptance of Bitcoin, has witnessed a surge in the adoption of the decentralized cryptocurrency. Local exchanges such as Lemon Cash and Belo have reported significant spikes in trading volume, with Bitcoin transactions reaching unprecedented levels. Notably, Bitcoin is not only replacing dollars but also outpacing dollar-backed stablecoins, indicating a growing preference for the cryptocurrency as a means of financial security.

Impact of President Milei's Policies

President Javier Milei's economic reforms have inadvertently influenced the shift towards Bitcoin in Argentina. By implementing measures to curtail spending and privatize state-owned enterprises, Milei aimed to build a budget surplus and reduce the circulation of US dollars within the country. Consequently, the devaluation of the peso and the increasing appeal of Bitcoin as a store of value have propelled its adoption among the populace.

Regulatory Developments and Market Response

With the burgeoning interest in Bitcoin, Argentina has started implementing new regulations to govern the cryptocurrency industry. The recent passage of a law mandating standards for virtual asset service providers has sparked debates within the Bitcoin community. While concerns about market consolidation linger, efforts are underway to introduce tax exemptions for digital asset holders to alleviate tensions.

President Milei's Stance and Economic Challenges

Despite his pro-Bitcoin leanings, President Milei has remained relatively silent on Bitcoin-related developments, focusing instead on broader economic reforms and austerity measures. While his policies have managed to mitigate inflation to some extent, they have also exacerbated social challenges such as rising poverty levels. The future trajectory of Bitcoin in Argentina remains uncertain, with Milei's attention primarily centered on stabilizing the economy and addressing pressing socio-economic issues.

Outlook on Bitcoin in Argentina

As Bitcoin continues to gain traction amidst economic uncertainties, the future of the cryptocurrency in Argentina hinges on the resilience of its community and the evolving regulatory landscape. Despite Milei's current priorities, the positive momentum surrounding Bitcoin in the country suggests a promising trajectory for its adoption and integration into mainstream financial practices. While challenges persist, the innovative spirit of the global Bitcoin community remains a driving force for its continued growth and relevance in Argentina and beyond.

Frequently Asked Questions

What is a gold IRA account?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can buy physical gold bullion coins at any time. You don't have to wait until retirement to start investing in gold.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold assets will not be subjected tax upon your death.

Your heirs will inherit your gold, and not pay capital gains taxes. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a IRA for gold, you must first create an individual retirement plan (IRA). After you do this, you will be granted an IRA custodian. This company acts as an intermediary between you and IRS.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 If you make more, however, you will get a higher interest rate.

Taxes will apply to gold that you take out of an IRA. You will be liable for income taxes and penalties if you take the entire amount.

You may not be required to pay taxes if you take out only a small amount. However, there are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

You should avoid taking out more than 50% of your total IRA assets yearly. If you do, you could face severe financial consequences.

Should You Buy or Sell Gold?

In the past, gold was considered a haven for investors during economic turmoil. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts think this could change quickly. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Consider first whether you will need the money to save for retirement. It is possible to save enough money to retire without investing in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each account offers different levels of security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. You may lose your gold coins and never be able to recover them.

Don't buy gold unless you have done your research. Protect your gold if you already have it.

How is gold taxed by Roth IRA?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

These rules vary from one state to another. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York is open until 70 1/2. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

What is the tax on gold in an IRA

The fair value of gold sold to determines the price at which tax is due. When you purchase gold, you don't have to pay any taxes. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Gold can be used as collateral for loans. Lenders try to maximize the return on loans that you take against your assets. For gold, this means selling it. There's no guarantee that the lender will do this. They may hold on to it. Or they might decide to resell it themselves. Either way, you lose potential profit.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. If you don't plan to use it as collateral, it is better to let it be.

Should You Invest in gold for Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold is a safe investment and can also offer potential returns. Retirees will find it an attractive investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. Its value fluctuates over time.

This does not mean you shouldn’t invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit to gold? It's a tangible asset. Gold is more convenient than bonds or stocks because it can be stored easily. It is also easily portable.

You can always access your gold if it is stored in a secure place. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. Gold rises in the face of a falling stock market.

Investing in gold has another advantage: you can sell it anytime you want. You can easily liquidate your investment, just as with stocks. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

You shouldn't buy too little at once. Begin by buying a few grams. Next, add more as required.

Don't expect to be rich overnight. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Even though gold is not the best investment, it could be an excellent addition to any retirement plan.

Who has the gold in a IRA gold?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

To find out what options you have, consult an accountant or financial planner.

How much should precious metals be included in your portfolio?

First, let's define precious metals to answer the question. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them extremely valuable for trading and investing. The most traded precious metal is gold.

However, many other types of precious metals exist, including silver and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

In general, all precious metals have a tendency to go up with the market. However, they may not always move in synchrony with each other. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. Investors expect lower interest rates which makes bonds less appealing investments.

The opposite effect happens when the economy is strong. Investors favor safe assets like Treasury Bonds, and less precious metals. They are more rare, so they become more expensive and less valuable.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads and Example. Risk Metrics

How To

A growing trend: Gold IRAs

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

Gold IRA owners can now invest in physical gold bullion or bars. This IRA can be used to grow your wealth tax-free and is an alternative option to stocks and bonds.

A gold IRA allows investors the freedom to manage their wealth without worrying about volatility in the markets. They can use the gold IRA to protect themselves against inflation and other potential problems.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: Argentinians Turning to Bitcoin Amidst Record Inflation

Sourced From: bitcoinmagazine.com/markets/argentinians-buy-bitcoin-to-combat-inflation-pass-friendly-legislation

Published Date: Tue, 26 Mar 2024 19:30:00 GMT