As Bitcoin once again finds itself in price discovery mode, market watchers and enthusiasts are curious: has retail FOMO set in yet, or is the retail surge we’ve seen in past bull cycles still on the horizon? Using data from active addresses, historical cycles, and various market indicators, we’ll examine where the Bitcoin market currently stands and what it might signal about the near future.

Rising Interest

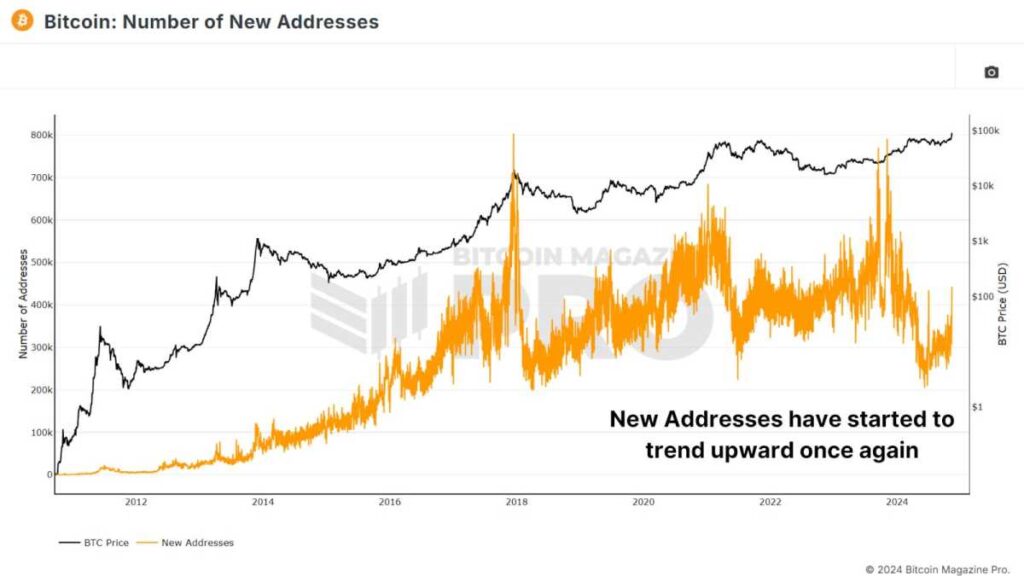

One of the most direct signs of retail interest is the number of new Bitcoin addresses created. Historically, sharp increases in new addresses have often marked the beginning of a bull run as new retail investors flood into the market. In recent months, however, the growth in new addresses hasn’t been as sharp as one might expect. Last year, we saw around 791,000 new addresses created in a single day—a sign of considerable retail interest. In comparison, we now hover significantly lower, although we have recently seen a modest uptick in new addresses.

Figure 1: The number of new addresses on the Bitcoin network has begun to rise.

View Live Chart 🔍

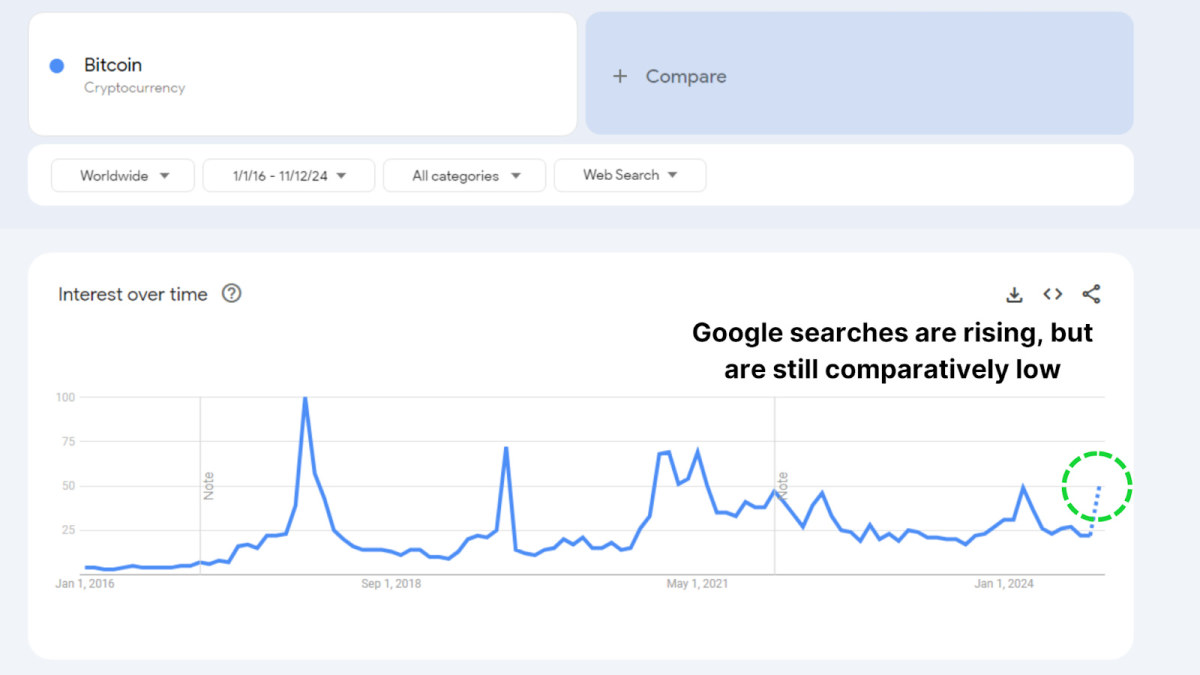

Google Trends also reflects this tempered interest. Although searches for "Bitcoin" have been increasing in the past month, they remain far below previous peaks in 2021 and 2017. It seems that retail investors are showing a renewed curiosity but not yet the fervent excitement typical of FOMO-driven markets.

Figure 2: Google searches for ‘Bitcoin’ are also rising but are still relatively low.

Supply Shift

We are witnessing a slight transition of Bitcoin from long-term holders to newer, shorter-term holders. This shift in supply can hint at the potential start of a new market phase, where experienced holders begin taking profits and selling to newer market participants. However, the overall number of coins transferred remains relatively low, indicating that long-term holders aren’t yet parting with their Bitcoin in significant volumes.

Figure 3: Only a slight increase in bitcoin shifting hands to new holders.

View Live Chart 🔍

Historically, during the last bull run in 2020-2021, we saw large outflows from long-term holders to newer investors, which fueled a subsequent price rally. Currently, the shift is only minor, and long-term holders seem largely unfazed by current price levels, opting to hold onto their Bitcoin despite market gains. This reluctance to sell suggests that holders are confident in further upside potential.

A Spot-Driven Rally

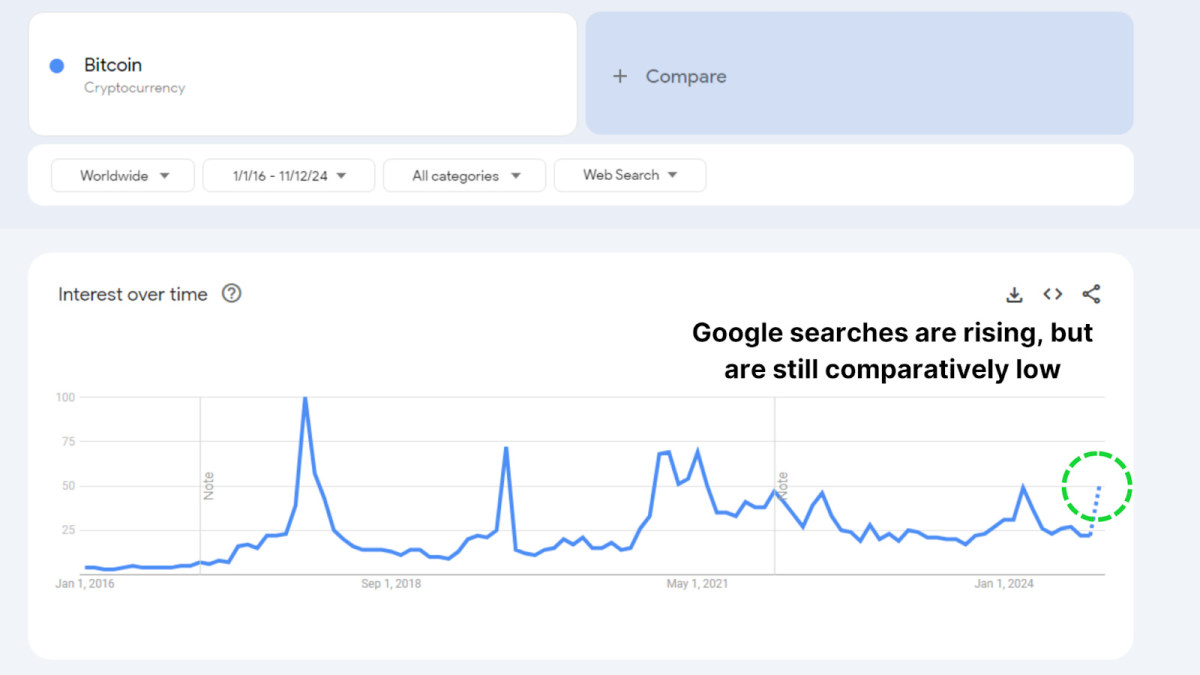

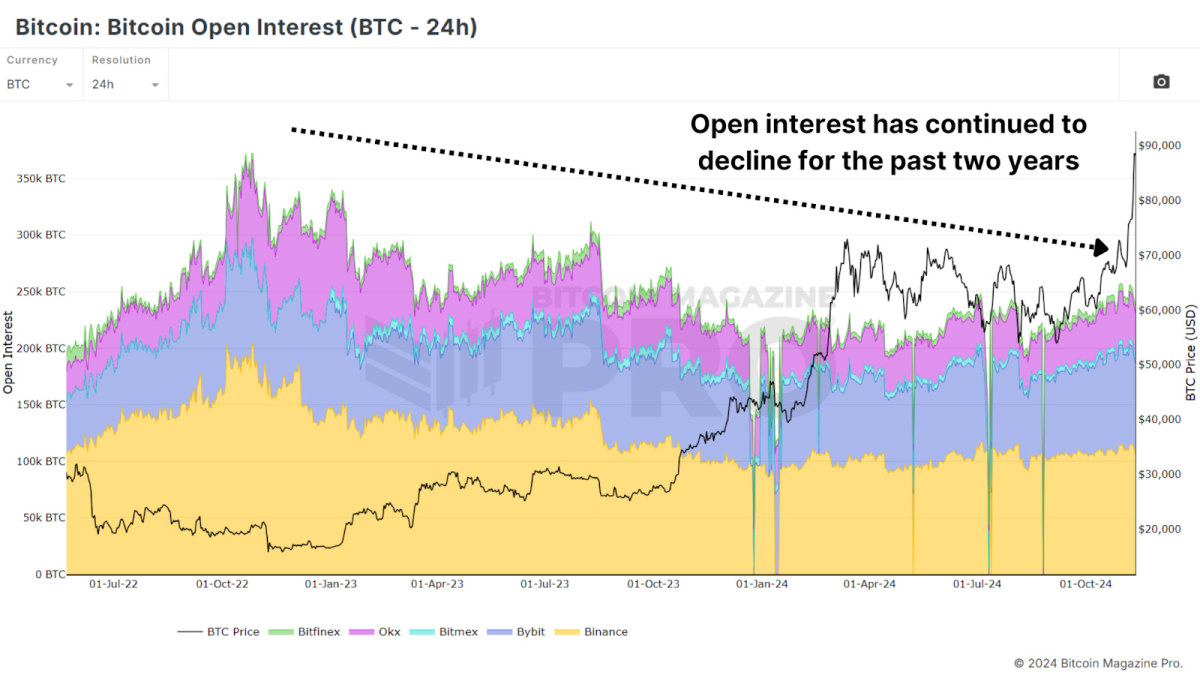

A key aspect of Bitcoin’s latest rally is its spot-driven nature, in contrast to previous bull runs heavily fueled by leveraged positions. Open interest in Bitcoin derivatives has seen only minor increases, which stands in sharp contrast to prior peaks. For instance, open interest was significant before the FTX crash in 2022. A spot-driven market, without excessive leverage, tends to be more stable and resilient, as fewer investors are at risk of forced liquidation.

Figure 4: Open interest has been declining on a macro scale, with only a slight recent increase.

View Live Chart 🔍

Big Holders Accumulating

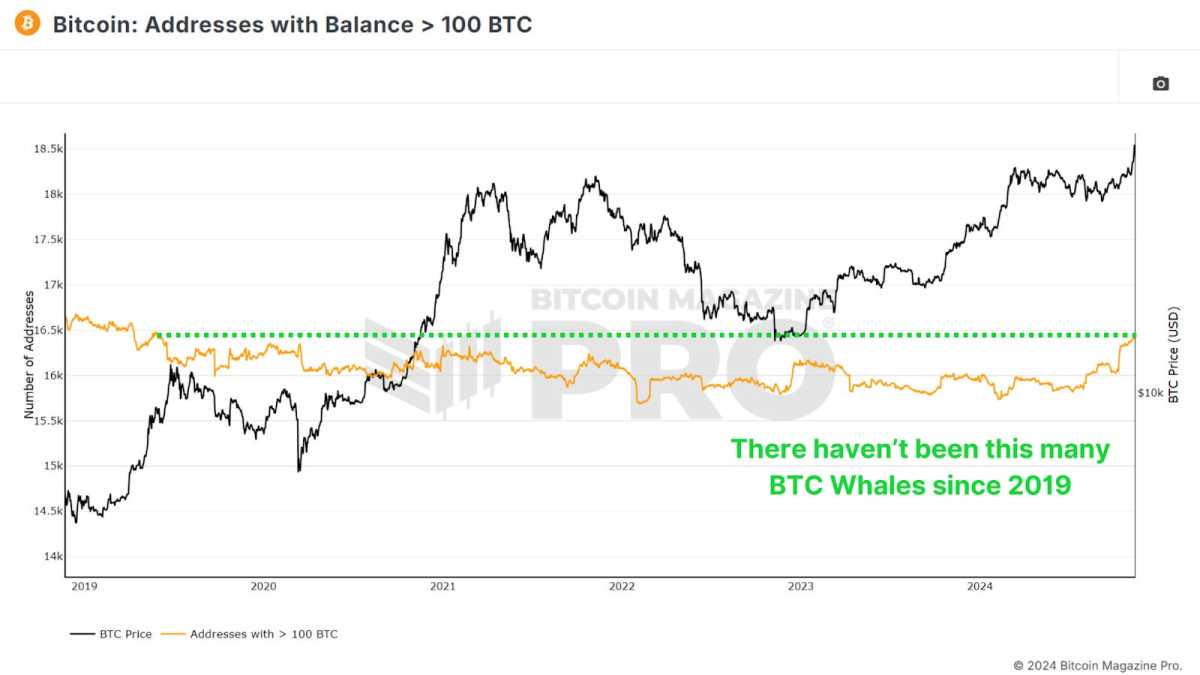

Interestingly, while retail addresses haven’t increased substantially, "whale" addresses holding at least 100 BTC have been rising. Over the past few weeks, wallets with large BTC holdings have added tens of thousands of coins, amounting to billions of dollars in value. This increase signals confidence among Bitcoin’s largest investors that the current price levels have more room to grow, even as Bitcoin reaches all-time highs.

Figure 5: Addresses holding at least 100+ BTC is at the highest value since 2019.

View Live Chart 🔍

In past bull cycles, we saw whales exit or decrease their positions near market peaks, a behavior we’re not seeing this time. This trend of accumulation by experienced holders is a strong bullish indicator, as it suggests faith in the market’s long-term potential.

While Bitcoin’s rally to all-time highs has brought renewed attention, we’re not yet seeing the telltale signs of widespread retail FOMO. The subdued retail interest suggests we may be only in the beginning phase of this rally. Long-term holders remain confident, whales are accumulating, and leverage remains modest, all indicators of a healthy, sustainable rally.

As we continue into this bull cycle, the market’s structure suggests that the potential for a larger retail-driven surge remains ahead. If this retail interest materializes, it could propel Bitcoin to new heights.

For a more in-depth look into this topic, check out a recent YouTube video here: Has Retail Bitcoin FOMO Begun?

Frequently Asked Questions

What Is a Precious Metal IRA?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These precious metals are extremely rare and valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Precious metals are often referred to as “bullion.” Bullion refers simply to the physical metal.

Bullion can be bought via various channels, such as online retailers, large coin dealers and grocery stores.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This means you'll receive dividends every year.

Precious metal IRAs do not require paperwork nor annual fees, unlike regular IRAs. Instead, you pay a small percentage tax on the gains. Additionally, you have access to your funds at no cost whenever you need them.

What does a gold IRA look like?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can buy physical gold bullion coins at any time. To start investing in gold, it doesn't matter if you are retired.

You can keep gold in an IRA forever. Your gold holdings won't be subject to taxes when you pass away.

Your heirs will inherit your gold, and not pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

To open a gold IRA, you will first need to create an individual retirement account (IRA). Once you've done so, you'll be given an IRA custodian. This company acts as a mediator between you, the IRS.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reporting.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit required is $1,000 However, you'll receive a higher interest rate if you put in more.

Taxes will be charged on gold you have withdrawn from an IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

You may not be required to pay taxes if you take out only a small amount. There are exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

You shouldn't take out more then 50% of your total IRA assets annually. You could end up with severe financial consequences.

Should You Open a Precious Metal IRA?

You should be aware that precious metals cannot be covered by insurance. You cannot recover any money you have invested. All your investments can be lost due to theft, fire or flood.

Protect yourself against this type of loss by investing in physical gold or silver coins. These items have been around thousands of years and are irreplaceable. These items are worth more today than they were when first produced.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

When you open an account, keep in mind that you won't receive any returns until your retirement. So, don't forget about the future!

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

investopedia.com

irs.gov

forbes.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

How To

Tips for Investing with Gold

Investing in Gold is one of the most popular investment strategies worldwide. There are many advantages to investing in Gold. There are many ways you can invest in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before buying any type gold, it is important to think about these things.

- First, make sure you check if your country allows you own gold. If it is, you can move on. Or, you might consider buying gold overseas.

- Secondly, you should know what kind of gold coin you want. There are many options for gold coins: yellow, white, and rose.

- You should also consider the price of gold. It is best to begin small and work your ways up. Diversifying your portfolio is a key thing to remember when purchasing gold. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- Lastly, you should never forget that gold prices change frequently. You need to keep up with current trends.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Are Retail Investors Behind The Bitcoin Price Surge This Bull Run?

Sourced From: bitcoinmagazine.com/markets/are-retail-investors-behind-the-bitcoin-price-surge-this-bull-run

Published Date: Sat, 16 Nov 2024 15:02:26 GMT