The introduction of Bitcoin ETFs in January 2024 was highly anticipated and seen as a pivotal moment for the market. There was a widespread belief that these financial products would attract institutional investment and propel Bitcoin prices to new highs. However, as we approach the one-year mark since their launch, the question arises: Have Bitcoin ETFs lived up to the hype?

A Solid Start

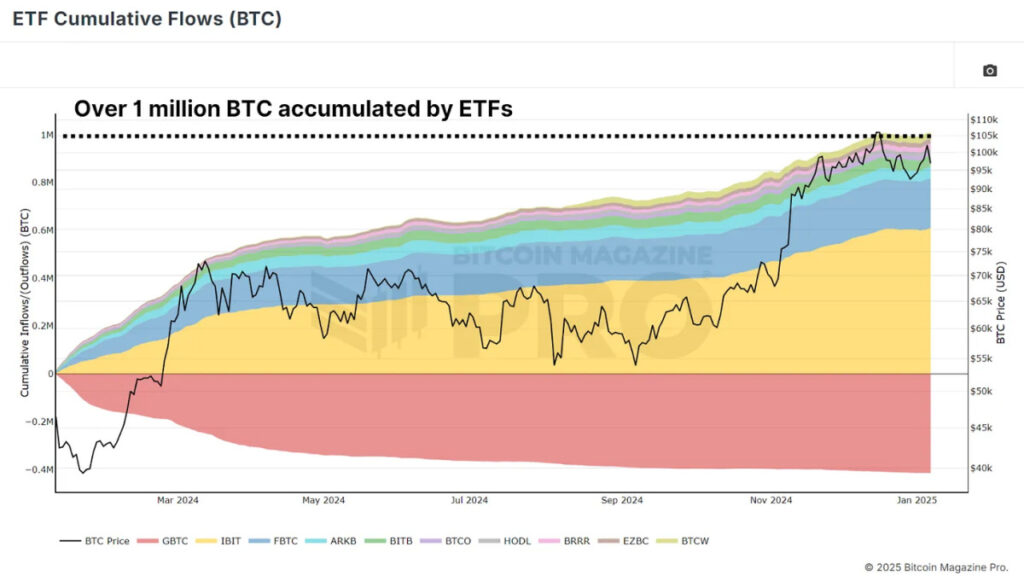

Since their inception, Bitcoin ETFs have amassed over 1 million BTC, translating to roughly $40 billion in assets under management. Despite some outflows from competing products like the Grayscale Bitcoin Trust (GBTC), which experienced withdrawals exceeding 400,000 BTC, the net inflows have been substantial, totaling around 540,000 BTC.

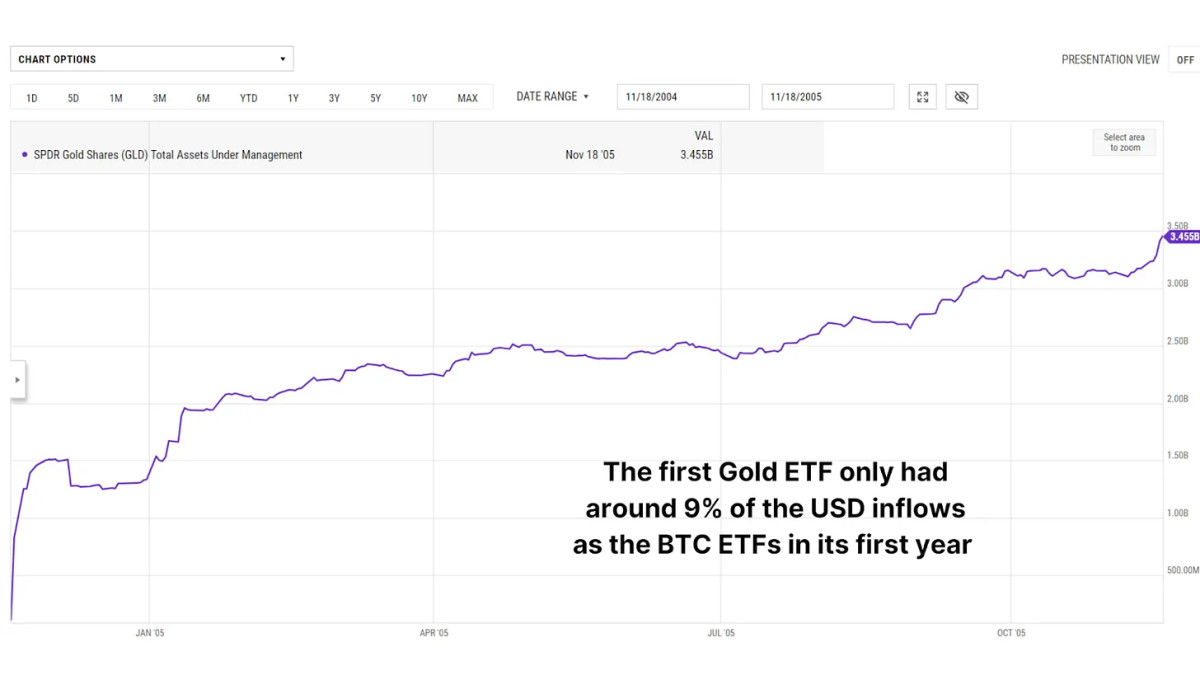

For context, the inflow scale far surpasses the initial year of gold ETFs in 2004, which accumulated $3.45 billion. This stark contrast underscores the significant institutional interest in Bitcoin as a financial asset.

Following the Gold Trend

Considering Bitcoin's 24/7 trading nature, resulting in approximately 5.3 times more annual trading hours compared to gold, a noteworthy correlation emerges. By juxtaposing Bitcoin ETFs' debut price movements with historical gold data (adjusted for trading hours), we observe nearly identical percentage returns. If Bitcoin continues to mirror gold's trajectory, we might witness an additional 83% price surge by mid-2025, potentially propelling Bitcoin's value to around $188,000.

Institutional Tactics

One fascinating observation regarding Bitcoin ETFs is the link between fund inflows and price fluctuations. A straightforward strategy involving buying Bitcoin on days with positive ETF inflows and selling on outflow days has consistently outperformed a traditional buy-and-hold approach. From January 2024 to date, this strategy has yielded a 130% return, surpassing the ~100% return for buy-and-hold investors by nearly 10%.

Supply and Demand Dynamics

Despite Bitcoin ETFs accumulating over 1 million BTC, this only represents a fraction of the total circulating supply of 19.8 million BTC. Companies like MicroStrategy have also boosted institutional adoption by collectively holding hundreds of thousands of BTC. Nonetheless, the majority of Bitcoin remains in the hands of individual investors, underscoring the continued influence of decentralized supply and demand dynamics on the market.

Conclusion

After a year, Bitcoin ETFs have surpassed expectations, with substantial inflows, notable price impact, and increasing institutional acceptance, solidifying their pivotal role in shaping Bitcoin's market narrative. While initial skeptics may have been disillusioned by the absence of immediate meteoric price surges, the long-term outlook remains optimistic.

The parallels drawn with gold ETFs offer an intriguing roadmap for Bitcoin's trajectory. Should the gold pattern persist, we might be on the brink of another significant upswing. Coupled with favorable macroeconomic conditions and escalating institutional interest, the future of Bitcoin appears brighter than ever.

For real-time data, charts, indicators, and comprehensive research to stay abreast of Bitcoin price movements, visit Bitcoin Magazine Pro.

Disclaimer: This content serves informational purposes exclusively and should not be construed as financial advice. Always conduct thorough research before making any investment choices.

Frequently Asked Questions

How to Open a Precious Metal IRA

An IRA to hold precious metals can be opened by opening a Roth Individual Retirement Account (IRA) that is self-directed.

This type account is better than others because you don’t have any tax on the interest that you earn from investments until you remove them.

This makes it appealing to those who want to both save money and get a tax cut.

You do not have to only invest in gold and silver. You can invest in anything you want if it fits the IRS guidelines.

While most people associate precious metals with silver and gold, there are many types of precious metals.

There are many examples: palladium; platinum; rhodium; osmium; iridium; ruthenium.

There are many ways that you can invest precious metals. There are two main options: buying bullion bars and coins, and purchasing shares in mining companies.

Bullion Coins, Bars

Buying bullion coins and bars is one of the easiest ways to invest in precious metals. Bullion is a general term that describes physical ounces, or physical gold and silver.

You get actual bullion bars and coins when you purchase bullion coins.

While you may not immediately see any change after buying bullion coins and bars in a store, there will be some long-term benefits.

For example, you will get a tangible piece of history. Each coin and bar has its own unique story behind it.

If you compare the nominal value to face value, you will often find that it is worth much less than its nominal. For example, the American Eagle Silver Coin was only $1.00 per ounce when it was introduced in 1986. The price of an American Eagle is now closer to $40.00 a ounce.

Bullion's price has risen dramatically since its inception, so many investors would rather invest in bullion coins than futures.

Mining Companies

If you are looking to invest in precious metals, there is another option: investing in mining shares. You invest in the company's ability produce gold and silver when you buy shares of mining companies.

You will then be entitled to dividends which are based upon the company’s profit. These dividends will be used to pay shareholders.

The company's growth potential will also be of benefit to you. The demand for the product will also cause an increase in share prices.

You should diversify because these stocks have a tendency to fluctuate in their prices. This involves spreading your risk over multiple companies.

It's important to remember, however, that mining companies can still be subject to financial losses, just as any other stock market investment.

If gold prices plummet significantly, ownership of your shares could be worthless.

The Bottom Line

Precious metals like gold and silver can provide safety during economic uncertainty.

Gold and silver can fluctuate in price. If you're looking to make a long-term, profitable investment in precious metallics, then consider opening a precious precious metals IRA Account with a reputable business.

You can enjoy tax benefits while still owning tangible assets.

What kind of IRA can you use to hold precious metals in?

An Individual Retirement Account (IRA) is an investment vehicle most employers and financial institutions offer. Through an IRA, you may contribute money to an account that grows tax-deferred until withdrawn.

An IRA allows you to save taxes and pay them later when you retire. This means you can save money and pay taxes later on the money that you have deposited to your retirement account.

The beauty of an IRA is that contributions and earnings grow tax-free until you withdraw the funds. You can face penalties if you withdraw funds before the deadline.

You can also make additional contributions to your IRA after age 50 without penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

Withdrawals made before age 59 1/2 are subject to a 5% IRS penalty. Between the ages of 591/2 and 70 1/2, withdrawals are subject to a 3.4% IRS penal.

An IRS penalty of 6.2% applies to withdrawals above $10,000 per year.

What is the most valuable precious metal?

The investment of gold is high-returning and has high capital appreciation. It is also immune to inflation and other risk factors. As people worry about inflation, the price of gold tends increase.

Gold futures are a great idea. These contracts will guarantee that you will receive a specific amount of gold at an agreed price.

However, gold futures aren't suitable for everyone. Some people prefer to own physical gold instead.

They can trade their precious metals with others. They can also make a profit by selling their gold at any time they desire.

Many people prefer not to pay taxes on their gold. They purchase gold directly from governments to achieve this.

This process requires you to make several trips to your local post office. First, convert any gold you have into coins or bars.

You will then need to obtain a stamp for the coins and bars. Finally, you send them to the US Mint. The US Mint will melt the coins and bars to make new ones.

These new bars and coins have the original stamps stamped on them. These new coins and bars are legal tender.

However, if you purchase gold directly from the US Mint you won't be required to pay any taxes.

Decide which precious metal you would like to invest.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

External Links

takemetothesite.com

kitco.com

regalassets.com

investopedia.com

How To

How to Open a Precious Metal IRA

Precious and precious metals are one the most sought-after investment vehicles. Precious metals have a higher return than traditional investments like bonds or stocks, which is why they are so sought-after. It is worth your time to research and plan before you invest in precious metals. Here are the basics to help you open your precious metal IRA account.

There are two main types in precious metal accounts. These are physical precious metals and paper gold or silver certificates (GSCs). Each type of account has its own advantages and disadvantages. For example, physical precious metals accounts offer diversification benefits, while GSCs are easy to access and trade. Keep reading to find out more about these options.

Physical precious metals accounts include bullion, bars and coins. Although this option can provide diversification benefits, there are some drawbacks. You will need to pay a lot of money for precious metals, whether you are buying, selling, or storing them. Their large size makes it difficult to transport them between locations.

The silver and paper gold certificates are also relatively affordable. These certificates can also be traded online, and they are easy to access. They're a great choice for people who don’t want precious metals. However, they aren't as diversified as their physical counterparts. Because they are supported by government agencies such the U.S. Mint the value of these assets may decrease if inflation rates increase.

If you open a precious metal IRA, choose the right account for your financial situation. Before you make that decision, here are some things to consider:

- Your tolerance level

- Your preferred asset-allocation strategy

- How much time are you willing to put in?

- It is up to you whether you intend on using the funds short-term for trading purposes.

- What type of tax treatment do YOU prefer?

- What precious metal(s), would you like to invest?

- How liquid is your portfolio?

- Your retirement date

- Where to store precious metals

- Your income level

- Your current savings rates

- Your future goals

- Your net worth

- Special circumstances that may influence your decision

- Your overall financial situation

- Your preference between physical or paper assets

- Your willingness and ability to take risks

- Your ability to manage losses

- Your budget constraints

- Financial independence is what you want

- Your investment experience

- Precious metals are familiar to you

- Your knowledge of precious Metals

- Your confidence in the economy

- Your personal preferences

After you have determined the type of precious metal IRA that best suits you, you can open an account with a reputable dealer. You can find these companies through referrals, word of mouth, or online research.

After opening your precious metal IRA you will need to decide how big you want it to be. It's important to note that each precious metal IRA account carries different minimum initial deposit amounts. Some account require just $100, while some allow you to put up to $50,000.

As you can see, your precious metal IRA IRA investment amount is completely up to the individual. A higher initial deposit will help you build wealth over a prolonged period. However, a smaller initial deposit might work for you if your goal is to invest less money each month.

You can purchase a variety of investments, regardless of whether the precious metals are actually used in your IRA. The most common include:

- Gold – Bullion bars, rounds, and coins

- Silver – Rounds, and coins

- Platinum – Coins

- Palladium – Round and bar forms

- Mercury – Bar and round forms

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Are Bitcoin ETFs Meeting Expectations?

Sourced From: bitcoinmagazine.com/markets/have-bitcoin-etfs-lived-up-to-the-hype

Published Date: Fri, 10 Jan 2025 13:30:00 GMT