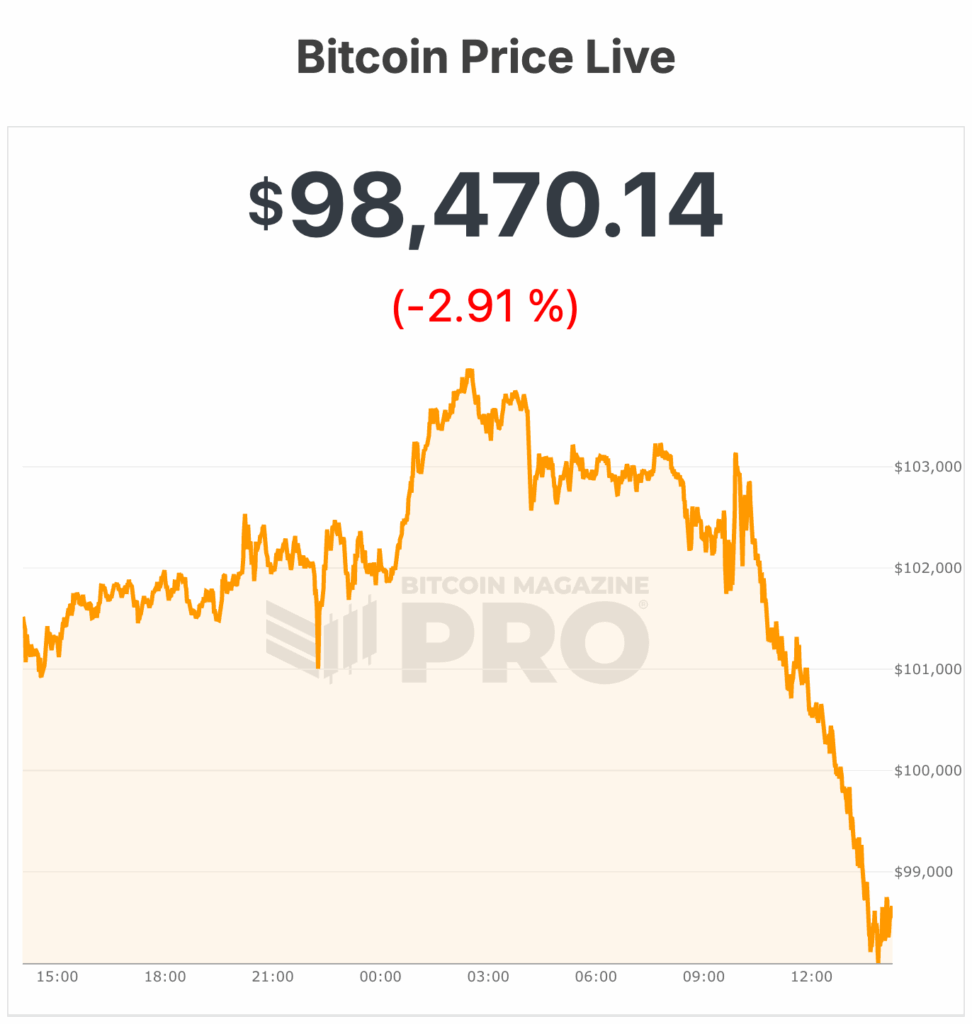

Hey there, fellow crypto enthusiasts! If you've been keeping an eye on Bitcoin's price lately, you might have noticed some significant drops. Today, Bitcoin took a nosedive from $104,000 to $98,113, leaving investors on edge.

The Rollercoaster Ride of Bitcoin Prices

The Recent Dip and Its Implications

This recent price plunge has stirred up a lot of chatter in the crypto community. According to data from Bitcoin Magazine Pro, we haven't seen Bitcoin prices this low since early May. Back then, Bitcoin rallied above $100,000 for over 40 days before tumbling back to $98,000 in late June.

The Sell-off Saga

So, why the sudden drop? Well, it seems like long-term holders are cashing out big time. Reports show that they've sold a whopping 815,000 BTC in just 30 days, raking in billions in profits. This selling spree, combined with weakening demand, is putting immense pressure on Bitcoin's price.

What Experts Are Saying

Insights from Bitfinex

Bitfinex analysts suggest that the current Bitcoin pullback echoes past market cycles. They point out that despite the price drop, a significant portion of BTC holders are still in the green. However, they predict a bumpy road ahead, emphasizing the need for fresh demand to drive a sustainable recovery.

JPMorgan's Take on Bitcoin

JPMorgan analysts believe that Bitcoin's production cost of $94,000 acts as a safety net for its price. They foresee a potential upside, projecting a target of $170,000 in the next 6 to 12 months. This optimistic outlook hinges on the network's increasing production costs and historical price-to-cost ratios.

The Bitcoin-Nasdaq Conundrum

The Unusual Relationship

Bitcoin's dance with the Nasdaq has taken an intriguing turn. According to Wintermute, Bitcoin seems more sensitive to stock market downturns than upswings. This unusual behavior hints at investor fatigue rather than excitement, signaling a more cautious market sentiment.

As we navigate through these fluctuations, it's crucial to stay informed and adapt our strategies accordingly. Remember, in the world of crypto, being prepared and flexible is key to weathering the storms.

So, what's your take on Bitcoin's recent rollercoaster ride? Share your thoughts and let's dive into this exciting journey together!

Frequently Asked Questions

Which precious metal is best to invest in?

High returns on capital are possible with gold investments. It is also immune to inflation and other risk factors. As people become worried about inflation, the value of gold tends rise.

Gold futures are a great idea. These contracts guarantee that you will receive certain amounts of gold at a given price.

However, futures on gold aren't for everyone. Some prefer to have physical gold.

They can trade their gold with other people. They can also sell their gold whenever they wish.

Many people prefer not to pay taxes on their gold. They purchase gold directly from governments to achieve this.

This process requires you to make several trips to your local post office. First, convert any gold you have into coins or bars.

Then you will need a stamp to attach the coins or bars. Then, send them to the US Mint. There they will melt the coins or bars into new ones.

These bars and coins are stamped with the original stamps. These new coins and bars are legal tender.

But if you buy gold directly from the US Mint, you won't have to pay taxes.

Decide what precious metal do you want to invest?

Can I have gold in my IRA.

Yes! You can add gold to your retirement plan. Gold is an excellent investment because it doesn't lose value over time. It is also resistant to inflation. It also protects against inflation.

It's important to understand the differences between gold and other investments before investing in it. You can't purchase shares in gold companies, unlike stocks and bonds. You cannot also sell them.

Instead, convert your precious metals to cash. You will have to get rid. You cannot keep it.

This makes gold different than other investments. Similar to other investments, gold can be sold at any time. That's not true with gold.

Even worse, you can't use the gold as collateral for loans. You may have to part with some of your gold if you take out mortgages.

What does this all mean? You can't keep your gold indefinitely. You will have to sell it at some point.

There's no need to be concerned about this right now. You only need to open an IRA account. Then, you are able to invest in gold.

What Is a Precious Metal IRA?

Precious metals are an excellent investment for retirement accounts. Precious metals have been around since Biblical times and still hold their value today. It is a great way of diversifying your portfolio and protecting against inflation by investing in precious metals like gold, silver, or platinum.

Certain countries permit citizens to hold their money in foreign currencies. You can buy Canadian gold bars and keep them at home. Then, when you go back to visit family, you can sell those same gold bars for Canadian dollars.

This is a quick and easy way of investing in precious metals. It's especially useful if you live outside of North America.

Are silver and gold IRAs a good idea for you?

This could be a great way to simultaneously invest in gold and silver. There are also many other options. If you have any questions regarding these types of investments, please feel free to contact us anytime. We are always here to help!

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

kitco.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

regalassets.com

wsj.com

How To

How to get started buying silver with an IRA

How to buy silver with an IRA – Direct ownership of physical bullion is the best way to invest. Silver coins and bars are the most popular form of investment because they offer diversification, liquidity, and convenience.However, many prefer owning physical bullion over paper certificates or electronic currency.

There are many options available if you wish to purchase precious metals such as gold and silver. You can purchase them directly from their producers, such as mining companies and refiners. If you don't want the hassle of dealing with a producer directly, you can purchase them from a dealer that buys and trades bullion products.

This article will tell you how to start investing with your IRA in silver.

- Investing in Gold & Silver through Direct Ownership – The best way to purchase precious metals is to directly go to the source. This means getting the bullion itself and having it delivered right to your door. Some investors keep their bullion at home, while others store it in a secure storage unit. When you hold onto your precious metal, ensure you're storing it properly. Most storage facilities offer insurance coverage that protects against theft, fire, or damage. You could lose your investments due either to natural disasters, human error, or even insurance. It is always a good idea to store precious metals in safe deposit boxes at banks or credit unions.

- Buy Precious Metals Online: If you don't want to carry around heavy boxes full of precious metals, there are other options. Bullion dealers sell bullion in different forms, including coins and bars. Coins come in different sizes, shapes, and designs. Generally speaking, coins are easier to carry around and less expensive than bars. Bars come in a variety of sizes and weights. Some bars weigh hundreds of pounds, while others only weigh a few ounces. The best rule of thumb for choosing the right type of bar is to consider your intended use. You might consider a smaller bar if you intend to give it as a gift. It might not be the best choice if you're looking to add it in your collection or display it proudly.

- Buying Precious Metal From Dealers – A third option is to buy bullion from a dealer. Most dealers have a specific area of expertise, usually in silver or gold. Some dealers specialize in particular types of bullion like rounds or minted currency. Others specialize in specific regions. Others specialize in bulk sales. No matter what dealer you choose you will find that they offer great prices and flexible payment options.

- Purchase Precious Metals via Retirement Accounts – Although this is technically not an investment, it can be used as a way to increase exposure to precious materials. A qualified retirement account is required to invest in precious metals in order to qualify for Section 219 IRS Code tax benefits. These include IRAs as well 403(b), 401(k), and 403 (b) plans. These accounts are designed to help you save for retirement and often provide higher returns than other investment vehicles. Many of these accounts let you diversify your holdings across multiple types of metals. But what's the downside? Retirement accounts don't allow everyone to invest. Only employees who have been sponsored by an employer can invest in retirement accounts.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Bitcoin Price Drops Below $98,000: What Does It Mean for Investors?

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-crashes-to-98000

Published Date: Thu, 13 Nov 2025 20:32:13 +0000