Hey there, crypto enthusiasts! Curious about where Bitcoin's price might head next? While everyone's buzzing about the current bull market's peak, let's dive into what lies beyond. Buckle up as we explore the data and math behind estimating Bitcoin's potential bear market bottom — not a crystal ball prediction, but a solid framework grounded in past cycles, valuation metrics, and the essence of BTC's value.

The Cycle Master Model: Unveiling Bitcoin's Historical Price Bottoms

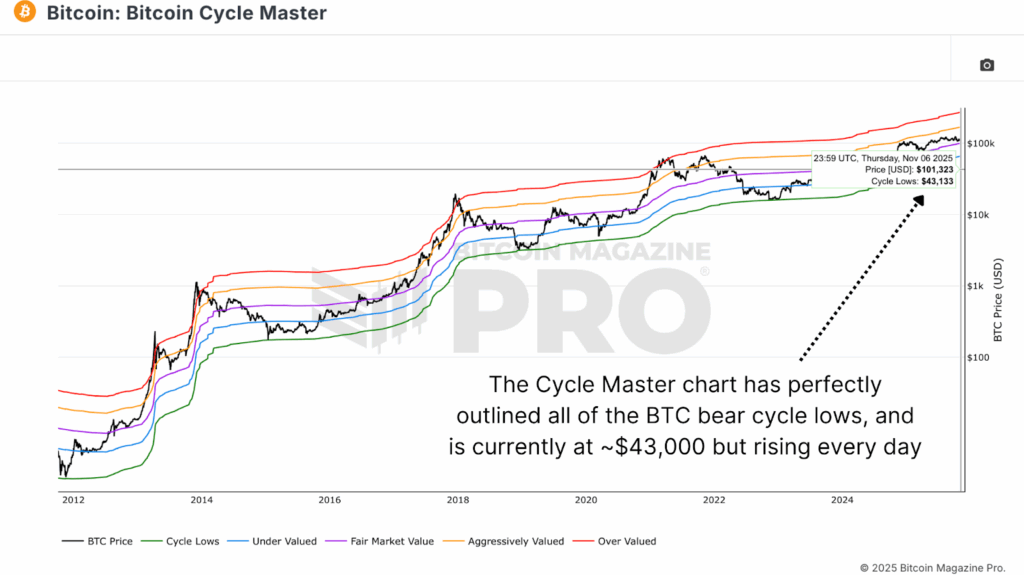

Decoding Bitcoin's Cyclical Lows

Picture this: imagine having a reliable crystal ball that historically pinpoints Bitcoin's major market bottoms with stunning accuracy. Enter the Bitcoin Cycle Master chart, a treasure trove of on-chain metrics that paints a vivid picture of price bands reflecting valuation levels. From calling $160 in 2015, $3,200 in 2018, to $15,500 in late 2022, this chart's green "Cycle Lows" line has been a beacon of precision. Currently hovering around $43,000, this line sets the stage for gauging Bitcoin's potential dip in the upcoming cycle.

The Diminishing Drawdowns: A Glimpse into Bitcoin's Bear Market Evolution

Unveiling the MVRV Ratio

Let's simplify things: the MVRV Ratio essentially measures how Bitcoin's market price stacks up against its realized price (the average cost of all coins). During harsh bear markets, Bitcoin tends to dip to about 0.75x its realized price, indicating that the market price hovers around 25% below the network's collective cost basis. This reliable pattern serves as a solid anchor for forecasting potential downturns, especially when paired with the trend of diminishing drawdowns. Over time, Bitcoin's downturns have become less severe, hinting at a possible ~70% retracement from peak prices in the next bear market.

Peeking into the Crystal Ball: Forecasting Bitcoin's Future Peaks and Valleys

Setting the Stage for Bitcoin's Price Trajectory

Before diving into the next low, let's set our sights on a reasonable peak for this bullish ride. Drawing insights from historical MVRV multiples and realized price growth trends, Bitcoin has a recent track record of peaking at around 2.5x its realized price. If this trend holds and the realized price keeps its upward momentum, we might be looking at a peak around $180,000 per BTC by late 2025. Following historical patterns, a potential 70% retracement from that peak could lead us to a new cycle low ranging from $55,000 to $60,000, aligning neatly with Bitcoin's past consolidation ranges.

The Interplay Between Bitcoin's Price and Production Costs

Unlocking Bitcoin's Production Cost Dynamics

Here's a simple analogy: think of Bitcoin's production cost as a solid bedrock supporting its price. Post each halving, this cost doubles, acting as a strengthening foundation under Bitcoin's value. When Bitcoin dips below this production cost, it signals miner stress and often heralds lucrative accumulation opportunities. Following the April 2024 halving, the production cost surged, currently hovering around ~$70,000, showcasing its influence on market dynamics.

In a Nutshell: The Evolving Bitcoin Price Cycles

Embracing Bitcoin's Historical Patterns

Let's face it: with each Bitcoin cycle, we hear the echoes of "This time is different." Yet, the data begs to differ. Despite institutional shifts and financial integrations, Bitcoin's cyclic nature remains intact. Anticipate a milder bear market next, reflecting a more mature landscape driven by liquidity. A pullback to the $55,000–$70,000 range signifies a continuation of Bitcoin's growth story, marking the ebb and flow of its historical journey.

Excited to ride the Bitcoin wave with a fresh perspective? Dive into these insights and stay ahead of the crypto curve!

Frequently Asked Questions

Do you need to open a Precious Metal IRA

This depends on what your investment goal is and how risk-tolerant you are.

Register now if you want to save money for retirement.

This is because precious metals are more likely to appreciate in the future. They also offer diversification benefits.

In addition, gold and silver prices tend to move together. This makes them an excellent choice for investors in both assets.

Do not invest in precious metals IRAs if your goal is to save money or take on any risk.

How much of your portfolio should be in precious metals?

To protect yourself from inflation, investing in physical metals is the best option. This is because when you invest in precious metals, you buy into the future value of these assets, not just the current price. The value of your investment increases with rising prices.

If you hold on to your investments for at least five years, you will receive tax benefits on any gains. After that time, capital gains taxes will be due. Our website has more information about how to purchase gold coins.

Can you make money in a gold IRA

Two things are necessary if you want to make a profit on your investment. First, you need to understand the market. Second, you need to know what type of products you have.

Trading should not be started if you don’t have sufficient information.

Also, you should find the broker that provides the best service possible for your account type.

There are many account options available, including Roth IRAs (standard IRAs) and Roth IRAs (Roth IRAs).

You may also wish to consider a rollover if you already have other investments, such as stocks and bonds.

Can you hold precious metals in an IRA?

The answer to that question will depend on whether the IRA owner plans to diversify his holdings to gold and/or keep them safekeeping.

He has two options if he wishes to diversify. He could purchase physical bars of gold or silver from a dealer and then sell these items to him at the end. But, what if he doesn't want to sell his precious metal investments? In this case, he should hold onto the investments as they are perfect for storing inside an IRA account.

Which is stronger, 14k or sterling gold?

Gold and silver are strong metals, but sterling silver is much less expensive because it contains 92% pure silver rather than just 24%.

Sterling silver is also called fine silver. It is made from a combination silver and other metals, such as zinc and copper.

It is generally believed that gold is very strong. It takes great pressure to break it apart. If you drop something on top of a chunk of gold it will shatter into thousands of pieces rather than breaking into two halves.

But silver isn’t nearly as sturdy as gold. If you dropped an item onto a sheet of silver, it would probably bend and fold without shattering.

Silver is often used in jewelry and coins. The price of silver can fluctuate according to supply and demande.

Which precious metals are best to invest in retirement?

Knowing what you have saved so far and where you plan to save money in the future is the first step towards retirement planning. You can start by making a list of all your assets. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. You can then add up all these items to determine the amount of investment you have.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. A Roth IRA, on the other hand, allows you to subtract contributions from your taxable revenue. But, future earnings won't allow you to take tax deductions.

You may need additional money if you decide you want more. Start with a regular brokerage.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

regalassets.com

wsj.com

kitco.com

takemetothesite.com

How To

How to convert your IRA into a Gold IRA

Are you looking to transfer your retirement savings out of a traditional IRA in favor of a gold IRA. This article will assist you in that endeavor. Here are some tips to help you switch.

“Rolling over” refers to the act of transferring money into an alternative type of IRA (traditional), or vice versa (gold). Rolling an account over offers tax advantages. In addition, some people prefer investing in physical assets like precious metals.

There are two types IRAs – Traditional IRAs (or Roth IRAs). The difference is simple. Traditional IRAs allow investors the ability to deduct taxes whenever they withdraw their earnings. Roth IRAs are not. That means that if you invest $5,000 in a Traditional IRA today, then after five years, you'll only be able to take out $4,850. The Roth IRA would allow you to keep every cent if you invested the same amount.

This is what you need to know if you want to convert an IRA from a conventional to a IRA to a IRA with gold.

First, you need to decide whether to roll over your current balance into a new account or simply transfer funds from your old account to your new one. When transferring money, you'll pay income tax at your regular rate on any earnings that exceed $10,000. However, if your IRA is rolled over, these earnings will not be subjected to income tax until age 59 1/2.

After you have made your decision, you will need to open a new account. It is likely that you will be asked to prove your identity by providing proof such as a Social Security card or passport. Then, you'll fill out paperwork showing that you own the IRA. Once you've filled out the forms you'll send them to your bank. They'll verify your identity and give instructions on where to send the checks and wire transfers.

This is the fun part. Now, deposit money into your account and wait for approval from the IRS. Once you have received approval, you will receive a letter that allows you to withdraw funds.

That's it! All you need to do now is watch your money grow. You can also close your IRA and transfer the balance to a new one if you change your mind.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Predicting Bitcoin's Price Floor: A Mathematical Approach

Sourced From: bitcoinmagazine.com/markets/predicting-bitcoin-price-floor

Published Date: Fri, 07 Nov 2025 21:50:58 +0000