Are you curious about the latest Bitcoin price movements and what they mean for the market? Dive into this insightful analysis to uncover valuable insights that could guide your investment decisions.

The Current Bitcoin Landscape

Key Levels to Watch

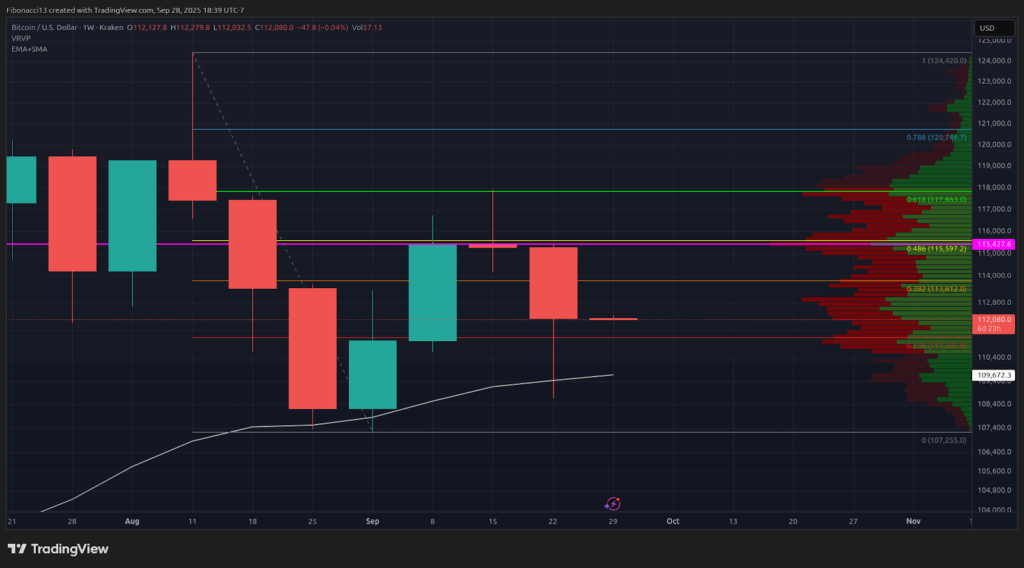

With Bitcoin closing above the crucial $109,500 mark, the focus is on maintaining this support level for a potential bullish trend. In case of a dip, $105,000 and $102,000 are key support levels to monitor. A breach below $102,000 could pave the way for a deeper decline towards long-standing support at $96,000.

On the upside, surpassing the $115,500 resistance level could signal a renewed uptrend. This breakthrough might set the stage for tackling the $118,000 resistance, with $121,000 emerging as a gateway to new highs.

What to Expect This Week

Price Movement Forecast

This week, anticipate a potential retest of the $109,500 support, aiming for a rebound towards $113,800. However, breaching the $115,500 resistance might require substantial buying pressure. A bullish candle this week could confirm a higher low from the previous week.

Despite a bearish bias on the weekly chart, the $113,800 resistance level is likely to remain intact in the short term. A breakdown below $109,500 could trigger a significant price drop towards the $105,000 to $102,000 support range.

Market Sentiment: Bearish Outlook

With bearish dominance evident in the recent market close, the onus is on bulls to defend the 21-week EMA support. A shift in sentiment is crucial for fostering positive price action in the coming weeks.

Insights into Future Trends

Looking ahead, Bitcoin's weekly chart retains a bearish tone, awaiting a sentiment shift for better price performance. Keep an eye on upcoming FOMC meetings for potential rate cuts, influencing market dynamics. Monitoring US financial data will be vital, as any hindrance to rate cuts could lead to further bearish trends.

Ready to navigate the Bitcoin market with confidence? Stay informed, watch key levels, and adapt to changing market conditions to make informed decisions. Embrace the terminology guide below to enhance your understanding of market dynamics.

Terminology Guide

- Bulls/Bullish: Investors anticipating price increases.

- Bears/Bearish: Investors predicting price declines.

- Support Level: Price level expected to hold initially, weakening with more tests.

- Resistance Level: Price level likely to reject advances, weakening with multiple rejections.

- EMA: Exponential Moving Average, offering a real-time price perspective.

Stay informed, stay ahead, and navigate the Bitcoin landscape with confidence! For more in-depth insights, check out the original post here.

Frequently Asked Questions

Are gold IRAs a good investment?

The best way to invest in gold is by buying shares in companies that mine for it. These companies can make you money by investing in precious metals and gold.

But, owning shares in direct form has two downsides:

First, you can lose money by holding onto your stock for too long. Stocks that fall are less than their underlying asset (like silver) and can end up losing more money. This means that you might end up losing more money than you make.

You may also miss potential profits if the market recovers before you sell. Be patient and wait for the market's recovery before you make any profits from your gold holdings.

You can still enjoy the benefits of physical gold if your investments are separate from your finances. A gold IRA can help diversify your portfolio and protect against inflation.

Visit our website to learn more about gold investment.

Are you able to keep precious metals in your IRA?

This question is dependent on whether an IRA owner wishes to diversify into gold or silver, or keep them safe.

If he does want to diversify, then there are two options available to him. He could purchase physical bars of gold or silver from a dealer and then sell these items to him at the end. However, suppose he isn't interested in selling back his precious metal investments. In that case, he should continue holding onto them as they would be perfectly suitable for storing within an IRA account.

Which precious metals are best to invest in retirement?

It is important to know what you have already saved and where money you are saving for retirement. Take a look at everything you own to determine how much you have left. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. Add all these items together to calculate how much money you have for investment.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. Traditional IRAs allow you to deduct contributions out of your taxable income. Roth IRAs don't. However, you will not be able take tax deductions on future earnings.

If you decide to invest more, you will most likely need to open a second investment account. You can start with a regular brokerage account.

How do I Withdraw from an IRA of Precious Metals?

You may consider withdrawing your funds if you have an account with a precious metal IRA company such as Goldco International Inc. This will ensure that your metals are worth more than if they were in an account with a precious metal IRA company like Goldco International Inc.

Here are the steps to help you withdraw money from your precious-metal IRA.

First, determine whether the precious metal IRA provider allows withdrawals. This option is available from some companies, but not all.

The second step is to determine if selling your metals will allow you tax-deferred gain. Most IRA providers offer this benefit. But, not all IRA providers offer this benefit.

Third, check with your precious metal IRA provider to see if any fees are associated with taking these steps. It is possible that the withdrawal will be more expensive.

Fourth, keep track of your precious metal IRA investments for at least three years after you sell them. This means that you must wait until January 1st of each year to calculate capital gain on your investment portfolio. You will then need to file Form 8949 which contains instructions on how to calculate the amount of gain that you have realized.

You must file Form 8949 and also report any sale of precious metals to IRS. This ensures you pay tax on any profits from your sales.

Before selling precious metals, it is a good idea to consult an attorney or trusted accountant. They will ensure you are following all the procedures and avoid making costly mistakes.

How much are gold IRA fees?

The average annual fee to open an individual retirement account (IRA), is $1,000. There are many types and types of IRAs. These include traditional, Roth or SEP-IRAs as well as SIMPLE IRAs. Each type has its own set of rules and requirements. If your investments are not tax-deferred, you might have to pay taxes on the earnings. You must also consider how long you want to hold onto the money. You will save money if you intend to keep your funds longer than a Roth IRA.

Traditional IRAs allow you to contribute up $5,500 annually ($6,500 if 50+). The Roth IRA allows unlimited contributions each year. The difference is simple. With a traditional IRA you can withdraw the money when you retire and pay no taxes. A Roth IRA will entail taxes for any withdrawals.

What precious metals will be allowed in an IRA account?

The most common precious metal used for IRA accounts is gold. As investments, you can also buy bars and bullion coins made of gold.

Precious metals, which don't lose any value over time, are considered safe investments. They are also a great way of diversifying your investment portfolio.

Precious metals include palladium and platinum. These metals all share similar properties. Each metal has its own use.

In jewelry making, for instance, platinum is used. The catalysts are made from palladium. The production of coins is done with silver.

Consider how much you plan to spend on gold when deciding on which precious metal to buy. You might be better off buying gold that costs less per ounce.

You need to decide if you want your investment to remain private. If so, then you should go with palladium.

Palladium is worth more than gold. However, it is also rarer. It's likely that you will have to pay more.

Storage fees are another important consideration when choosing between silver and gold. The weight of gold is what you store. The price for larger amounts will go up.

Silver is measured in volume. So you'll pay less for storing smaller amounts of silver.

Keep in mind all IRS rules when you store precious metals inside an IRA. This includes keeping records of transactions and reporting them back to the IRS.

Can I add gold to my IRA?

The answer is yes You can add gold into your retirement plan. Because it doesn’t lose value over the years, gold makes a good investment. It protects against inflation. It doesn't come with taxes.

Before investing in gold, you need to know that it's not like other investments. You cannot buy shares of companies that are gold, like stocks and bonds. You cannot also sell them.

Instead, convert your precious metals to cash. This means that you'll have to get rid of it. You cannot just keep it.

This makes gold an investment that is different from other investments. With other investments, you can always sell them later. However, gold is different.

You can't even use your gold as collateral to get loans. To cover a mortgage, you may need to give up some gold.

What does this translate to? You can't keep your gold indefinitely. You will have to sell it at some point.

But there's no reason to worry about that now. All you need to do is create an IRA. You can then invest in gold.

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

forbes.com

en.wikipedia.org

kitco.com

wsj.com

How To

Best Precious Metals Ira in 2022: Things to Remember

Precious Metals Ira ranks high among investors as one of their most popular investment options. This article will show you how to invest in precious metals and what makes it so appealing.

The main attraction of these assets is their long-term growth potential. The historical data shows incredible returns for gold prices. Gold prices have increased by almost $1900 per troy ounce in the past 200 year, from $20 an ounce to nearly $1900 over that time. In comparison, the S&P 500 Index only grew by around 50%.

During times of economic uncertainty, people consider gold a safety net. People tend to sell stocks when the stock market is in trouble and shift into gold for safety. As an inflation hedge, gold is also thought to be a good investment. Many economists believe that there will always be some degree of inflation. Physical gold is a way to protect your money from future price increases.

Before you buy any precious metal, such as silver, gold, palladium or platinum, there are some things you should consider. First, consider whether you would prefer to invest in bullion or coins. Bullion bars usually come in large amounts (e.g 100 ounces), and are stored away until needed. Bullion bars are often replaced by coins, which can be used to buy smaller amounts of bullion.

Second, you should consider where you plan to store your precious metals. Some countries are safer then others. If you are in the US, it might be a good idea to store your precious metals abroad. But if you're planning on storing them in Switzerland, you might want to ask yourself why.

Finally, you need to decide whether you want precious metals investments directly or through “precious Metals Exchange-Traded Funds” (ETFs). ETFs can be financial instruments that track different commodities' performance, such as gold. These can be used to gain exposure to precious metals, without the need to own them.

—————————————————————————————————————————————————————————————-

By: Ethan Greene – Feral Analysis

Title: Bitcoin Price Analysis: FOMC Rate Cuts Impending While Bitcoin Maintains Strong Position Above $109,500 EMA

Sourced From: bitcoinmagazine.com/markets/fomc-rate-cuts-loom-as-bitcoin-holds-above-109500-ema

Published Date: Tue, 30 Sep 2025 23:36:05 +0000