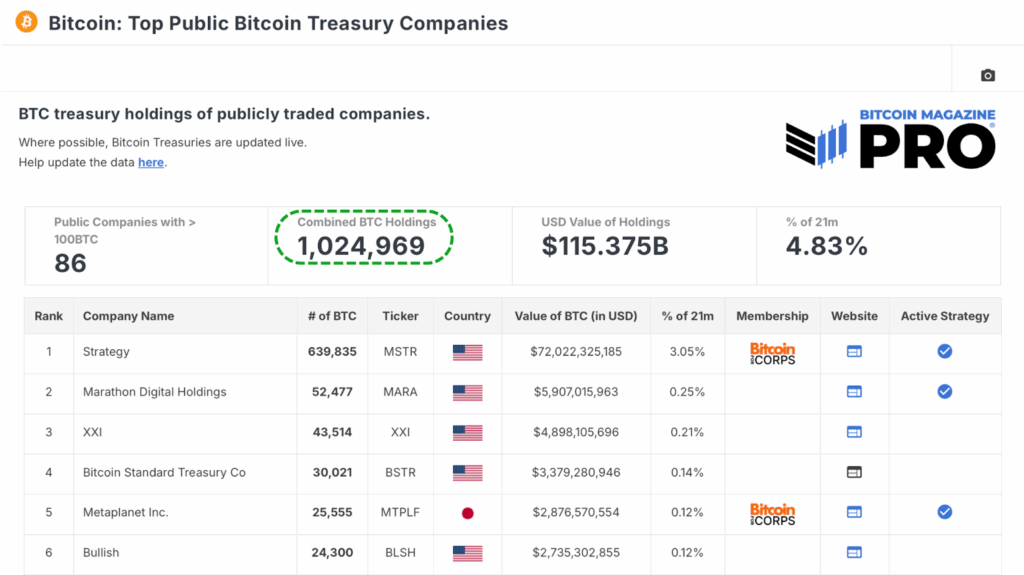

Bitcoin treasury companies play a pivotal role in the current market cycle, significantly impacting demand. Currently, there are 86 publicly traded firms holding over 1 million BTC collectively. What kickstarted in 2020 with MSTR (Strategy) has now become a trend across the corporate sector, witnessing new players entering the scene regularly. However, a deeper dive into their buying patterns unveils a remarkable insight – many of these companies could have held substantially more Bitcoin today if they had followed a straightforward, rule-based accumulation strategy.

MSTR Taking the Lead in Bitcoin Treasury Holdings

Setting the Stage for Bitcoin Treasury Companies

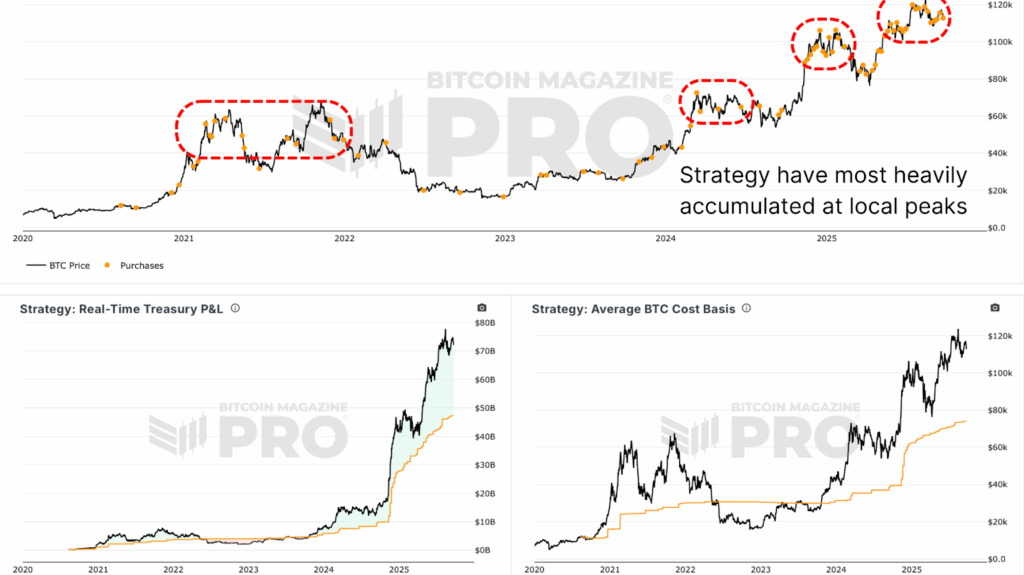

MSTR (Strategy) stands out as the frontrunner among corporate Bitcoin holders, with a stash of almost 640,000 BTC. Cumulatively, the Top Public Bitcoin Treasury Companies now secure over 1 million BTC, locking away a portion of the liquid supply, thereby bolstering Bitcoin’s monetary value (assuming they hodl!) While this trend has immensely benefited Bitcoin's supply-demand dynamics, data reveals that a significant chunk of these acquisitions took place during frenzied market conditions, especially at local peaks.

Decoding MSTR's Bitcoin Cycles Strategy

Analyzing MSTR's Bitcoin Cycle Behavior

Let’s take a close look at MSTR's (Strategy) approach. The company notably made hefty investments during late 2024, as Bitcoin soared above $70,000 post ETF green lights. This trend wasn’t exclusive to MSTR, as the broader treasury realm exhibited a similar trend of loading up during euphoric phases.

While this buying spree is understandable (raising capital is easier during price upticks and bullish sentiment), the aftermath often involves overpayment. In retrospect, by waiting for even slight pullbacks, these firms could have saved 10–30% on average compared to their actual buy-in points. Nobody can predict price actions perfectly, but refraining from immediate purchases post triple-digit percentage spikes over a few weeks could have been a wiser move!

Implementing a Data-Driven Fix: MVRV Strategy for MSTR and Treasuries

Utilizing MVRV Ratio for Tactical Bitcoin Holdings

A simple tweak could have yielded significant benefits: integrating the MVRV Ratio as a screening tool. This method isn’t intricate. It doesn’t aim to time market bottoms precisely or rely on subjective opinions. Instead, it employs a rolling MVRV percentile threshold to avoid investing during the hottest phases of bullish runs.

By refraining from acquisitions when the MVRV ratio hit the top 20% of historical readings (indicative of overvaluation) and deploying capital during calmer periods, MSTR (Strategy) could have possessed nearly 685,000 BTC today, almost 50,000 BTC more than its current holdings.

At current valuations, this amounts to over $5 billion in extra Bitcoin. To put it into perspective, the Bitcoin "missed" is roughly equivalent to the total lifetime holdings of other Active Bitcoin Treasury Companies (excluding Marathon Digital).

Similar methodologies have been tested across various markets like altcoins, equities, and even the S&P 500, consistently outperforming blind dollar-cost averaging. Strategic dollar-cost averaging triumphs over emotional dollar-cost averaging almost irrespective of market conditions.

Impact on MSTR, Treasuries, and Retail Investors

Significance for MSTR, Treasuries, and Retail Players

For treasury entities, adopting this model could translate into billions in additional value over time. Individual investors can apply the same principle – avoid chasing rallies during euphoric periods and rather let the market come to you.

Admittedly, we must consider the complexities. Corporations encounter challenges in fundraising, executing significant block trades without slippage, and managing shareholder expectations. Nonetheless, even within these limitations, a straightforward data-driven filter could substantially enhance outcomes.

Closing Thoughts: MSTR's Journey to Intelligent Bitcoin Accumulation

Looking Ahead: Smarter Bitcoin Accumulation for MSTR

Bitcoin treasury companies have undeniably been a massive boon for the network. Their collective 1 million BTC holdings reduce supply, amplify the money multiplier effect, and underscore the escalating institutional acceptance of Bitcoin. Yet, data indicates that most of them could undoubtedly do better. A basic strategy of bypassing purchases during overheated phases would have netted MSTR (Strategy) alone an extra 50,000 BTC, valued at over $5 billion today.

For both corporations and individuals, the lesson remains consistent: discipline surpasses FOMO. Treasury accumulation has transformed Bitcoin's supply landscape, but the next phase may involve adopting smarter accumulation strategies to maximize returns and mitigate market downside volatility without heightening risk.

For an in-depth exploration of this subject, check out our latest YouTube video:

This Simple Bitcoin Strategy Would Have Made Them Billions

Frequently Asked Questions

What precious metals are permitted in an IRA

Gold is the most widely used precious metal for IRA account accounts. Also available as investments are bars and bullion gold coins.

Precious metals are considered safe investments because they don't lose value over time. Precious metals are also great for diversifying an investment portfolio.

Precious metallics include platinum, silver and palladium. These metals share similar properties. Each has its own purpose.

Platinum is used to make jewelry, for example. To create catalysts, palladium is used. To produce coins, silver can be used.

When deciding which precious metal to choose, consider how much you expect to spend on your gold. It may be more cost-effective to purchase gold at lower prices per ounce.

Also, think about whether or not you wish to keep your investment secret. If you are unsure, palladium is the right choice.

Palladium is more valuable than gold. But it's also rarer. So you'll likely have to pay more for it.

When choosing between gold or silver, another important aspect is the storage fees. Gold is measured by weight. If you have larger amounts of gold to store, you will be charged more.

Silver is best stored in volumes. You'll be charged less for smaller amounts.

You should follow all IRS rules if you plan to store precious metals in an IRA. This includes keeping track and reporting transactions to the IRS.

How Much of your IRA Should Be Made up of Precious Metals

Protect yourself against inflation by investing in precious metals like gold and silver. It's not just a way to save money for retirement.

The prices of gold and silver have increased substantially over the past few decades, but they remain safe investments because they do not fluctuate as frequently as stocks. These materials are in constant demand.

Gold and silver prices are usually stable and predictable. They tend to increase when the economy is growing and decrease during recessions. This makes them excellent money-savers, and long-term investment options.

Precious metals should make up 10 percent of your portfolio. This percentage can be increased if your portfolio is more diverse.

How much should precious metals be included in your portfolio?

The best way to avoid inflation is to invest in physical gold. This is because when you invest in precious metals, you buy into the future value of these assets, not just the current price. The value of your investment increases with rising prices.

Gains will be taxed if you keep your investments for at minimum five years. You will also have to pay capital gains taxes if your investments are sold after the five-year period. Our website has more information about how to purchase gold coins.

Which type of IRA works best?

It is essential to find an IRA that matches your needs and lifestyle when you are choosing one. Consider whether you are looking to maximize tax-deferred growth, minimize taxes and pay penalties later, avoid taxes, or both.

The Roth option can be a smart choice if your retirement savings are limited and you don't have any other investments. It's also worth considering if your plan is to work after the age of 59 1/2.

Traditional IRAs might be more beneficial if you are looking to retire early. You'll likely owe income taxes. The Roth IRA is a better option if you plan to continue working well beyond age 65. It allows you to withdraw any or all of your earnings and not pay taxes.

Statistics

- Silver must be 99.9% pure • (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

regalassets.com

kitco.com

forbes.com

wsj.com

How To

How to Buy Gold For Your Gold IRA

Precious metal is a term used to describe gold, silver, platinum, palladium, rhodium, iridium, osmium, ruthenium, rhenium, and others. It can be any element naturally occurring between atomic numbers 7 and 110 (excluding the helium). This is valuable due to its beauty and rarity. Precious metals that are most commonly used include silver and gold. Precious metals can be used to make money, jewelry, industrial products, and art objects.

Due to supply and demand, the price of gold fluctuates every day. The demand for precious materials has increased dramatically over the last decade as investors seek to find safe havens in volatile economies. This has resulted in a substantial rise in the prices. Some people are concerned about investing in precious metals due to the rising cost of production.

Because gold is rare and durable, it makes a good investment. Gold never loses its value, unlike other investments. Additionally, you can sell and buy gold without any taxes. There are two ways that you can invest your gold. You have two options: you can buy gold bars and coins, or you can invest in futures contracts.

The physical gold bars and coins provide immediate liquidity. They're easy to trade and store. However, they are not very inflation-proof. For protection against rising prices, gold bullion is a good option. Bullion, also known as physical gold and available in different sizes, is physical. One-ounce pieces are available for billions, while larger quantities such as kilobars and tens of thousands can be purchased. Bullion is stored in vaults that are protected against theft and fire.

If you prefer owning shares of gold rather than holding actual gold, you should consider buying gold futures. Futures allow you to speculate as to how the gold price will change. You can purchase gold futures to get exposure to the gold price, but not the actual commodity.

For example, if I wanted to speculate on whether the price of gold would go up or down, I could purchase a gold contract. My position at the expiration of the contract will be either “long-term” or “short-term.” A long contract means that I believe the price of gold will go higher, so I'm willing to give someone else money now in exchange for a promise that I'll get more money later when the contract ends. A shorter contract will mean that I expect the price to fall. In exchange for making less money in the future, I am willing to accept the money now.

I'll get the contract's specified amount of gold plus interest when it expires. By doing this, I can get exposure to the market price for gold without actually owning it.

Precious Metals are great investments as they are difficult to counterfeit. While paper currency can be easily counterfeited simply by printing new notes, precious metals cannot. This is why precious metals have always held their value well over time.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: How MSTR Can Enhance Bitcoin Holdings with MVRV BTC Strategy

Sourced From: bitcoinmagazine.com/markets/mstr-50k-bitcoin-mvrv-btc-strategy

Published Date: Fri, 26 Sep 2025 13:49:51 +0000