Hey there, crypto enthusiasts! Today, we're diving into the exciting world of Bitcoin price predictions. If you've been keeping an eye on the crypto market, you know that Bitcoin has been on a wild ride. But what if I told you that Bitcoin could potentially reach $130,000? Yes, you read that right!

Bitcoin's Price Movement

The Current Scenario

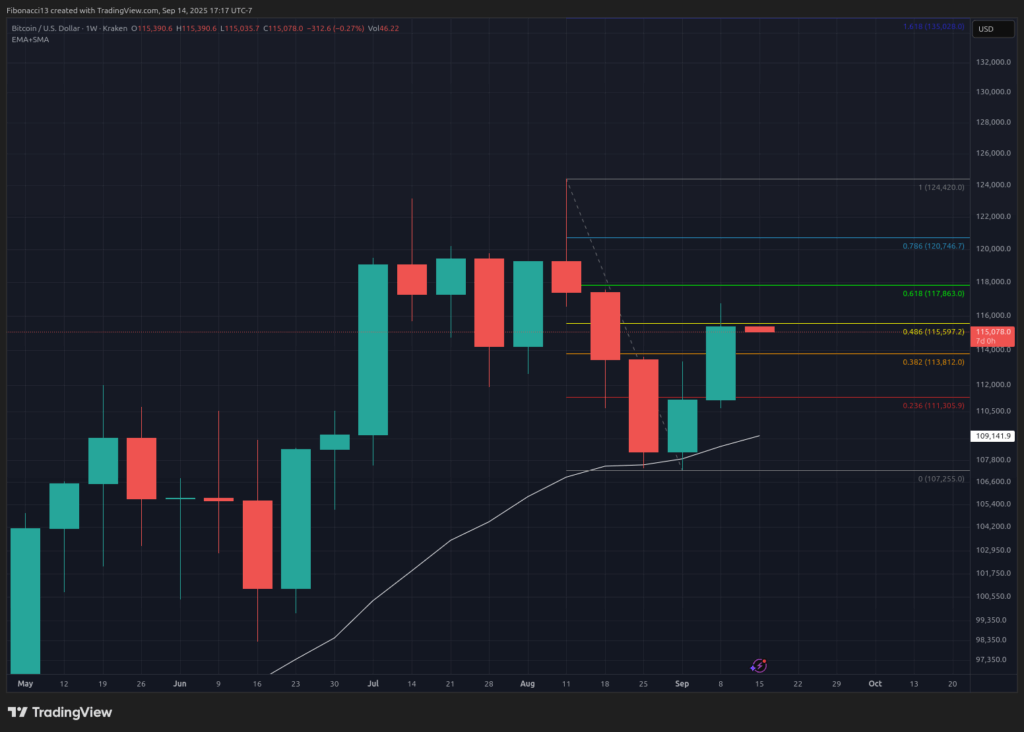

Last week, Bitcoin closed at $115,390 after testing the $115,500 resistance level. The market sentiment turned bullish with the hope of a rate cut decision by the Federal Reserve. The upcoming FOMC Meeting will play a crucial role in determining Bitcoin's trajectory.

Key Levels to Watch

- Resistance: $115,500, $118,000

- Support: $113,800, $111,000, $107,000

What to Expect This Week

Market Outlook

As we look ahead, Bitcoin faces resistance at $118,000. The price may fluctuate around this level, with potential support at $113,800. All eyes are on the FOMC Meeting and Chairman Powell's announcements, as they could significantly impact Bitcoin's price.

Short-Term Forecast

While the current bias is slightly bearish, a positive stock market trend could shift it back to bullish. Technical indicators like MACD and RSI suggest a cautious approach. The market mood remains bullish, with expectations of testing the $118,000 level.

Looking Ahead

The Road to $130,000

To reach new highs, Bitcoin needs to surpass $118,000 and maintain it as a support level. The Fed's rate decisions and market data will influence Bitcoin's journey. Any surprises could lead to price corrections.

Terminology Explained

- Bulls/Bullish: Investors expecting prices to rise

- Bears/Bearish: Investors anticipating price drops

- Support: Price level expected to hold initially

- Resistance: Price level likely to reject further movement

- SMA: Simple Moving Average

- Oscillators: Indicators showing oversold or overbought conditions

Exciting times are ahead in the world of Bitcoin! Stay tuned for updates and get ready for potential price surges. Remember, the crypto market is full of surprises, so buckle up and enjoy the ride!

Frequently Asked Questions

How much do gold IRA fees cost?

A monthly fee of $6 for an Individual Retirement Account is charged. This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you want to diversify, you may be required to pay extra fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge an annual management fee. These fees can range from 0% up to 1%. The average rate for a year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

How do I open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. Open the account by filling out Form 8606. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. You must complete this form within 60 days of opening your account. Once this has been completed, you can begin investing. You can also contribute directly to your paycheck via payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, the process will look identical to an existing IRA.

To qualify for a precious Metals IRA, there are specific requirements. The IRS states that you must be at least 18 and have earned income. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Contributions must be made on a regular basis. These rules are applicable whether you contribute through your employer or directly from the paychecks.

An IRA for precious metals allows you to invest in gold and silver as well as platinum, rhodium, and even platinum. However, you can't purchase physical bullion. This means you won’t be able to trade stocks and bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option can be provided by some IRA companies.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they don't have the same liquidity as stocks or bonds. This makes them harder to sell when needed. They also don't pay dividends, like stocks and bonds. Therefore, you will lose more money than you gain over time.

Should You Open a Precious Metal IRA?

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. There is no way to recover money that you have invested in precious metals. All your investments can be lost due to theft, fire or flood.

This type of loss can be avoided by investing in physical silver and gold coins. These coins have been around for thousands and represent a real asset that can never be lost. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

Consider a reputable business that offers low rates and good products when opening an IRA. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

Remember that you will not see any returns unless you are retired if you open an Account. Do not forget about the future!

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

irs.gov

bbb.org

finance.yahoo.com

How To

Tips for Investing In Gold

One of the most sought-after investment strategies is investing in gold. There are many advantages to investing in Gold. There are many ways you can invest in gold. Some people buy physical gold coins, while others prefer investing in gold ETFs (Exchange Traded Funds).

Before you purchase any type or gold, here are some things to think about.

- First, make sure you check if your country allows you own gold. If the answer is yes, you can go ahead. Or, you might consider buying gold overseas.

- Secondly, you should know what kind of gold coin you want. You have the option of choosing yellow, white, or rose gold.

- Thirdly, it is important to take into account the gold price. Start small and build up. When purchasing gold, diversify your portfolio. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- Remember that gold prices are subject to change regularly. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Ethan Greene – Feral Analysis

Title: Bitcoin Price Prediction: Could Bitcoin Hit $130,000 with a Dovish Fed?

Sourced From: bitcoinmagazine.com/markets/bitcoin-eyes-130000-if-fed-signals-dovish-policy

Published Date: Mon, 15 Sep 2025 20:56:26 +0000