Hey there, fellow investors and crypto enthusiasts! Today, I'm thrilled to dive into the exciting world of Metaplanet's latest move that has the potential to shake up Japan's financial landscape. Let's explore how Metaplanet is tripling its assets in Q2 by introducing Bitcoin-backed preferred shares tailored for Japan's hunger for higher yields.

The Game-Changing Announcement

Revolutionizing Japan's Fixed Income Market

Picture this: Japan boasts a staggering $14.9 trillion in household financial assets. However, the traditional fixed income market in Japan offers meager returns compared to other developed countries. With the 10-year Japanese Government Bond barely yielding ~1% and corporate bonds struggling to surpass 2%, investors have long been stuck in a rut of low returns.

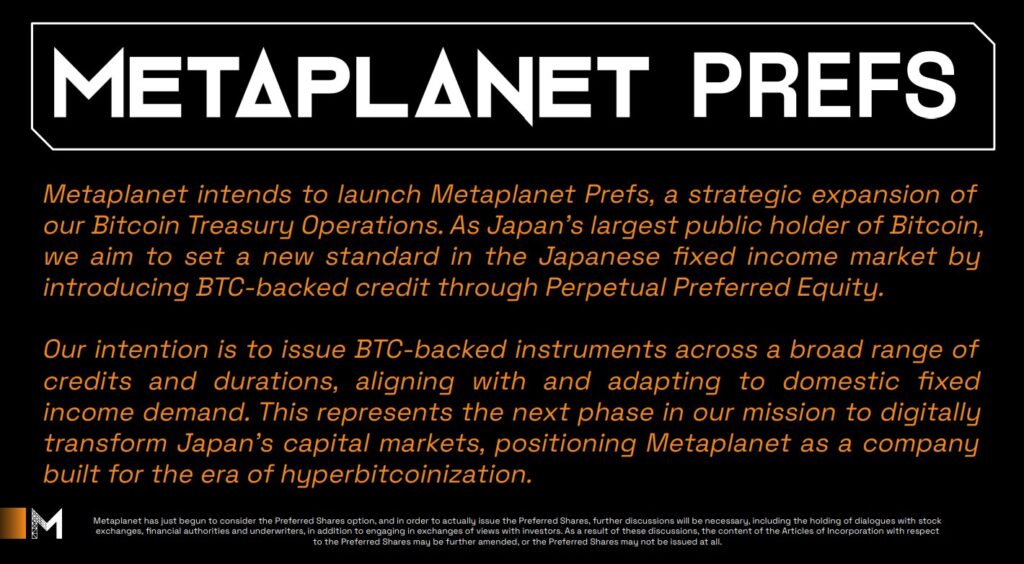

But wait, here comes Metaplanet to the rescue! In a bold move, Metaplanet introduced "Metaplanet Prefs" – a genius program of Bitcoin-Backed Preferred Shares designed to revolutionize its Bitcoin treasury operations and build a Bitcoin-backed yield curve in Japan's fixed income market. Imagine getting a return of 7–12% in a market where even "high yield" barely scratches the surface. It's a game-changer!

The Meteoric Rise of Metaplanet in Q2

Financial Performance Soaring to New Heights

Metaplanet's Q2 results were nothing short of spectacular. Revenue and profitability skyrocketed, assets and net assets saw an exponential increase, showcasing the company's remarkable growth trajectory. The numbers speak for themselves:

- Revenue: ¥1.239B ($8.4M) +41% QoQ

- Gross Profit: ¥816M ($5.5M) +38% QoQ

- Ordinary Profit: ¥17.4B ($117.8M) vs. -¥6.9B

- Net Income: ¥11.1B ($75.1M) vs. -¥5.0B

- Assets: ¥238.2B ($1.61B) +333% QoQ

- Net Assets: ¥201.0B ($1.36B) +299% QoQ

This phenomenal performance not only boosts Metaplanet's credibility but also sets the stage for the widespread adoption of Bitcoin-Backed Preferred Shares in Japan's fixed income market.

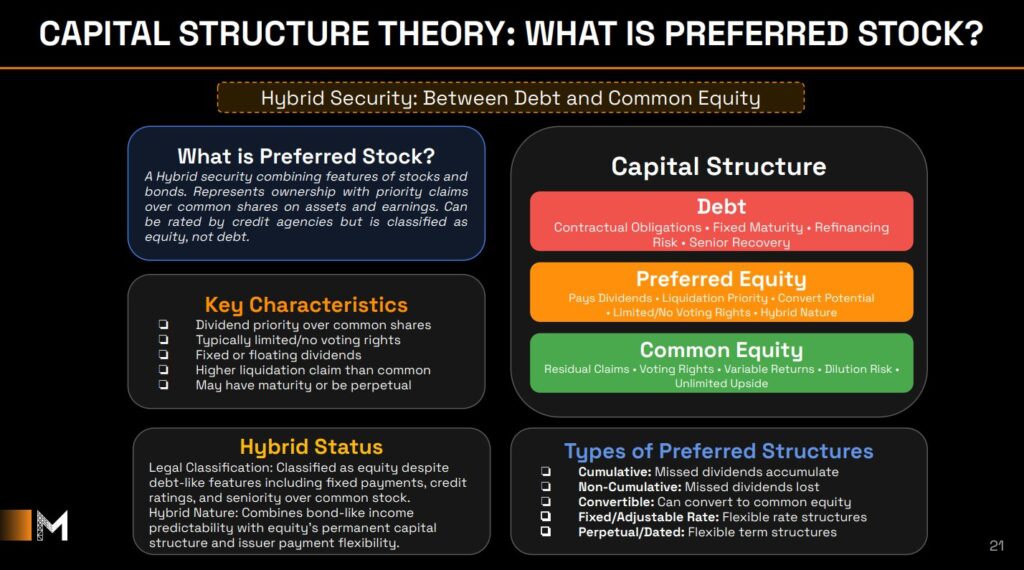

The Ingenious Concept of BTC-Backed Preferred Equity

Decoding 'Metaplanet Prefs'

Preferred equity, nestled between debt and common stock, offers premium benefits like dividend priority and predictable payouts without voting dilution. Metaplanet's Bitcoin-Backed Preferred Shares are a stroke of genius:

- Offering substantially higher yields than JGBs while maintaining a familiar format for Japanese investors.

- Mitigating refinancing risk associated with debt maturities.

- Diversifying funding avenues for Bitcoin accumulation beyond common equity.

The Road to Success: Building a BTC-Backed Yield Curve

Strategizing for Market Domination

Metaplanet's vision involves issuing various classes of Bitcoin-Backed Preferred Shares to cater to diverse investor segments:

- Short Duration Variable Dividend Perpetuals tailored for conservative buyers.

- Medium Duration Variable Dividend Perpetuals as a corporate credit alternative.

- Senior Fixed Dividend Perpetuals (Class A) for stability-focused portfolios.

- Fixed Dividend Convertibles (Class B) offering predictable income with BTC upside potential.

- High Yield Fixed Dividend Perpetuals for risk-tolerant investors eyeing higher returns.

It's not just a product lineup; it's the art of crafting an investable BTC-backed yield curve. Metaplanet mirrors Strategy's success in the U.S. but with a unique Japanese twist, tapping into a market hungry for yield.

Seizing the Opportunity in Japan's Capital Market

Unleashing Japan's Financial Potential

Japan's fixed income realm has long grappled with near-zero yields, leaving trillions stagnating with limited income options. The introduction of Bitcoin-Backed Preferred Shares could be the much-needed breakthrough:

- Japan's household assets breakdown: $9.5 trillion in fixed income, $6.8 trillion in equities, and $7.6 trillion in cash and deposits.

Here lies the opportunity: a Bitcoin-Backed Preferred Share offering an 8% yield could outshine a 10-year JGB by 8 times and high-grade corporate bonds by 4 times. The enticing prospect of higher returns within a familiar, regulatory-compliant structure could allure both domestic institutions and retail investors seeking yield.

In Conclusion: Embracing Bitcoin's Evolution in Corporate Strategies

Embracing the Future of Corporate Finance

Metaplanet's strategic approach offers valuable insights for corporate minds:

- Capital Efficiency: Bitcoin-Backed Preferred Shares efficiently attract yield-seeking capital without excessive reliance on common equity, providing a stable capital source with lesser maturity constraints.

- Market Adaptation: Adapting strategies to fit the nuances of local markets, as Metaplanet does in Japan, is key for success, unlike the U.S. market where Strategy thrived.

- Bitcoin Legitimization: Every Bitcoin-Backed Preferred Share finding a place in regulated, yield-centric portfolios chips away at Bitcoin's speculative image, paving the way for wider acceptance globally.

Metaplanet's journey signifies more than just a financial move; it's a step towards integrating Bitcoin into national capital markets. As they pioneer this path in Japan, the future holds the promise of a new era where Bitcoin becomes a staple in fixed income strategies. Exciting times lie ahead!

CFTC

How To

The best way online to buy gold or silver

Understanding how gold works is essential before you buy it. Gold is a precious metal similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They are not exchangeable in any currency exchange system. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. For every dollar spent, the buyer gets 1 gram of Gold.

You should also know where to buy your gold. There are a few options if you wish to buy gold directly from a dealer. First off, you can go through your local coin shop. You could also look into eBay or other reputable websites. You may also be interested in buying gold through private sellers online.

Private sellers are individuals that offer gold at wholesale or retail prices. Private sellers charge a 10% to 15% commission per transaction. That means you would get back less money from a private seller than from a coin shop or eBay. This option can be a good choice for investing in gold because it allows you to control the price.

Another option for buying gold is to invest in physical gold. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks often charge higher interest rates then pawnshops.

A third way to buy gold? Simply ask someone else! Selling gold is easy too. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————-

By: Nick Ward

Title: Metaplanet Triples Assets in Q2 With Bitcoin-Backed Preferred Shares for Japan’s Yield-Starved Market

Sourced From: bitcoinmagazine.com/bitcoin-for-corporations/metaplanet-bitcoin-backed-preferred-shares

Published Date: Wed, 13 Aug 2025 12:02:19 +0000