Exciting news! Bitcoin has skyrocketed to over $117,500 today, bouncing back from a recent low of $114,278 just yesterday, as reported by Bitcoin Magazine Pro. The remarkable surge follows President Donald Trump's official signing of a groundbreaking executive order. This order paves the way for cryptocurrencies like Bitcoin to be integrated into 401(k) retirement accounts.

The Impact of the Executive Order

Empowering Retirement Investments with Cryptocurrency

President Trump's executive order instructs various departments and agencies to explore the inclusion of digital assets in retirement funds. This move aims to provide American workers with more diverse investment options for securing stronger and financially stable retirement outcomes.

Rewriting Financial Rules for the Future

Regulatory Updates for Enhanced Support

The order calls for collaborative efforts among governmental bodies like the Department of Labor, the Treasury Department, and the SEC to evaluate the need for regulatory adjustments. Specifically, the SEC is tasked with amending its rules to facilitate easier access to alternative investment options within retirement accounts, marking a significant step towards modernizing investment strategies.

The Future of Retirement Investments

Bitcoin's Potential in the $8 Trillion 401(k) Market

- 1% … $80 billion

- 2% … $160 billion

- 3% … $240 billion

- 4% … $320 billion

- 5% … $400 billion

- 6% … $480 billion

- 7% … $560 billion

- 8% … $640 billion

- 9% … $720 billion

- 10% … $800 billion

This executive order has the potential to revolutionize Bitcoin's adoption rate. Institutional interest in Bitcoin has been steadily growing, with a notable surge in purchases by institutions. The trend is expected to continue, with institutions acquiring substantial amounts of BTC compared to mining activities.

The Rise of Corporate Bitcoin Adoption

Shaping the Corporate Landscape with Bitcoin Reserves

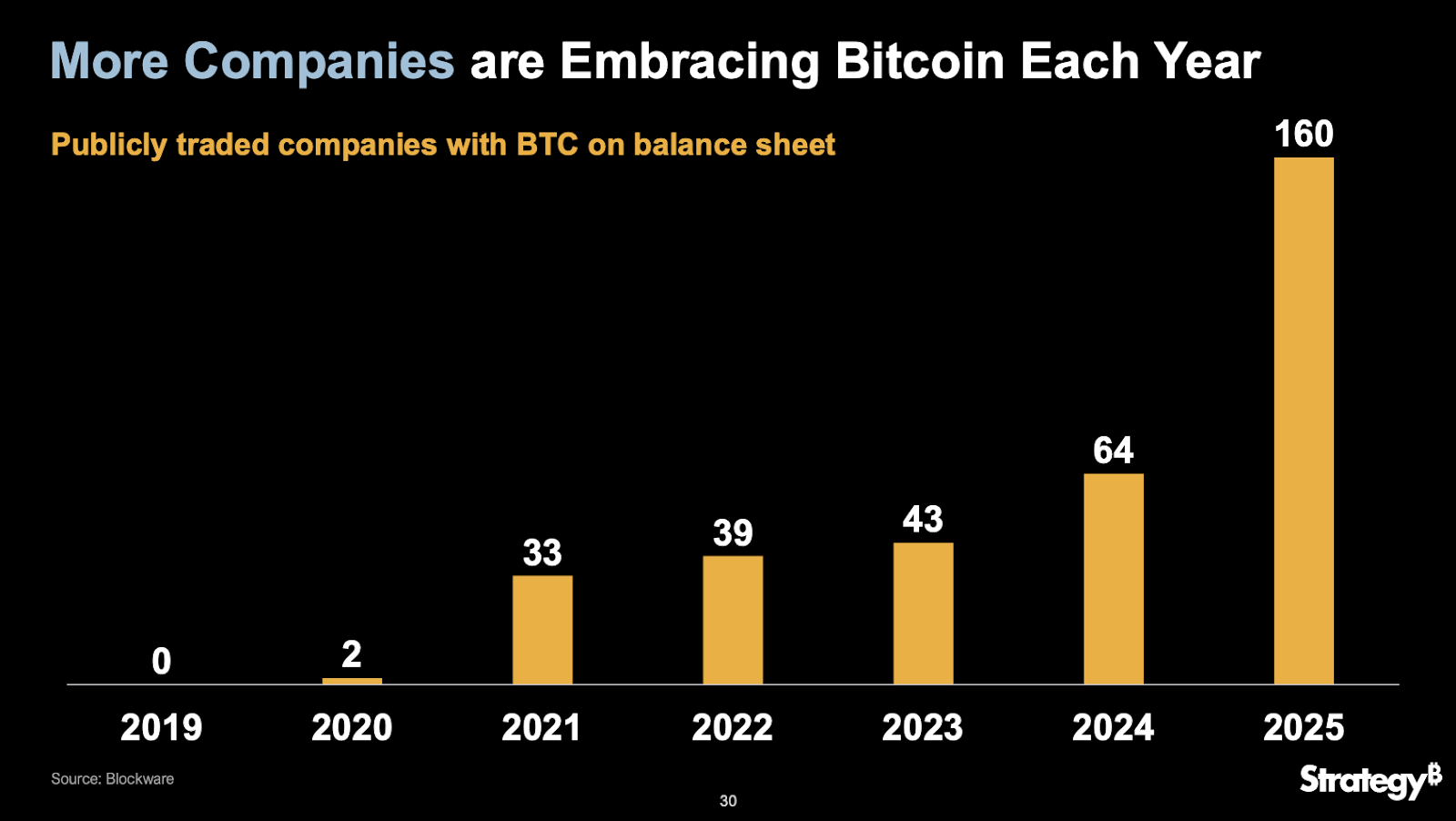

Institutional adoption of Bitcoin is breaking records, with an increasing number of publicly traded companies incorporating Bitcoin into their balance sheets. Leading this trend are companies like Nakamoto and Twenty One Capital, positioning themselves as key players in the corporate Bitcoin treasury space.

Exciting times lie ahead for Bitcoin as it becomes more intertwined with traditional financial systems. The future looks promising for those looking to diversify their investment portfolios and explore the world of cryptocurrencies.

Are you ready to seize the opportunities presented by this new era of financial inclusion and innovation? Dive into the world of Bitcoin and witness the transformative power of digital assets in shaping the future of investments!

CFTC

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Guidelines for Gold Roth IRA

You should start investing early to ensure you have enough money for retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. To ensure sufficient growth, it is vital that you contribute enough each year.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. This makes them a great choice for people who don’t have access employer matching funds.

The key is to save regularly and consistently over time. You will lose any potential tax advantages if you don't contribute enough.

—————————————————————————————————————————————————————————————-

By: Nik

Title: Trump's Executive Order Boosts Bitcoin to $117K with 401(k) Crypto Inclusion

Sourced From: bitcoinmagazine.com/markets/bitcoin-surges-to-117k-as-trump-signs-401k-crypto-order-plans

Published Date: Thu, 07 Aug 2025 19:59:06 +0000