When it comes to valuing bitcoin, traditional methods fall short due to its multifaceted nature. Is it a currency, a commodity, or a monetary network? Well, it's all of them. This complexity opens the door to various valuation approaches that paint a diverse picture of this digital asset.

The Rise of Bitcoin: A Store of Value

The Individual Perspective

Over the past decades, soaring consumer price inflation has chipped away at purchasing power, especially since the fiat standard inception in 1971. Individuals embracing bitcoin as their primary store of value witness a surge in their purchasing power, outshining their peers. This trend sets a benchmark that others strive to match, creating a focal point that guides their financial decisions.

Asset Managers Embrace Change

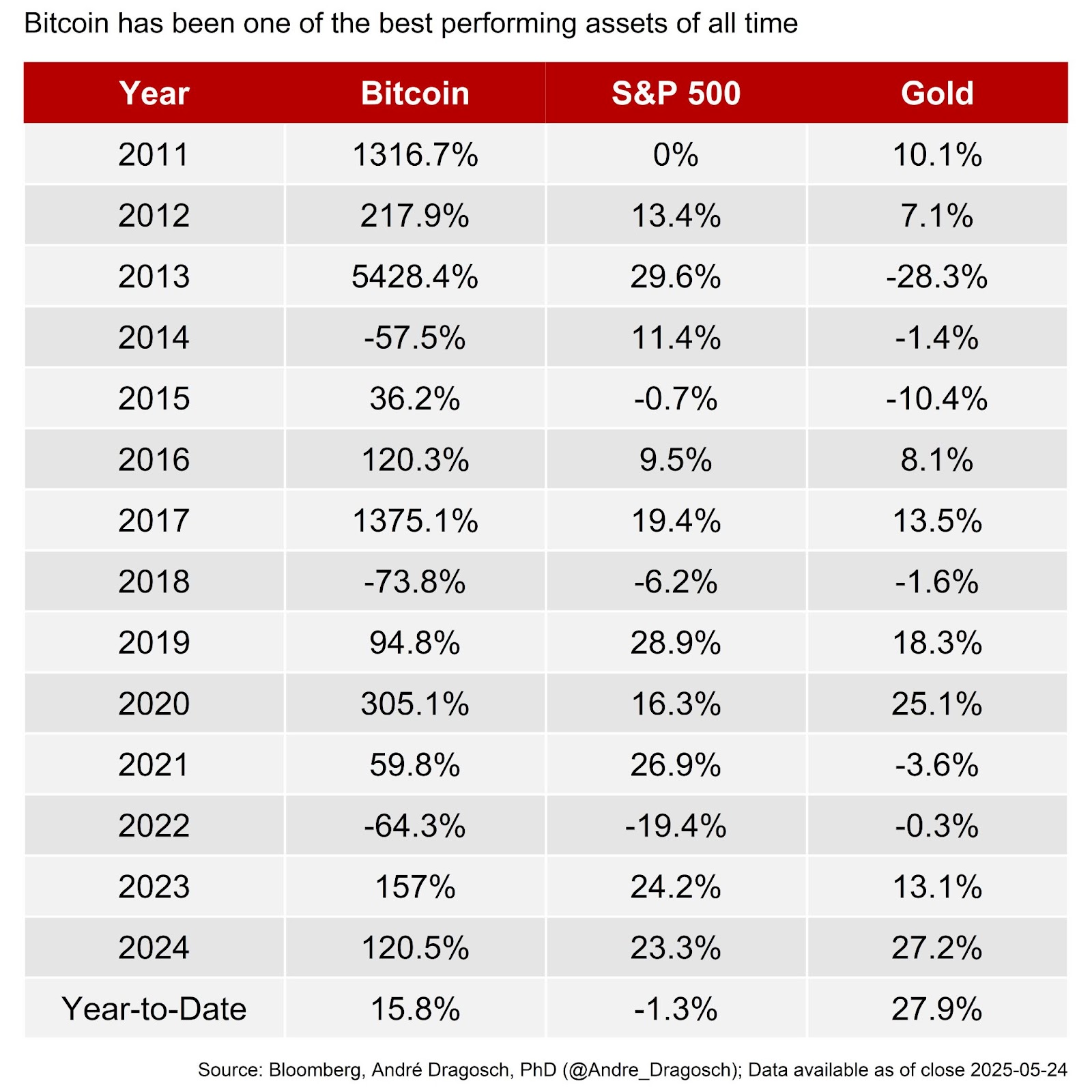

Even a small allocation to bitcoin in a portfolio can significantly boost overall performance without adding excessive risk. Asset managers incorporating bitcoin since 2011 have consistently outperformed peers. The pressure to join this trend will only intensify, nudging others to follow suit to maintain competitiveness and performance metrics.

Corporate Landscape Transformation

Corporations, like Metaplanet, are shifting to a bitcoin standard to shield cash reserves from purchasing power erosion. These strategic moves pay off, as seen in Metaplanet's exponential growth after adopting bitcoin. Similar success stories will push other companies to integrate bitcoin into their balance sheets to stay ahead of the curve.

Nations Embrace the Future

Sovereign adoption of bitcoin brings economic incentives, as demonstrated by El Salvador's path to adopting bitcoin as legal tender. The positive impact on El Salvador's credit rating and economic growth showcases the potential benefits for countries willing to embrace this digital evolution.

Social Dynamics of Bitcoin Adoption

Accelerating Adoption Through Behavioral Phenomena

Bitcoin's adoption is accelerated by network effects, the Lindy effect, and the Dunning-Kruger effect. These behavioral phenomena shape the trajectory of bitcoin's acceptance and utilization in the market.

- Network Effects: As the Bitcoin network expands, its utility grows, driving further adoption and reinforcing its value proposition.

- The Lindy Effect: Bitcoin's resilience and longevity increase with every successful day of operation, enhancing its credibility and potential for sustained growth.

- The Dunning-Kruger Effect: Initial skepticism and critique pave the way for eventual understanding and accelerated adoption as individuals grasp the true value of bitcoin.

Quantitative Model of Bitcoin Adoption

Bitcoin's adoption mirrors a power law, where minor occurrences are frequent, and major ones are rare. This phenomenon is observed in various contexts, from city sizes to virus spread, highlighting how bitcoin's adoption trajectory resembles the propagation of a powerful idea.

Bitcoin's evolution as a monetary technology echoes the spread of a virus, following a power law that accelerates with time. This unique model explains the exponential growth and widespread acceptance of bitcoin in the financial landscape.

Embrace the future of finance with bitcoin and unlock a world of opportunities for growth and financial resilience!

Frequently Asked Questions

How much gold do you need in your portfolio?

The amount of capital required will affect the amount you make. A small investment of $5k-10k would be a great option if you are looking to start small. Then as you grow, you could move into an office space and rent out desks, etc. Renting out desks and other equipment is a great way to save money on rent. It's only one monthly payment.

It is also important to decide what kind of business you want to run. My website design company charges clients $1000-2000 per month depending on the order. This is why you should consider what you expect from each client if you're doing this kind of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. You may get paid just once every 6 months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k-$2k of gold and growing from there.

What does gold do as an investment?

Gold's price fluctuates depending on the supply and demand. Interest rates are also a factor.

Because of their limited supply, gold prices can fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

Should You Buy Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

Although gold prices have shown an upward trend in recent years, they are still relatively low when compared to other commodities like oil and silver.

Some experts believe that this could change very soon. According to them, gold prices could soar if there is another financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

Here are some things to consider if you're considering investing in gold.

- First, consider whether or not you need the money you're saving for retirement. It's possible to save for retirement without putting your savings into gold. Gold does offer an extra layer of protection for those who reach retirement age.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each account offers different levels of security and flexibility.

- Remember that gold is not as safe as a bank account. Your gold coins may be lost and you might never get them back.

Do your research before you buy gold. If you already have gold, make sure you protect it.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

investopedia.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds