When it comes to corporate treasury management, the stakes are high. Traditional assets like cash, bonds, and currencies are not as secure as they may seem. But what if there was a way to reduce counterparty risk and increase financial sovereignty? Enter Bitcoin, the game-changer in corporate treasury strategy.

The Hidden Risks Lurking in Treasury Reserves

Unveiling the Vulnerabilities

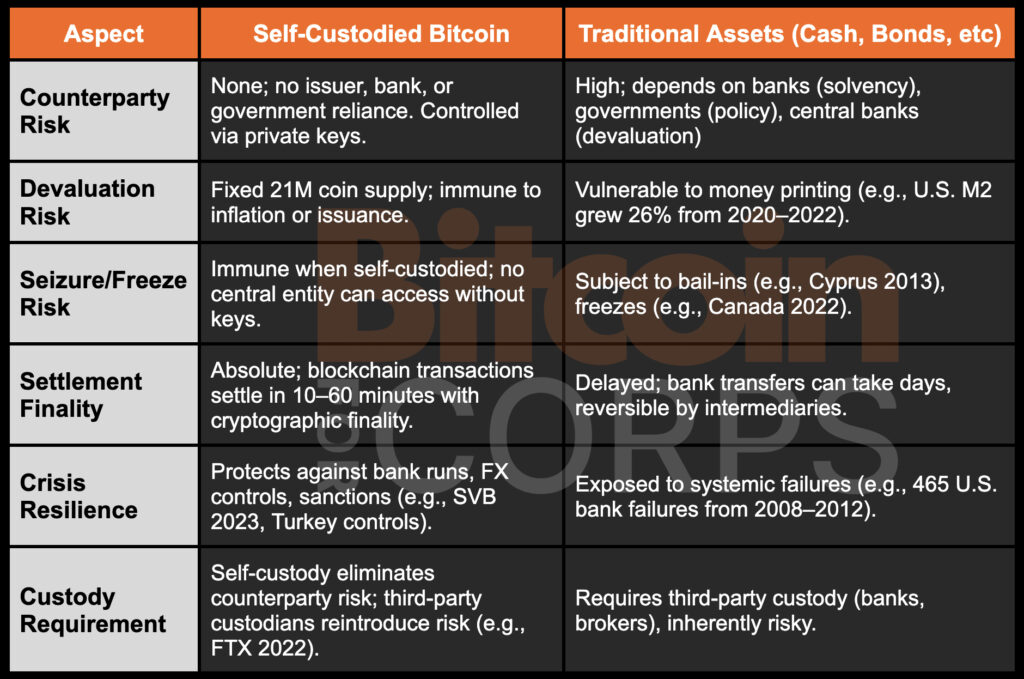

Corporate treasury reserves are meant to provide stability and liquidity. However, they are susceptible to hidden risks tied to conventional financial systems. Assets like cash, government bonds, and money market funds rely on external entities, exposing them to potential dangers:

- Banks: The 2008 financial crisis showed that even major banks can collapse, putting corporate cash at risk.

- Governments: Monetary policy changes can devalue fiat-based reserves, impacting their real worth.

- Central Banks: Unchecked money supply growth can erode the purchasing power of cash reserves.

These dependencies create a fragile foundation for corporate treasuries. In contrast, Bitcoin offers a unique alternative by operating outside the traditional financial system. By self-custodying Bitcoin, corporations can shield their reserves from the failures of intermediaries, positioning it as a key asset for risk mitigation.

Bitcoin: The Sovereign Corporate Capital

Unlocking Financial Sovereignty

Bitcoin's design inherently eliminates counterparty risk when corporations hold their private keys. Self-custodied Bitcoin offers unparalleled financial sovereignty, making it a transformative asset for corporate treasuries:

- No Credit Exposure: Bitcoin's decentralized nature means it has no issuer or debtor, protecting its value.

- No Devaluation via Issuance: With a capped supply and predictable issuance, Bitcoin avoids devaluation risks faced by fiat currencies.

- No Forced Bail-Ins, Freezes, or Capital Controls: Self-custodied Bitcoin cannot be seized or restricted, ensuring corporations maintain control over their capital.

- Bearer Asset with Absolute Finality: Bitcoin transactions settle on a global blockchain, giving direct ownership to corporations without intermediaries.

It's crucial for corporations to self-custody Bitcoin to maintain its counterparty-free nature. By securing their Bitcoin independently, companies can hold capital that is truly resilient to external risks.

Real-World Stress Tests Demonstrating the Necessity

Learning from Past Crises

Recent events have highlighted the vulnerabilities of traditional treasury assets, emphasizing the need for a counterparty-free alternative like self-custodied Bitcoin:

- Cyprus Bail-In (2013): Cash held in Cypriot banks faced losses during a bailout, showcasing the risks of custodial dependence.

- Canada Trucker Protests (2022): Bank account freezes during protests underscored liquidity risks, which Bitcoin could have mitigated.

- SVB and Credit Suisse Collapses (2023): Liquidity crises at major banks disrupted corporate depositors, highlighting the need for resilient assets like Bitcoin.

- Emerging Markets: Currency devaluations and capital controls in countries like Argentina and Turkey revealed the limitations of traditional assets compared to Bitcoin's global mobility.

These events emphasize that traditional reserves are only as secure as the entities behind them. Self-custodied Bitcoin offers a hedge against such disruptions, empowering corporations to maintain control over their capital in any scenario.

Bitcoin as a Strategic Risk Mitigation Tool

Enhancing Resilience

Self-custodied Bitcoin acts as a long-term store of value and a hedge against disasters, providing corporations with a powerful risk mitigation tool:

- Dual-Purpose Asset: Bitcoin's historical performance and decentralized nature make it a reliable store of value and a protection against systemic failures.

- Highly Portable Capital: Bitcoin's global transferability and minimal fees offer a swift alternative to traditional banking transfers.

- Black Swan Protection: Bitcoin shields treasuries from unexpected events like hyperinflation or capital controls, ensuring value preservation.

- Resilient Growth: Allocating reserves to Bitcoin allows corporations to balance stability with growth opportunities.

However, to maximize these benefits, self-custody is essential. By holding their Bitcoin independently, corporations can leverage its counterparty-free advantages effectively.

Integrating Bitcoin into Corporate Treasury Operations

Practical Implementation

Successfully integrating self-custodied Bitcoin into corporate treasuries involves strategic planning and evolving standards:

- Custody Strategies: Opting for self-custody through hardware wallets or multi-signature setups enhances security and eliminates counterparty risks.

- Evolving Standards: Audit firms and insurance products tailored for Bitcoin holdings help meet regulatory requirements while maintaining control.

- Strategic Deployment: Using Bitcoin as a reserve asset and for crisis management requires clear policies and governance structures.

- Board Governance: Establishing governance protocols ensures secure key management and preparedness for unforeseen events.

By embracing self-custody, corporations can seamlessly integrate Bitcoin into their treasury operations, combining innovation with operational excellence.

In Conclusion

While traditional assets come with hidden counterparty risks, Bitcoin offers a path to financial sovereignty and risk mitigation. Self-custodied Bitcoin serves as a crucial asset in corporate treasuries, providing a shield against systemic failures and ensuring long-term growth potential. As the need for risk diversification grows, Bitcoin emerges not just as a tool but as a fundamental shift towards true financial autonomy for companies.

Frequently Asked Questions

What is the benefit of a gold IRA?

There are many advantages to a gold IRA. You can diversify your portfolio with this investment vehicle. You decide how much money is put in each account and when it is withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. This makes for an easy transition if you decide to retire early.

The best part is that you don't need special skills to invest in gold IRAs. They're readily available at almost all banks and brokerage firms. You don't have to worry about penalties or fees when withdrawing money.

However, there are still some drawbacks. Gold has historically been volatile. It is important to understand why you are investing in gold. Are you looking for safety or growth? Are you trying to find safety or growth? Only when you are clear about the facts will you be able take an informed decision.

You might want to buy more gold if you intend to keep your gold IRA for a long time. One ounce doesn't suffice to cover all your needs. Depending on the purpose of your gold, you might need more than one ounce.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even live with just one ounce. These funds won't allow you to purchase anything else.

Can I keep physical gold in an IRA?

Not just paper money or coins, gold is money. It is an asset that people have used over thousands of years as money, and a way to protect wealth from inflation and economic uncertainties. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Another reason is that gold has historically outperformed other assets in financial panic periods. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

One of the best things about investing in gold is its virtually zero counterparty risk. You still have your shares even if your stock portfolio falls. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold offers liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. The liquidity of gold makes it a good investment. This allows for you to benefit from the short-term fluctuations of the gold market.

What is a Precious Metal IRA and How Can You Benefit From It?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These metals are known as “precious” because they are rare and extremely valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Bullion is often used to refer to precious metals. Bullion is the physical metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. This allows you to receive dividends every year.

Precious metal IRAs do not require paperwork nor annual fees, unlike regular IRAs. Instead, you pay a small percentage tax on the gains. Plus, you can access your funds whenever you like.

How to Open a Precious Metal IRA?

First, decide if an Individual Retirement Account is right for you. You must complete Form 8606 to open an account. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form must be submitted within 60 days of the account opening. After this, you are ready to start investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. And, you have to make contributions regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. This means you can't trade shares of stock and bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option may be offered by some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they are not as liquid or as easy to sell as stocks and bonds. It's also more difficult to sell them when they are needed. Second, they don’t produce dividends like stocks or bonds. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

Should you Invest In Gold For Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold is a safe investment and can also offer potential returns. It is a good choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. Because of this, gold's value can fluctuate over time.

However, this does not mean that gold should be avoided. You should just factor the fluctuations into any overall portfolio.

Another advantage of gold is its tangible nature. Gold is less difficult to store than stocks or bonds. It can also be transported.

You can always access gold as long your place it safe. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. When the stock market drops, gold usually rises instead.

Another advantage to investing in gold is the ability to sell it whenever you wish. Just like stocks, you can liquidate your position whenever you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start with a few ounces. You can add more as you need.

The goal is not to become rich quick. It is to create enough wealth that you no longer have to depend on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

Can I buy gold using my self-directed IRA

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts can be described as financial instruments that are determined by the gold price. They allow you to speculate on future prices without owning the metal itself. However, physical bullion is real gold or silver bars you can hold in your hands.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Lawful – WSJ

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Tips for Investing in Gold

Investing in Gold is one of the most popular investment strategies worldwide. This is due to the many benefits of investing in gold. There are several options to invest in the gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before buying any type gold, it is important to think about these things.

- First, make sure you check if your country allows you own gold. If it is, you can move on. Otherwise, you can look into buying gold from abroad.

- Second, it is important to know which type of gold coin you are looking for. You have the option of choosing yellow, white, or rose gold.

- Thirdly, it is important to take into account the gold price. Start small and move up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversifying your portfolio includes stocks, bonds, mutual funds, real estate, commodities, and mutual funds.

- Don't forget to keep in mind that gold prices often change. You need to keep up with current trends.

—————————————————————————————————————————————————————————————-

By: Nick Ward

Title: Maximizing Corporate Treasury Strategy with Bitcoin: A Counterparty Risk Game Changer

Sourced From: bitcoinmagazine.com/bitcoin-for-corporations/how-bitcoin-reduces-counterparty-risk-in-corporate-treasury-strategy

Published Date: Fri, 20 Jun 2025 11:51:44 +0000