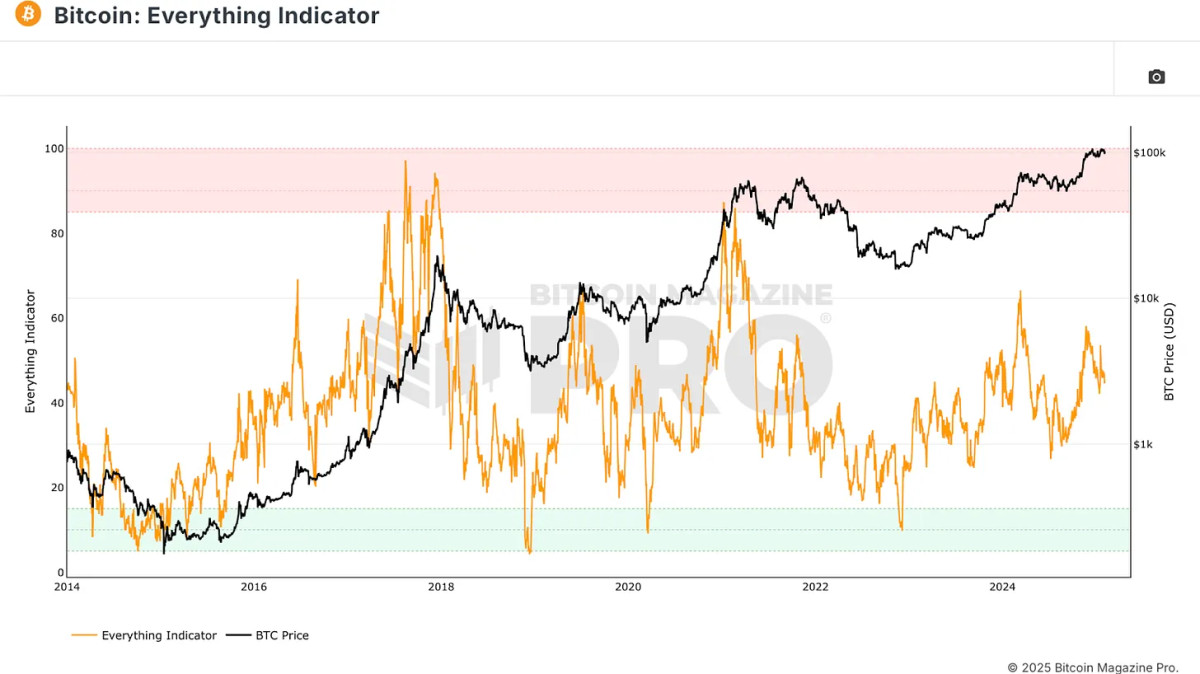

Wouldn’t it be fantastic to have a comprehensive metric to streamline our Bitcoin investment decisions? That’s precisely what the Bitcoin Everything Indicator aims to achieve. Recently integrated into Bitcoin Magazine Pro, this indicator consolidates various metrics into a single framework, enhancing Bitcoin analysis and investment decision-making.

Why a Comprehensive Indicator is Essential

Investors and analysts often rely on different metrics like on-chain data, technical analysis, and derivative charts. However, focusing too much on one aspect can lead to an incomplete understanding of Bitcoin’s price movements. The Bitcoin Everything Indicator addresses this issue by integrating key components into a unified metric.

The Core Components of the Bitcoin Everything Indicator

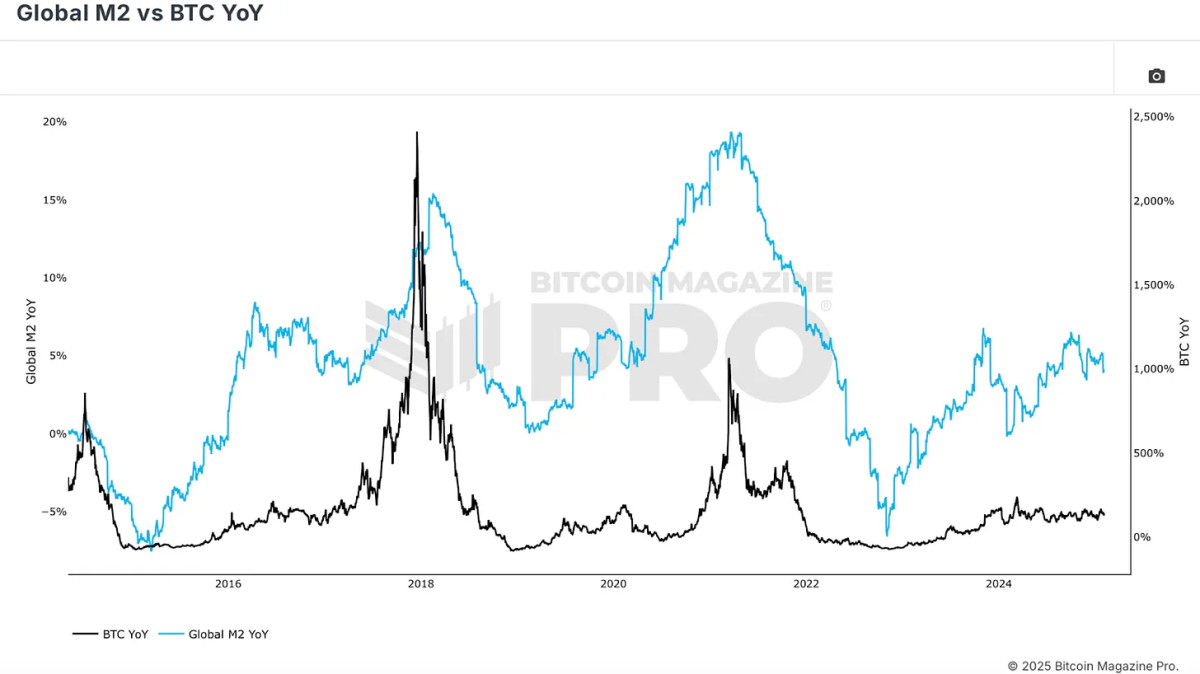

Bitcoin's price movements are significantly influenced by global liquidity cycles, making macroeconomic conditions a crucial factor in this indicator. The correlation between Bitcoin and broader financial markets, particularly Global M2 money supply, is evident. Generally, when liquidity expands, Bitcoin tends to appreciate.

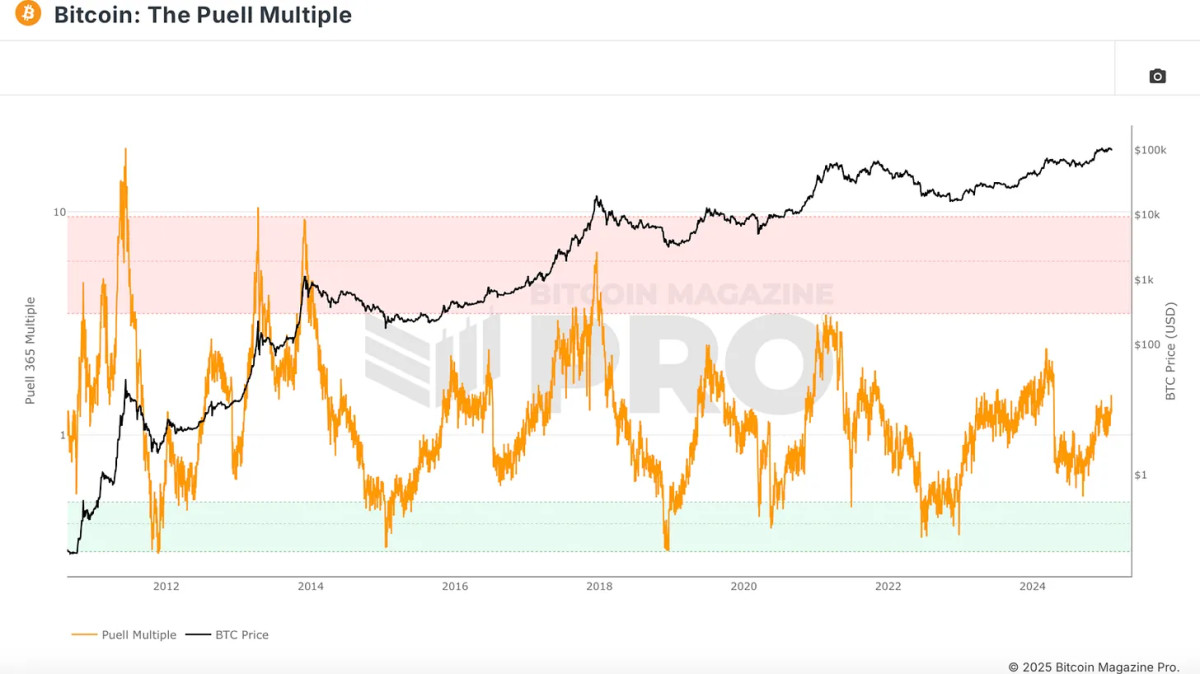

Key fundamental factors such as Bitcoin’s halving cycles and miner strength also play a critical role in its valuation. While halvings reduce new Bitcoin supply, their impact on price appreciation has lessened due to over 94% of Bitcoin’s total supply being in circulation. Nonetheless, miner profitability remains essential. The Puell Multiple, which gauges miner revenue against historical averages, offers insights into market cycles. Historically, strong miner profitability aligns with a favorable Bitcoin position.

On-chain indicators assist in evaluating Bitcoin's supply and demand dynamics. For instance, the MVRV Z-Score compares Bitcoin’s market cap to its realized cap, identifying accumulation and distribution zones to pinpoint overvalued or undervalued periods.

Another crucial on-chain metric is the Spent Output Profit Ratio (SOPR), which analyzes the profitability of spent coins. High profits signal a market peak when realized by Bitcoin holders, while substantial losses suggest a market bottom.

The Bitcoin Crosby Ratio is a technical metric that evaluates Bitcoin’s overextended or discounted conditions solely based on price action, ensuring that market sentiment and momentum are considered in the Bitcoin Everything Indicator.

Network usage can provide valuable insights into Bitcoin’s strength. The Active Address Sentiment Indicator measures the percentage change in active addresses over 28 days, confirming a bullish trend with a rise in active addresses and signaling price weakness with stagnation or decline.

How the Bitcoin Everything Indicator Functions

By blending these diverse metrics, the Bitcoin Everything Indicator ensures no single factor is disproportionately emphasized. Unlike models overly reliant on specific signals like the MVRV Z-Score or Pi Cycle Top, this indicator equally distributes influence across multiple categories, preventing overfitting and enabling adaptation to market changes.

Historical Performance vs. Buy-and-Hold Strategy

An intriguing discovery is that the Bitcoin Everything Indicator has surpassed a simple buy-and-hold strategy since Bitcoin’s valuation was under $6. Employing a strategy of accumulating Bitcoin during oversold conditions and gradually selling in overbought zones, investors utilizing this model would have significantly enhanced their portfolio performance with lower drawdowns.

For example, this model maintains a 20% drawdown compared to the typical 60-90% declines witnessed in Bitcoin’s history. This indicates that a well-balanced, data-driven approach can assist investors in making more informed decisions with reduced downside risks.

Conclusion

The Bitcoin Everything Indicator simplifies investing by consolidating the critical factors influencing Bitcoin’s price action into a single metric. It has historically outperformed buy-and-hold strategies while reducing risk, making it a valuable tool for both retail and institutional investors.

For a more detailed Bitcoin analysis and access to advanced features like live charts, personalized indicator alerts, and in-depth industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes only and should not be construed as financial advice. Always conduct thorough research before making any investment decisions.

Frequently Asked Questions

How much gold should you have in your portfolio?

The amount that you want to invest will dictate how much money it takes. You can start small by investing $5k-10k. As you grow, you can move into an office and rent out desks. So you don't have all the hassle of paying rent. Rent is only paid per month.

It is also important to decide what kind of business you want to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. Therefore, you might only get paid one time every six months.

Decide what kind of income do you want before you calculate how much gold is needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

Can I buy gold with my self-directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts are financial instruments that are based on gold's price. They allow you to speculate on future prices without owning the metal itself. You can only hold physical bullion, which is real silver and gold bars.

What Is a Precious Metal IRA?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These metals are known as “precious” because they are rare and extremely valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Precious metals are sometimes called “bullion.” Bullion refers simply to the physical metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This will ensure that you receive annual dividends.

Precious Metal IRAs don’t require paperwork nor have annual fees. You pay only a small percentage of your gains tax. You can also access your funds whenever it suits you.

How do I open a Precious Metal IRA

The first step is to decide if you want an Individual Retirement Account (IRA). If you do, you must open the account by completing Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be filled within 60 calendar days of opening the account. After this, you are ready to start investing. You may also choose to contribute directly from your paycheck using payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. The process for an ordinary IRA will not be affected.

You'll need to meet specific requirements to qualify for a precious metals IRA. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. You must also contribute regularly. These rules apply to contributions made directly or through employer sponsorship.

You can invest in precious metals IRAs to buy gold, palladium and platinum. You can only purchase bullion in physical form. This means you won't be allowed to trade shares of stock or bonds.

Your precious metals IRA may also be used to invest in precious-metal companies. This option can be provided by some IRA companies.

There are two major drawbacks to investing via an IRA in precious metals. They aren't as liquid as bonds or stocks. It's also more difficult to sell them when they are needed. They also don't pay dividends, like stocks and bonds. So, you'll lose money over time rather than gain it.

How is gold taxed within a Roth IRA

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

The rules governing these accounts vary by state. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York has a maximum age limit of 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

bbb.org

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

finance.yahoo.com

How To

Investing gold vs. stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. The reason behind this is that many people believe that gold is no longer profitable to invest in. This belief stems from the fact that most people see gold prices being driven down by the global economy. They feel that gold investment would cause them to lose money. However, investing in gold can still provide significant benefits. Below are some of them.

One of the oldest currencies known to man is gold. It has been used for thousands of years. It is a valuable store of value that has been used by many people throughout the world. It continues to be used in South Africa, as a way of paying their citizens.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. The price of gold may have fallen, but the production costs haven’t.

Another thing to remember when thinking about whether or not you should buy gold is the amount of gold you plan on purchasing. For example, if you only intend to purchase enough to cover your wedding rings, it probably makes sense to hold off on buying any gold. It is worth considering if you intend to use it for long-term investment. Selling your gold at a higher value than what you bought can help you make money.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We recommend you do your research before making any final decisions. Only then will you be able to make an informed decision.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Introducing the Bitcoin Everything Indicator

Sourced From: bitcoinmagazine.com/markets/introducing-the-bitcoin-everything-indicator

Published Date: Fri, 07 Feb 2025 13:57:13 GMT