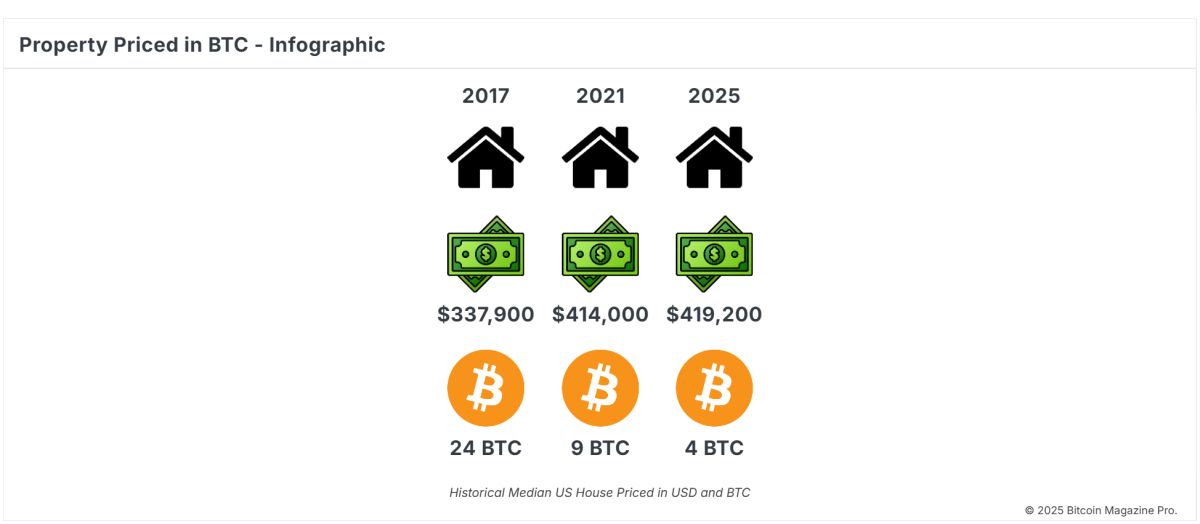

In the current dynamic economic landscape, experienced investors are reassessing their portfolios and exploring the potential of Bitcoin as a viable alternative to traditional assets such as real estate. With its finite supply and significant growth prospects, Bitcoin presents a compelling option for forward-thinking investment strategies.

Real Estate: The Myth of Stability

Real estate has often been perceived as a secure investment for wealth preservation. However, the real estate market is susceptible to systemic risks like interest rate fluctuations, government interventions, and economic downturns. Additionally, property investments entail substantial maintenance costs, taxes, and liquidity constraints.

The Emergence of Bitcoin as a Store of Value

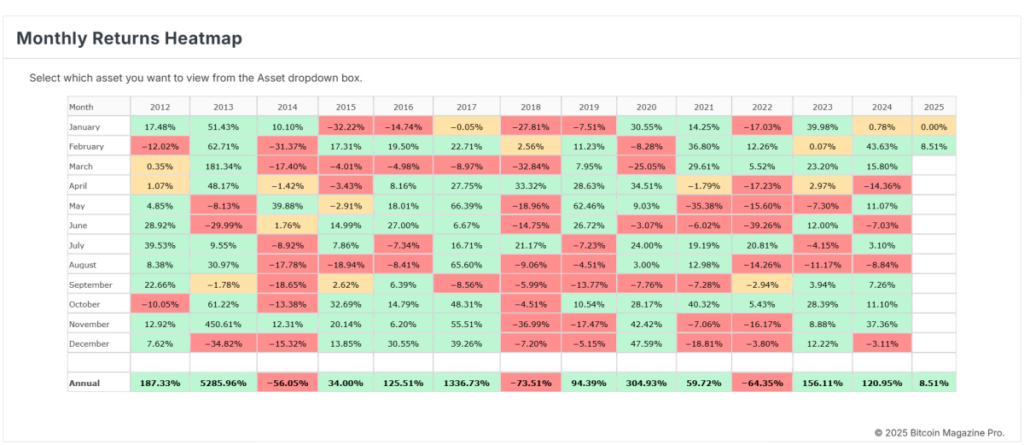

Bitcoin's capped supply of 21 million coins positions it as the "digital gold" of the 21st century. Over the past decade, Bitcoin has consistently outperformed various asset classes, yielding exponential returns despite its volatility. In contrast, the appreciation of real estate is typically linked to inflation and government monetary policies, potentially eroding its actual value over time. Bitcoin, on the other hand, follows a deflationary model, ensuring scarcity and preserving its purchasing power.

Liquidity and Accessibility

Real estate investments often involve prolonged transactions, high fees, and substantial regulatory obstacles. Selling a property can be a time-consuming process, tying up capital and restricting flexibility. Conversely, Bitcoin offers immediate liquidity and can be traded around the clock on global exchanges. This accessibility enables investors to transfer their wealth seamlessly across borders.

Hedging Against Inflation

While real estate prices may reflect inflationary patterns, they often fail to outpace them significantly. Bitcoin, designed as a hedge against the devaluation of fiat currencies, has showcased its resilience during periods of inflation. With central banks continuously printing money at unprecedented rates, Bitcoin's limited supply safeguards its value from monetary devaluation.

Flexibility for Modern Investors

Contemporary investors prioritize flexibility and global reach. Real estate represents a localized, illiquid asset that restricts mobility. In contrast, Bitcoin transcends borders and allows for decentralized ownership without reliance on traditional financial systems. This attribute appeals particularly to younger, tech-savvy investors who value autonomy and control.

A Visionary Outlook for the Future

Bitcoin transcends mere speculation; it embodies a financial revolution. By embracing Bitcoin, savvy investors position themselves at the vanguard of this paradigm shift. As the adoption of Bitcoin expands, its value proposition becomes increasingly evident: a robust, deflationary asset tailored for the modern economy.

While real estate has traditionally been a mainstay in investment portfolios, Bitcoin presents a transformative alternative that resonates with the requirements of a swiftly evolving global economy. For those looking to safeguard wealth, hedge against inflation, and leverage groundbreaking technology, Bitcoin emerges as the preferred asset. The question shifts from "Why Bitcoin?" to "Why not Bitcoin?"

If you seek comprehensive analysis and real-time data, consider exploring Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article serves informational purposes solely and should not be construed as financial advice. Always conduct your research before making investment choices.

Frequently Asked Questions

Can a gold IRA earn any interest?

It all depends on how much you invest in it. If you have $100,000 then yes. If your net worth is less than 100,000, no.

How much money you place in an IRA will determine how it earns interest.

You should consider opening a regular brokerage account instead if you put in more than $100,000 per year for retirement savings.

Although you'll likely earn higher interest, there are greater risks. You don't want your entire portfolio to go bankrupt if the stock markets crash.

An IRA is better if you have $100,000 to invest per year. You can do this until the market grows again.

Are gold IRAs a good place to invest?

The best way to invest in gold is by buying shares in companies that mine for it. To make money in investing in gold or other precious metals, such as silver, you should purchase shares in these companies.

However, there are two drawbacks to owning shares directly:

Holding on to your stock for too many years can lead you to losing money. Stocks can fall more than their underlying asset (like, gold) when they decline. That means you could end up losing money instead of making it.

Second, waiting for the market to recover before selling your gold holdings could result in you missing out on potential profits. It is possible to wait until the market recovers before selling your gold.

Physical gold can be beneficial if you prefer to keep investments separate from your finances. An IRA in gold can diversify your portfolio and protect you against inflation.

Visit our website to learn more about gold investment.

How do you choose an IRA.

Understanding the type of account you have is the first step towards finding an IRA that suits your needs. This is whether you want a Roth IRA, a traditional IRA, or both. You also want to know how much money you have available to invest.

The next step is determining which provider fits your situation best. Some providers offer both, while others can only provide one type of account.

The fees associated with each option should be considered. Fees vary widely between providers and may include annual maintenance fees and other charges. A monthly fee may be charged by some providers depending on how many shares your company holds. Some providers charge only once a quarter.

Which precious metals are best to invest in retirement?

Knowing what you have saved so far and where you plan to save money in the future is the first step towards retirement planning. Start by listing everything you have. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. You can then add up all these items to determine the amount of investment you have.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. A Roth IRA is not able to allow contributions to be deducted from your taxable earnings, but a traditional IRA can. You won't be allowed to deduct tax for future earnings.

You will need another investment account if you decide that you require more money. You can start with a regular brokerage account.

Which type is best for an IRA?

The most important thing when choosing an IRA for you is to find one that fits within your goals and lifestyle. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

The Roth option can be a smart choice if your retirement savings are limited and you don't have any other investments. If you plan to continue working beyond age 59 1/2, and pay income taxes on any account withdrawals, the Roth option may be a good choice.

Traditional IRAs might be more beneficial if you are looking to retire early. You'll likely owe income taxes. The Roth IRA could be more beneficial if you intend to continue working after age 65. This allows you the freedom to withdraw some, or all, of your earnings.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

investopedia.com

kitco.com

en.wikipedia.org

takemetothesite.com

How To

How to open a Precious Metal IRA

Precious metals are one of the most sought-after investment vehicles today. Precious metals are a popular investment option because they provide investors with higher returns than traditional bonds and stocks. It is worth your time to research and plan before you invest in precious metals. If you want to open your own precious metal IRA account, here's what you should know first.

There are two main types of precious metal accounts: physical precious metals accounts and paper gold and silver certificates (GSCs). Each type has its advantages and disadvantages. GSCs and physical precious metals accounts can offer diversification, but they are difficult to trade and easy to access. To learn more about these options, keep reading below.

Physical precious Metals accounts consist of bullion, bullion, and bars. This option is great for diversification, but it has its drawbacks. It is expensive to buy, store, and sell precious metals. Due to their size, it can be difficult for them to be transported from one place to another.

The silver and paper gold certificates are also relatively affordable. They are also easily available and can be traded online. This makes them an ideal choice for those who don’t desire to invest in precious metallics. They aren't as diverse as physical counterparts. Because they are supported by government agencies such the U.S. Mint the value of these assets may decrease if inflation rates increase.

Choose the best account for you financial situation when opening a precious metal IRA. These are some factors to consider before you do this:

- Your risk tolerance level

- Your preferred asset-allocation strategy

- How much time are you willing to put in?

- No matter if you intend to use the funds in short-term trading.

- What tax treatment do you prefer?

- Which precious metals would you prefer to invest in

- How liquid do your portfolio need to be

- Your retirement date

- Where to store precious metals

- Your income level

- Current savings rate

- Your future goals

- Your net worth

- Special circumstances that may influence your decision

- Your overall financial position

- Preference between paper and physical assets

- Your willingness to take risks

- Your ability and willingness to accept losses

- Your budget constraints

- You desire to be financially independent

- Your investment experience

- Precious metals are familiar to you

- Your knowledge of precious metals

- Your confidence in the economy

- Your personal preferences

Once you have decided which type of precious-metal IRA is best for you, it's time to open an account at a reputable dealer. These dealers can be found via referrals, word-of-mouth, and online research.

Once you've opened your precious metal IRA, you'll need to determine how much money you want to put into it. It's important to note that each precious metal IRA account carries different minimum initial deposit amounts. Some accounts only require $100, while others may allow you up to $50,000.

You can invest as much or as little money in your precious metal IRA as you like. A higher initial deposit will help you build wealth over a prolonged period. You might prefer a lower initial deposit if you intend to invest smaller amounts every month.

You have many options when it comes to the type of investments you can make. Here are some of the most common:

- Bullion bars. Rounds, and gold coins.

- Silver – Rounds and coins

- Platinum – Coins

- Palladium Round and Bar Forms

- Mercury – Bar and round forms

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Why Smart Investors Choose Bitcoin Over Real Estate

Sourced From: bitcoinmagazine.com/markets/why-smart-investors-buy-bitcoin-not-real-estate

Published Date: Tue, 04 Feb 2025 21:16:01 GMT