The recent divergence in U.S. Treasury yields, with shorter-term yields decreasing while longer-term yields are increasing, has garnered significant interest in financial markets. This shift provides valuable insights into macroeconomic conditions and potential strategies for Bitcoin investors navigating uncertain markets.

Treasury Yield Dynamics

Treasury yields indicate the return investors require to hold U.S. government debt, serving as a crucial gauge for the economy and monetary policy expectations. Here's a breakdown of the current scenario:

Short-term yields falling:

The decline in short-term Treasury bond yields, like the 6-month yield, suggests market anticipation of potential Federal Reserve rate cuts in response to economic slowdown risks or decreased inflation expectations.

Long-term yields rising:

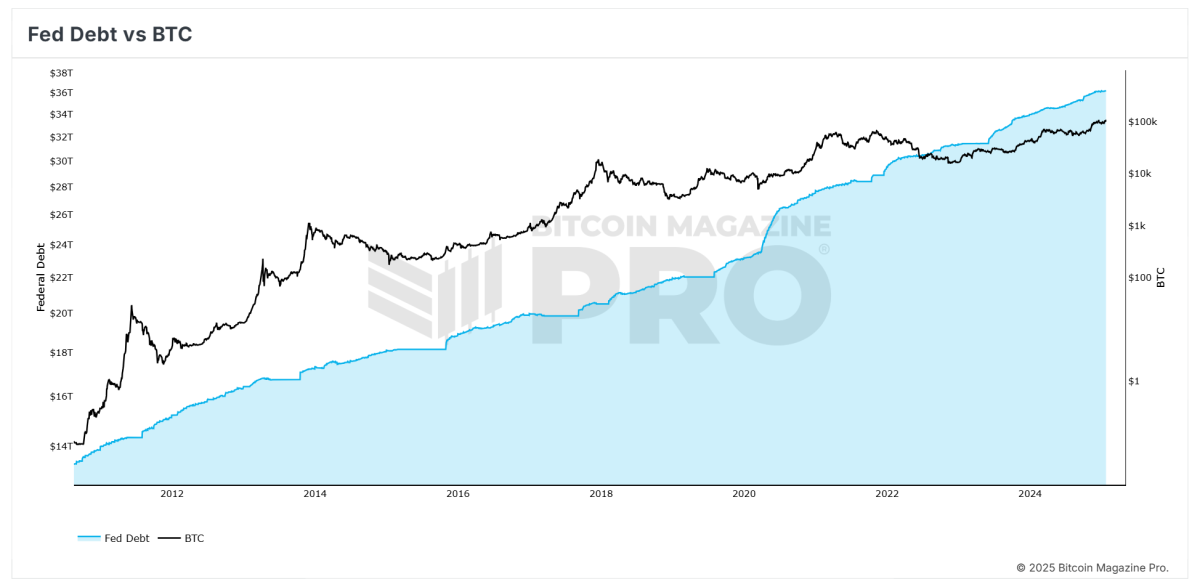

Conversely, the upward trend in longer-term bond yields, such as the 10-year Treasury yield, signals mounting concerns regarding sustained inflation, fiscal deficits, or increased term premiums demanded by investors for holding extended-duration debt.

Significance for Bitcoin Investors

Bitcoin's distinct characteristics as a non-sovereign, decentralized asset render it particularly responsive to macroeconomic trends. The prevailing yield environment could influence Bitcoin in various ways:

Inflation Hedge Appeal:

The rise in long-term yields may signify persistent inflation worries. Historically, Bitcoin has been viewed as a hedge against inflation and currency devaluation, potentially heightening its attractiveness to investors seeking wealth protection.

Risk-On Sentiment:

Decreasing short-term yields might indicate forthcoming relaxed financial conditions. Easier monetary policies often foster a risk-on atmosphere, benefiting assets like Bitcoin as investors pursue higher returns.

Financial Instability Hedge:

Yield discrepancies, especially if leading to an inverted yield curve, can indicate economic instability or recession risks. During such periods, Bitcoin's narrative as a safe-haven asset and alternative to traditional finance may gain prominence.

Liquidity Considerations:

Reduced short-term yields lower borrowing expenses, potentially boosting liquidity in the financial system. This liquidity often spills into risk assets, including Bitcoin, driving upward price trends.

Broader Market Insights

The impact of yield divergence extends beyond Bitcoin to various segments of the financial landscape:

Stock Market:

Diminishing short-term yields typically benefit equities by cutting borrowing costs and bolstering valuation metrics. However, escalating long-term yields can exert pressure on growth stocks, particularly those sensitive to higher discount rates.

Debt Sustainability:

Elevated long-term yields heighten financing costs for governments and corporations, potentially straining heavily indebted entities and creating repercussions across global markets.

Economic Outlook:

The yield disparity might mirror market expectations of sluggish near-term growth combined with prolonged inflationary pressures, indicating potential stagflation risks.

Takeaways for Bitcoin Investors

For Bitcoin investors, comprehending the interaction between Treasury yields and macroeconomic trends is crucial for informed decision-making. Here are key points to consider:

Monitor Monetary Policy:

Stay abreast of Federal Reserve announcements and economic indicators. A dovish stance could benefit Bitcoin, while tighter policies might pose short-term challenges.

Diversify and Hedge:

Increasing long-term yields could induce volatility across asset classes. Diversifying into Bitcoin within a diversified portfolio strategy could help hedge against inflation and economic uncertainties.

Leverage Bitcoin's Narrative:

In a landscape of fiscal deficits and monetary easing, Bitcoin's narrative as a non-inflationary store of value gains traction. Educating new investors on this narrative could drive further adoption.

Conclusion

The divergence in Treasury yields reflects evolving market expectations concerning growth, inflation, and monetary policies—factors with extensive implications for Bitcoin and broader financial markets. Understanding these dynamics and adapting strategies accordingly can unlock opportunities to leverage Bitcoin's unique position in a rapidly changing economic environment. Staying informed and proactive remains pivotal in navigating these intricate times.

For real-time data access, advanced analytics, and exclusive content, visit BitcoinMagazinePro.com.

Disclaimer: This article serves informational purposes only and does not offer financial advice. Readers are advised to conduct thorough independent research before making investment decisions.

Frequently Asked Questions

Which type of IRA could be used for precious metals

Most financial institutions and employers offer an Individual Retirement Account (IRA). This is an investment vehicle that most people can use. An IRA allows you to contribute money that is tax-deferred until it is withdrawn.

An IRA allows for you to save taxes while still paying taxes when you retire. This means you can save money and pay taxes later on the money that you have deposited to your retirement account.

An IRA is a great investment because your earnings and contributions are tax-free. You can withdraw funds at any time. You can face penalties if you withdraw funds before the deadline.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

A 5% IRS penalty is applicable to withdrawals made before the age of 59 1/2. There is a 3.4% penalty for withdrawals between the ages 70 1/2 and 59 1/2.

An IRS penalty of 6.2% applies to withdrawals above $10,000 per year.

What precious metals could you invest in to retire?

First, you need to understand what you have and where you are spending your money. If you don't know how much you currently have saved, start by taking an inventory of everything you own. This includes all savings accounts and stocks, bonds or mutual funds. It also should include certificates of Deposit (CDs), life insurance policies. Annuities, 401k plans, real-estate investments, and other assets like precious metals. To determine how much money is available to invest, add all these items.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. A traditional IRA allows you to deduct contributions from your taxable income, while a Roth IRA doesn't. You won't be allowed to deduct tax for future earnings.

You will need another investment account if you decide that you require more money. Begin with a regular brokerage.

Do you need to open a Precious Metal IRA

This will depend on whether or not you have an investment objective and what level of risk you are willing to accept.

An account should be opened if you are planning to use the money in retirement.

Precious metals will appreciate over time. They also offer diversification benefits.

Furthermore, the prices of gold and silver tend to move together. This makes them an excellent choice for investors in both assets.

You shouldn't invest precious metal IRAs if you don't plan on retiring or aren't willing to take risks.

What are the pros & con's of a golden IRA?

A gold IRA is an excellent investment vehicle for those who want to diversify their holdings but don't have access to traditional banking services. It allows you invest in precious metals like platinum, silver, and gold without any taxes, until they're withdrawn.

The downside is that early withdrawals will result in ordinary income taxes on earnings. But because these funds are held outside of the country, there is little chance of them being seized by creditors when you default on your loan.

A gold IRA is a great option if you want to own gold but not worry about taxes.

Statistics

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

regalassets.com

wsj.com

kitco.com

investopedia.com

How To

How to decide if a Gold IRA is right for you

Individual Retirement account (IRA), is the most widely used type of retirement plan. IRAs may be obtained from financial planners or banks as well as mutual funds and banks. Individuals can contribute as much as $5,000 per year without any tax consequences. You can contribute this amount to any IRA regardless of your age. There are limits to how much money you may put into certain IRAs. You cannot contribute to a Roth IRA if you are under 59 1/2 years of age. Contributions must be made by those under 50 years old. Some employees may be eligible to match contributions from their employer.

There are two types primarily of IRAs. Traditional IRAs can be used to invest in stocks or bonds, as well other investments. Roth IRAs are only available for after-tax dollars. Contributions to a Roth IRA aren't taxed when they come out, but withdrawals taken from a Roth IRA are taxed once again. Some people choose to use a combination of these two accounts. Each type of IRA comes with its own pros and cons. There are pros and cons to each type of IRA. Below are three important things to keep your mind on:

Traditional IRA Pros

- Each company has its own contribution options

- Employer match possible

- You can save up to $5,000 per person

- Tax-deferred Growth until Withdrawal

- Income level may be a factor in some restrictions

- Maximum annual contribution is $5,500 ($6,500 for married couples filing jointly).

- Minimum investment: $1,000

- After age 70 1/2 you are required to begin mandatory distributions

- For an IRA to be opened, you must have at least five-years-old

- Cannot transfer assets from IRAs

Roth IRA pros:

- Contributions are exempt from taxes

- Earnings grow tax-free

- There are no minimum distribution requirements

- The only options for investing are stocks, bonds, or mutual funds

- No maximum contribution limit

- No limitations on transferring assets between IRAs

- An IRA can only be opened by those 55 and older

If you are thinking about opening an IRA, it is important to be aware that not all companies offer exactly the same IRAs. For instance, some companies offer a choice between a traditional or a Roth IRA. Others will give you the option to combine them. It is also important to note that different types IRAs will have different requirements. Roth IRAs don't have a minimum capital requirement. Traditional IRAs only require a $1,000 minimum investment.

The Bottom Line

The most important factor when choosing an IRA is whether you plan to pay taxes immediately or later. If you're planning to retire in the next ten-years, a traditional IRA may be the best option. Otherwise, a Roth IRA could be a better fit for you. Either way, it's always a good idea to consult a professional about your retirement plans. Someone who understands the market will be able to recommend the best options.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Impact of Declining Short-Term U.S. Treasury Yields on Bitcoin Price

Sourced From: bitcoinmagazine.com/markets/how-declining-short-term-u-s-treasury-yields-impact-bitcoin-price

Published Date: Mon, 27 Jan 2025 18:54:56 GMT