As we step into 2025, the Bitcoin market is abuzz with anticipation as investors delve into historical data and seasonal trends to gain insights into what February might have in store. With Bitcoin's cyclical nature often intertwined with its halving events, a look back at historical data can serve as a valuable guide for predicting future performance. By examining Bitcoin's average monthly returns and its past February performances post-halving, we aim to paint a clear picture of what February 2025 could potentially look like.

Decoding Bitcoin's Seasonal Patterns

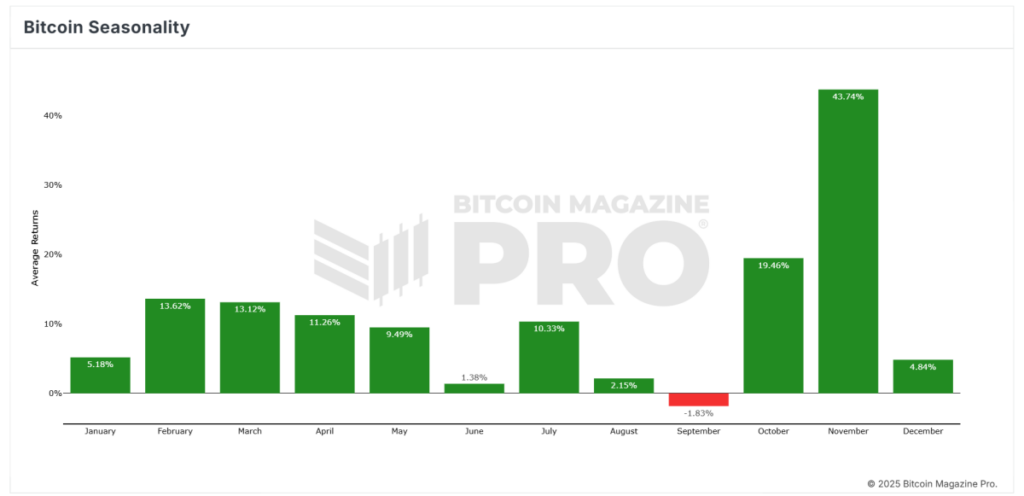

The first point of analysis is the "Bitcoin Seasonality" chart, which showcases the average monthly returns from 2010 to the most recent monthly close. This data highlights Bitcoin's best and worst performing months, shedding light on its cyclical behavior. Historically, February has boasted an average return of 13.62%, positioning it among the stronger months in terms of Bitcoin performance. Notable standouts include November with the highest average return at 43.74% and October at 19.46%. In contrast, September has historically been the weakest month with an average return of -1.83%. With February's solid performance, investors can look forward to potentially positive returns as we head into early 2025.

Historical Performance of February in Post-Halving Years

A deeper dive into Bitcoin's historical February returns in years following a halving event unveils intriguing insights. Bitcoin's halving, occurring approximately every four years, halves block rewards, leading to a supply shock that historically triggers price surges. February in these post-halving years has consistently yielded positive returns:

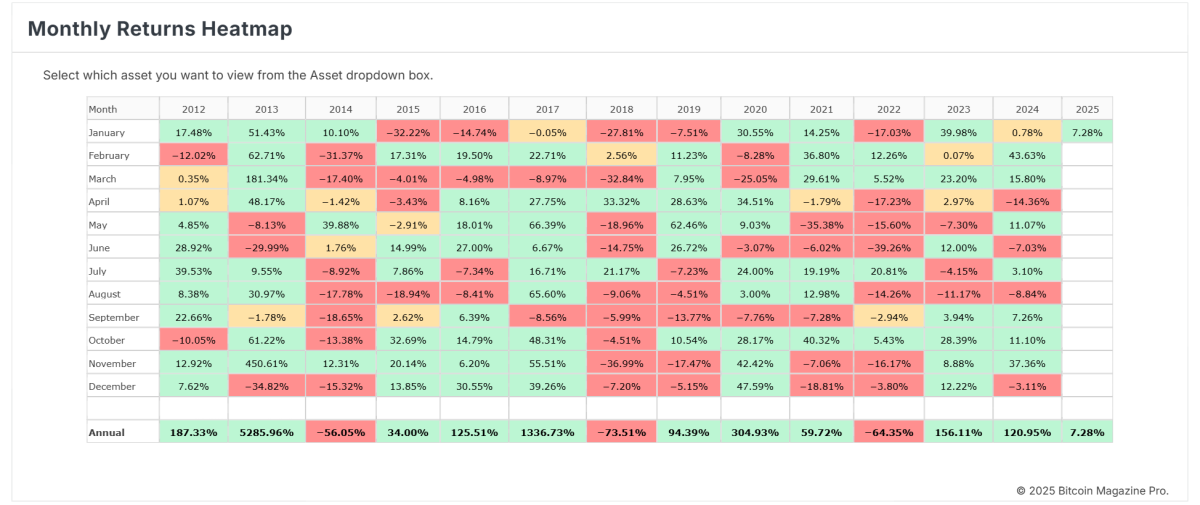

- 2013 (Post-2012 Halving): 62.71%

- 2017 (Post-2016 Halving): 22.71%

- 2021 (Post-2020 Halving): 36.80%

With an average return of 40.74% across these years, each February showcases the bullish momentum often seen post-halving, fueled by reduced supply issuance and heightened market demand.

Setting the Stage: January 2025 Performance

While February 2025 is on the horizon, January witnessed a modest 7.28% return, as depicted in the "Monthly Returns Heatmap." This positive start hints at continued bullish sentiment in the early months of 2025, aligning with historical post-halving trends. If February 2025 mirrors past post-halving years, investors could anticipate returns ranging from 22% to 63%, with an average expectation around 40%.

Drivers of February's Post-Halving Strength

Several factors contribute to February's historical robust performance in post-halving years:

- Supply Shock: The halving curbs new Bitcoin supply, heightening scarcity and fueling price appreciation.

- Market Momentum: Investors typically respond to halving events with heightened enthusiasm, propelling prices upward in the ensuing months.

- Institutional Interest: Recent cycles have seen accelerated institutional adoption post-halving, injecting significant capital inflows into the market.

Key Insights for February 2025

Approaching February 2025 with cautious optimism is advisable. Historical and seasonal data point towards the month holding strong potential for positive returns, especially within the context of Bitcoin's post-halving cycles. With an impressive average return of 40.74% in past post-halving Februarys, investors could anticipate a similar performance this year, barring any major macroeconomic or regulatory challenges.

Bitcoin's history offers a valuable perspective on its future trajectory. February 2025 appears poised for another positive month, driven by the post-halving dynamics that have historically fueled substantial gains. By marrying historical performance data with a favorable regulatory landscape, the incoming pro-Bitcoin administration, and the recent guideline changes by The Financial Accounting Standards Board (FASB), 2025 holds promise as a transformative year for Bitcoin. Investors are advised to blend these insights with comprehensive market analysis and brace for Bitcoin's inherent volatility.

By leveraging historical lessons and seasonal patterns, Bitcoin investors can navigate informed decisions amidst the market's evolution in this pivotal year.

Disclaimer: This article serves for informational purposes only and should not be construed as financial advice. Conduct thorough research before making any investment decisions.

Frequently Asked Questions

What are the three types of IRAs?

There are three types: Roth, Traditional, and SEP. Traditional, Roth, and SEP. Each type offers its advantages and disadvantages. Below, we'll discuss each one.

Traditional Individual Retirement Account (IRA)

A traditional IRA allows you to contribute pre-tax money to an account where you can defer taxes on contributions made now while earning interest. The account can be withdrawn tax-free once you are retired.

Roth IRA

Roth IRAs allow you after-tax dollars to be deposited into an account. Any earnings will grow tax-free. Withdrawals from the account are also tax-free when you withdraw funds for retirement purposes.

SEP IRA

This is similar to a Roth IRA, except that it requires employees to make additional contributions. The additional contributions are taxed but earnings remain tax-deferred. The entire amount can be converted to a Roth IRA if you are leaving the company.

Are precious metals allowed in an IRA?

The answer to this question depends on whether the IRA owner wants to diversify his holdings into gold and silver or keep them for safekeeping.

Two options are available for him if diversification is something he desires. He could either buy bars of physical gold and/or sterling from a dealer or simply sell these items back at the end. Imagine he doesn't desire to sell off his precious metals investments. In that case, he should continue holding onto them as they would be perfectly suitable for storing within an IRA account.

How do I choose an IRA?

Understanding your account type is the first step to finding the best IRA. This is regardless of whether you are looking to invest in a Roth IRA. Also, you should know how much money is available for investment.

The next step is determining which provider fits your situation best. While some providers offer both accounts, others specialize in only one.

Consider the fees that come with each option. Fees vary widely between providers and may include annual maintenance fees and other charges. Some providers charge a monthly cost based on how many shares you own. Some providers charge only once a quarter.

Which is better: sterling silver or 14k-gold?

Although gold and silver can be strong metals, sterling silver is far less expensive as it contains 92% silver instead of 24%.

Sterling silver is also called fine silver. It is made from a combination silver and other metals, such as zinc and copper.

Gold is generally considered to be very strong. It takes a lot of pressure to break it down. If you were to drop an object on top of a piece of gold, it would shatter into thousands of pieces instead of breaking into two halves.

Silver isn't nearly as strong as either gold or silver. If you dropped something onto a sheet made of silver, it would most likely bend and fold easily without breaking.

It is commonly used in coins and jewelry. Its value fluctuates based on demand and supply.

Is it a good idea to have an IRA that holds gold and silver?

This is a great option if you're looking for an easy way of investing in both silver and gold simultaneously. There are other options as well. We are happy to answer any questions you may have about these types of investments. We are always happy to assist!

Statistics

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

External Links

regalassets.com

en.wikipedia.org

kitco.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to Open a Precious Metal IRA

Precious metals remain one of the most highly-valued investment options. Precious metals have a higher return than traditional investments like bonds or stocks, which is why they are so sought-after. However, you need to be careful when investing in precious materials. These are the first things you need to know if you're looking to open a precious metal IRA.

There are two main types for precious metal accounts: paper gold and Silver certificates (GSCs), and physical precious Metals accounts. Each type comes with its own set of advantages and disadvantages. GSCs can be traded and access physical precious metals accounts, which offer diversification benefits. Keep reading to find out more about these options.

Physical precious metals accounts consist of coins, bars, and bullion. Although this option can provide diversification benefits, there are some drawbacks. The costs involved in buying, storing and selling precious metals can be quite high. Due to their size, it can be difficult for them to be transported from one place to another.

However, paper silver and gold certificates are relatively cheap. They can also be traded online and are easily accessible. This makes them ideal for people who don't want to invest in precious physical metals. But, they're not as well-diversified as physical counterparts. Additionally, they are backed by government agencies like U.S. Mint and could lose value if inflation rates rise.

You should choose the account that best suits your financial needs before you open a precious-metal IRA. Before you make that decision, here are some things to consider:

- Your risk tolerance level

- Your preferred asset-allocation strategy

- What time do you have available to invest?

- Whether or not you plan on using the funds for short-term trading purposes

- What tax treatment do you prefer?

- Which precious metal would you like to place your money in?

- How liquid do your portfolio need to be

- Your retirement age

- You'll need somewhere to keep your precious metals

- Your income level

- Your current savings rate

- Your future goals

- Your net worth

- Any special circumstances that may affect your decision

- Your financial overall situation

- Your preference between physical or paper assets

- Your willingness to take risks

- Your ability manage losses

- Your budget constraints

- Financial independence is what you want

- Your investment experience

- Your familiarity in precious metals

- Your knowledge of precious Metals

- Your confidence in economy

- Your personal preferences

After you've decided on the best type of precious metal IRA for you, you can start to open an accounts with a reputable broker. These companies can also be found online, through word-of mouth or referrals.

After you have opened your precious metal IRA account, you will need to decide how much money to put in it. You should note that every precious metal IRA account has a different minimum deposit amount. Some accounts will only accept $100, others will allow for you to invest as high as $50,000.

The amount you invest in your precious-metal IRA is entirely up to you, as stated above. A higher initial deposit will help you build wealth over a prolonged period. On the other hand, if you're planning on investing smaller sums of money every month, a lower initial deposit might work better for you.

As far as the actual precious metals used in your IRA go, you can purchase any number of different types of investments. The most common include:

- Bullion bars, rounds and coins in gold – Gold

- Silver – Rounds and coins

- Platinum – Coins

- Palladium-Bar and Round Forms

- Mercury – Bar and round forms

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Forecasting Bitcoin Price Trends for February 2025

Sourced From: bitcoinmagazine.com/markets/what-bitcoin-price-history-predicts-for-february-2025

Published Date: Thu, 16 Jan 2025 18:24:39 GMT