Bitcoin has been known to adhere to a distinct four-year cycle pattern. As we find ourselves at the midpoint of the current cycle, it is crucial to analyze historical trends, market behaviors, and future possibilities. This article aims to delve into the intricacies of Bitcoin's four-year cycle.

Understanding the 4 Year Cycle

The four-year cycle of Bitcoin is intricately linked to its halving events, which occur every four years and result in a 50% reduction in the block reward for miners. This reduction in supply often leads to supply-demand imbalances that contribute to upward price movements.

One way to visualize this is through the Stock-to-Flow Model, which compares the circulating supply of BTC to its inflation rate and establishes a 'fair value' based on similar hard assets like Gold and Silver.

At present, we find ourselves in the middle of this cycle, indicating a potential phase of significant price surges as the post-halving catch-up period unfolds.

Reflecting on 2022

Looking back two years ago, Bitcoin experienced a major crash triggered by a series of corporate collapses. The downfall of FTX in November 2022, coupled with rumors of insolvency, led to widespread panic selling. This cascade effect extended to other crypto institutions such as BlockFi, 3AC, Celsius, and Voyager Digital, all facing financial turmoil.

Bitcoin's price plummeted from $20,000 to $15,000, instigating market fear and doubts about its sustainability. However, true to its nature, Bitcoin rebounded significantly, surging fivefold from the 2022 lows. Investors who remained steadfast through the turbulence were duly rewarded, underscoring the cyclical resilience of Bitcoin.

Analyzing Investor Sentiment

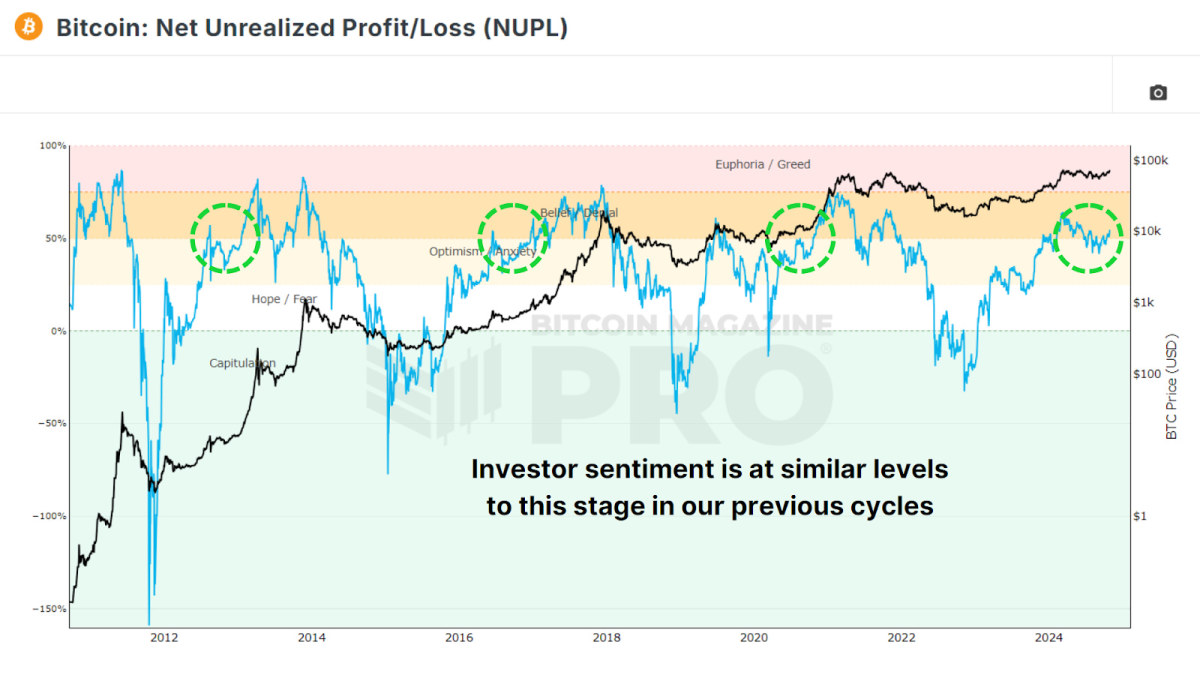

Aside from price trends, investor sentiment also follows a predictable pattern throughout each cycle. The Net Unrealized Profit and Loss (NUPL) metric, indicating unrealized gains and losses, highlights a cycle of emotions ranging from euphoria to fear and capitulation. Investors typically oscillate between fear and optimism as the market transitions from bearish to bullish phases.

Impact of Global Liquidity Cycle

The cyclical nature of global money supply, as reflected in Global M2 YoY vs BTC, aligns closely with Bitcoin's four-year cycle. Periods of economic downturn, marked by low liquidity, often precede Bitcoin's bear market bottoms. Subsequent fiscal expansions by central banks and governments worldwide create favorable conditions for Bitcoin's price appreciation.

Recognizing Historical Trends

Historical price analysis indicates that Bitcoin's current trajectory mirrors past cycles closely. Typically, it takes around 24-26 months for Bitcoin to surpass previous highs from its lows. Following this pattern, significant price increases may be observed until October 2025, with a subsequent bear market potentially emerging.

Looking ahead, a bear phase in 2026 could precede the beginning of a new cycle. While these patterns offer a roadmap based on past behavior, they are not absolute guarantees but rather provide insights for investors to navigate the market effectively.

Final Thoughts

Despite its challenges, Bitcoin's four-year cycle has remained resilient, driven by its unique supply dynamics, global liquidity trends, and investor behavior. Understanding and leveraging this cycle can offer valuable insights into potential price movements. However, it is essential for investors to complement this analysis with on-chain data, liquidity assessments, and real-time sentiment analysis to make informed decisions in a dynamic market environment.

For a detailed exploration of this subject, consider watching a recent YouTube video titled: The 4 Year Bitcoin Cycle – Half Way Done?

Frequently Asked Questions

How much gold should you have in your portfolio?

The amount of capital required will affect the amount you make. If you want to start small, then $5k-$10k would be great. As you grow, you can move into an office and rent out desks. So you don't have all the hassle of paying rent. Rent is only paid per month.

It's also important to determine what type business you'll run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. You might get paid only once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

How does gold perform as an investment?

Gold's price fluctuates depending on the supply and demand. Interest rates can also affect the gold price.

Because of their limited supply, gold prices can fluctuate. There is also a risk in owning gold, as you must store it somewhere.

What Is a Precious Metal IRA?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These are “precious metals” because they are hard to find, and therefore very valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals are sometimes called “bullion.” Bullion refers actually to the metal.

You can buy bullion through various channels, including online retailers, large coin dealers, and some grocery stores.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This ensures that you will receive dividends each and every year.

Precious Metal IRAs don’t require paperwork nor have annual fees. Instead, your gains are subject to a small tax. Plus, you get free access to your funds whenever you want.

What is the value of a gold IRA

A gold IRA has many benefits. It can be used to diversify portfolios and is an investment vehicle. You decide how much money is put in each account and when it is withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This will allow you to transition easily if it is your decision to retire early.

The best part? You don’t need to have any special skills to invest into gold IRAs. They are readily available at most banks and brokerages. You do not need to worry about fees and penalties when you withdraw money.

There are also drawbacks. Gold has always been volatile. It's important to understand the reasons you're considering investing in gold. Are you looking for growth or safety? Is it for security or long-term planning? Only by knowing the answer, you will be able to make an informed choice.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. A single ounce will not be sufficient to meet all your requirements. Depending on the purpose of your gold, you might need more than one ounce.

You don't have to buy a lot of gold if your goal is to sell it. Even a single ounce can suffice. You won't be capable of buying anything else with these funds.

What precious metals can you invest in for retirement?

These precious metals are among the most attractive investments. Both are easy to sell and can be bought easily. These are great options to diversify your portfolio.

Gold: This is the oldest form of currency that man has ever known. It is very stable and secure. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: Silver has always been popular among investors. It's a great option for those who want stability. Silver is more volatile than gold. It tends to rise rather than fall.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. Like gold and silver, it's very durable and resistant to corrosion. However, it's much more expensive than either of its counterparts.

Rhodium: The catalytic converters use Rhodium. It is also used as a jewelry material. It is relatively affordable when compared to other types.

Palladium: Palladium is similar to platinum, but it's less rare. It is also cheaper. It's a popular choice for investors who want to add precious metals into their portfolios.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts