As we enter Q4, a period historically known for strong Bitcoin performance, the latest edition of The Bitcoin Report from Bitcoin Magazine Pro delivers essential insights into the evolving market dynamics of Bitcoin. With a blend of quantitative on-chain data, technical analysis, and macroeconomic perspectives, this report offers a comprehensive look at Bitcoin’s positioning, highlighting critical opportunities and challenges for both investors and market participants.

Key Highlights from the Report:

– Historical Q4 Performance: Bitcoin has averaged a 23.3% return in Q4, showing a strong seasonal trend toward bullish performance.

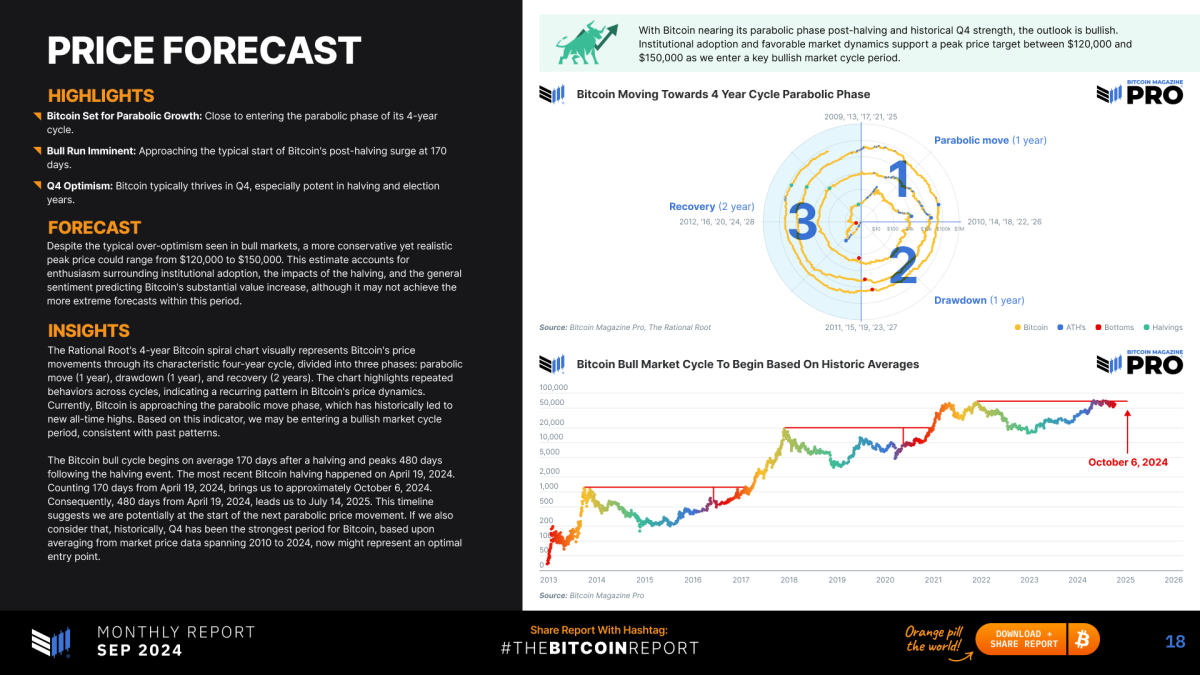

– Breaking Significant Resistance: Recent technical analysis points to Bitcoin breaking through key resistance levels, potentially setting the stage for parabolic growth.

– Derivatives Market Momentum: The derivatives market shows renewed momentum, with rising open interest and reduced leverage across major exchanges.

– Mining Profitability Recovery: Mining profitability has rebounded, with hash price reaching a two-month high, signaling a strengthening of Bitcoin's underlying fundamentals.

– Institutional Accumulation: In September, U.S. Bitcoin ETFs purchased 17,941 Bitcoins—32.9% more than the 13,500 new Bitcoins mined during the same period, indicating significant institutional demand.

Expert Analysis and Insights

Featuring exclusive commentary and insights from leading industry figures like Lyn Alden, The Rational Root, and Julian Liniger, this second monthly edition of The Bitcoin Report is a must-read for both investors and enthusiasts.

The analytical rigor presented in this edition is further enriched by the perspectives of thought leaders such as Philip Swift, Pete Rizzo, Dr. Michael Tabone, Dr. Demelza Hays, Patrick Heusser, Lucas Betschart, Lukas Pfeiffer, Pascal Hugli, and Joël Kai Lenz. Their insights cover a spectrum of issues including macroeconomic policy implications, sector-specific developments, and technical indicators. By leveraging the collective expertise of leading analysts, The Bitcoin Report delivers an unparalleled breadth of analysis, from micro-level on-chain behaviors to macro-level geopolitical and economic drivers influencing Bitcoin's adoption curve.

Share, Discuss, and Engage

We invite you to read and download the September edition, filled with insights that will keep you ahead in this fast-evolving market. Whether you’re managing portfolios, seeking long-term Bitcoin exposure, or simply staying informed, The Bitcoin Report provides the knowledge you need to stay on top of the trend.

Feel free to share the report’s content, take screenshots, and post on social media using the hashtag #TheBitcoinReport. By tracking these conversations, we can improve future editions and continue delivering high-value content to the Bitcoin community.

Opportunities for Sponsorship and Collaboration

Interested in sponsoring future editions of The Bitcoin Report or exploring joint-publication opportunities? Partner with us to gain exposure in the fast-growing Bitcoin space.

For more information, reach out to Mark Mason at mark.mason@btcmedia.org to discuss how your brand can be part of this exciting initiative.

Frequently Asked Questions

What precious metals will be allowed in an IRA account?

The most commonly used precious metal in IRA accounts is, of course, gold. As investments, you can also buy bars and bullion coins made of gold.

Precious metals can be considered safe investments as they don't lose their value over time. They can also be used to diversify investment portfolios.

Precious metals include palladium and platinum. These three metals all have similar properties. Each one has its own uses.

For example, platinum is used in making jewelry. To create catalysts, palladium is used. The production of coins is done with silver.

You should consider the amount you will spend on your gold before you decide which precious metal. You may be better buying gold that is less expensive per ounce.

Also, think about whether or not you wish to keep your investment secret. If so, then you should go with palladium.

Palladium is more expensive than gold. However, it is also rarer. This means you might have to spend more.

Their storage fees are another important factor to consider when choosing between sterling and gold. Gold is stored by weight. If you have larger amounts of gold to store, you will be charged more.

Silver is stored by volume. Therefore, smaller amounts of silver will cost less.

If you decide to store your precious metals in an IRA, follow all IRS rules regarding gold and silver. This includes keeping track of transactions and reporting them to the IRS.

Which type of IRA works best?

When selecting an IRA for yourself, the most important thing is to find one that meets your lifestyle and goals. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

The Roth option may make sense if you are saving for retirement but don't have much other money invested. It also makes sense if you continue working after age 59 1/2 and expect to pay income taxes on any accounts withdrawals.

Traditional IRAs are more suitable if you intend to retire young. However, you will most likely owe taxes on any earnings from those funds. However, if your goal is to retire early, the traditional IRA might be more sensible. The Roth IRA allows you to withdraw some of your earnings or all without paying taxes.

Can I put gold in my IRA?

The answer is yes You can add gold to your retirement plan. Because it doesn't lose any value over time, gold is a great investment. It protects against inflation. You don't even have to pay taxes.

It's important to understand the differences between gold and other investments before investing in it. Unlike stocks or bonds, you can't buy shares of gold companies. These shares can also be not sold.

Instead, convert your precious metals to cash. This means that it will be necessary to dispose of the gold. It is not possible to keep it.

This makes gold an investment that is different from other investments. You can always sell other investments later. This is not true for gold.

The worst part is that you cannot use your gold to secure loans. For example, if a mortgage is taken out, you may have to sell some of your gold in order for the loan to be paid.

What does this all mean? You can't hold onto your gold forever. You will have the need to make it cash someday.

But there's no reason to worry about that now. To open an IRA, all you need is to create one. Then, you can invest in gold.

How much do gold IRA fees cost?

An individual retirement account's average annual fee (IRA) costs $1,000. However, there are many different types of IRAs, such as traditional, Roth, SEP-IRAs, and SIMPLE IRAs. Each type has its own set of rules and requirements. If your investments are not tax-deferred, you might have to pay taxes on the earnings. The amount of time you intend to keep the money must be considered. If you plan to keep your money longer, you can save more money by opening a Traditional IRA instead of a Roth IRA.

Traditional IRAs allow you to contribute up $5,500 annually ($6,500 if 50+). A Roth IRA allows for unlimited annual contributions. The difference is simple. With a traditional IRA you can withdraw the money when you retire and pay no taxes. On the other hand, you'll owe taxes on any withdrawals made from a Roth IRA.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

kitco.com

wsj.com

investopedia.com

en.wikipedia.org

How To

How to determine if a Gold IRA works for you

Individual Retirement Accounts (IRA) are the most popular type. IRAs can also be purchased through banks, mutual funds, financial planners, and other institutions. The IRS allows individuals to contribute up to $5,000 annually without tax consequences. This amount can be deposited into any IRA, regardless your age. There are limits to how much money you may put into certain IRAs. For example, if your age is less than 591/2 years old, you can't contribute to a Roth IRA. Under 50-year-olds must wait until they reach 70 1/2 years of age before you can make contributions. In addition, some people who work for their employer may be eligible for matching contributions from their employer.

There are two types primarily of IRAs. Traditional IRAs let you invest in stocks, bonds, and other investments. Roth IRAs only allow you to make after-tax money. Contributions to a Roth IRA aren't taxed when they come out, but withdrawals taken from a Roth IRA are taxed once again. Some people may choose to use both. Each type of IRA comes with its own pros and cons. Before you decide which type of IRA is right for you, what are the pros and cons? Three things to bear in mind before you decide which type of IRA is best for you:

Traditional IRA pros:

- There are many options for contributing to your company.

- Employer match possible

- Can save more than $5,000 per person

- Tax-deferred growth up to withdrawal

- May have restrictions based on income level

- Maximum annual contribution is $5,500 ($6,500 for married couples filing jointly).

- The minimum investment is $1,000

- After you turn 70 1/2, you can begin receiving mandatory distributions

- For an IRA to be opened, you must have at least five-years-old

- Cannot transfer assets from IRAs

Roth IRA Pros:

- Contributions are free of taxes

- Earnings grow tax-free

- There are no minimum distribution requirements

- Investment options are limited to stocks, bonds, and mutual funds

- There is no maximum amount limit

- No limitations on transferring assets between IRAs

- An IRA can only be opened by those 55 and older

It is important to understand that not all companies offer the exact same IRAs when opening a new IRA. For instance, some companies offer a choice between a traditional or a Roth IRA. Others allow you to combine them. There are different requirements for different types. Roth IRAs have no minimum investment requirements, while traditional IRAs require a minimum $1,000 investment.

The Bottom Line

The most important factor when choosing an IRA is whether you plan to pay taxes immediately or later. If you plan to retire in the next ten years, a traditional IRA might be the best choice. If you are not able to retire within ten years, a Roth IRA may work better for you. Whatever your situation, it's a good idea that you consult a professional about retirement planning. An expert can advise you on the best options and how to navigate the market.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: The Bitcoin Report: Insights into Bitcoin's Market Dynamics in Q4

Sourced From: bitcoinmagazine.com/markets/the-bitcoin-report-parabolic-growth-predicted-for-q4-2024

Published Date: Tue, 08 Oct 2024 15:17:43 GMT