Over the years, the presence of institutional investors in the realm of Bitcoin has been a topic of great interest and speculation among enthusiasts. The idea that large companies and financial entities getting involved in Bitcoin would lead to a surge in market value and sustained price increments seemed simple and promising. However, the actual unfolding of events has proven to be more intricate and nuanced than initially anticipated.

Institutional Accumulation in Bitcoin

The involvement of institutional players in Bitcoin has witnessed a significant uptick in recent times, characterized by substantial investments from major corporations and the emergence of Bitcoin Exchange-Traded Funds (ETFs) earlier this year.

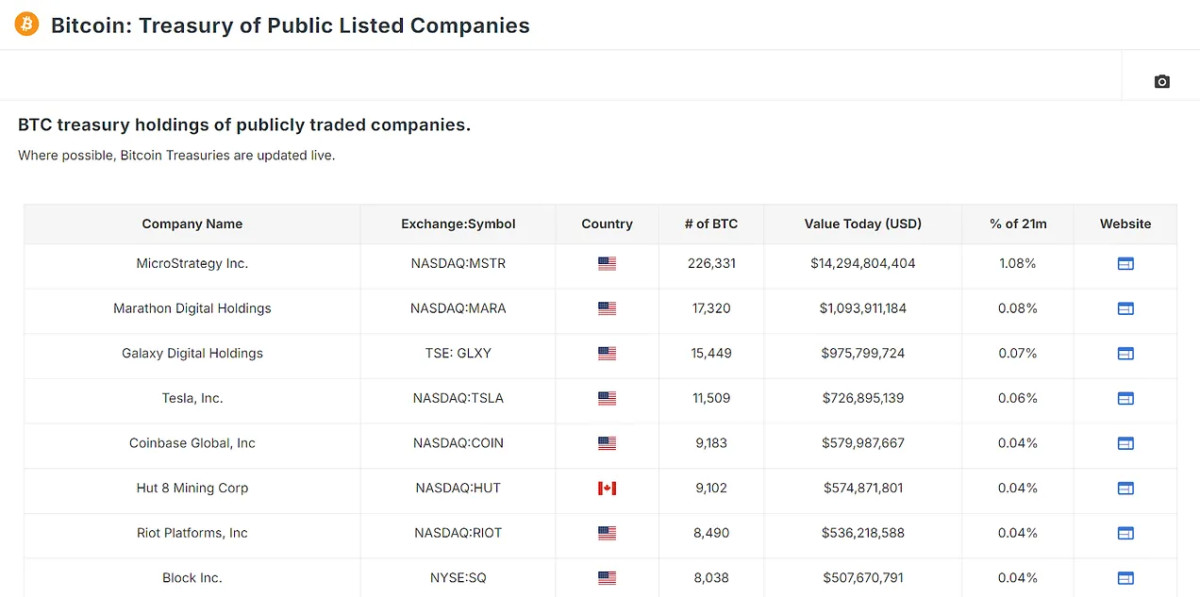

A notable frontrunner in this movement is MicroStrategy, which singlehandedly holds over 1% of the total Bitcoin supply. Following suit are other key players like Marathon Digital, Galaxy Digital, Tesla, and notable Canadian and international firms. A comprehensive overview of these holdings can be accessed through the new Treasury data charts available on the platform.

Collectively, these entities possess over 340,000 bitcoin. However, the introduction of Bitcoin ETFs has been a game-changer. Since their inception, these financial instruments have attracted billions of dollars in investments, resulting in the accumulation of over 91,000 bitcoin in a relatively short span. When combined, private companies and ETFs now control approximately 1.24 million bitcoin, equivalent to about 6.29% of the total circulating bitcoin.

An Analysis of Recent Bitcoin Price Movements

An examination of Bitcoin's recent price trends post the approval of Bitcoin ETFs in January provides valuable insights into the potential future impact of institutional investments. Initially valued at around $46,000, Bitcoin experienced a temporary decline following the approval, reminiscent of a "buy the rumor, sell the news" scenario. However, the market swiftly rebounded, witnessing a remarkable 60% surge in Bitcoin's price within two months.

This surge aligns with the increased accumulation of Bitcoin by institutional investors through ETFs. Should this trend persist, with institutions continuing to purchase at the current or escalated rate, a sustained upward momentum in Bitcoin prices could be on the horizon. The pivotal factor here lies in the assumption that these institutional investors are inclined towards long-term retention of their assets, thereby reducing the liquid supply of Bitcoin and necessitating lesser capital influx to propel prices higher.

The Money Multiplier Effect: Amplifying Influence

The accumulation of assets by institutional players holds significant implications, further amplified by the money multiplier effect. This effect posits that when a substantial portion of an asset's supply is withdrawn from active circulation, as evidenced by the HODL Waves indicating that nearly 75% of supply has remained stagnant for at least six months, the price of the remaining circulating supply becomes more susceptible to volatility. Each dollar injected into the market can have a magnified impact on the overall market capitalization.

For Bitcoin, with only about 25% of its supply being actively traded, the money multiplier effect can wield a potent influence. Assuming a $1 market inflow results in a $4 increase in market cap (4x money multiplier), institutional ownership of 6.29% of all bitcoin could essentially impact around 25% of the circulating supply.

If these institutions opt to divest their holdings, it could trigger a significant market downturn, potentially prompting retail holders to follow suit. Conversely, sustained buying by these entities could lead to a substantial surge in BTC price, especially if they uphold their positions as long-term investors. This underscores the dual nature of institutional involvement in Bitcoin, as it gradually but significantly dictates the asset's trajectory.

Concluding Remarks

The involvement of institutional investors in Bitcoin presents both positive and negative implications. While it bestows legitimacy and capital that could propel Bitcoin to unprecedented heights, the concentration of Bitcoin among a select few institutions could heighten market volatility and pose considerable downside risks upon their exit.

For a more comprehensive exploration of this subject, consider viewing a recent YouTube video at the following link: https://www.youtube.com/embed/2uK3ki9ngAk

CFTC

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not legal – WSJ

finance.yahoo.com

How To

The best place to buy silver or gold online

Before you can buy gold, it is important to understand its workings. Gold is a precious metal similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They can't be exchanged in currency exchange systems. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent by the buyer is worth 1 gram.

Next, you need to find out where to buy gold. There are a few options if you wish to buy gold directly from a dealer. First, you can visit your local coin store. You can also try going through a reputable website like eBay. You can also purchase gold through private online sellers.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers typically charge 10% to 15% commission on each transaction. You would receive less money from a private buyer than you would from a coin store or eBay. This is a great option for gold investing because you have more control over the item’s price.

You can also invest in gold physical. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. Customers can borrow money from pawnshops to purchase items. Banks often charge higher interest rates then pawnshops.

You can also ask for help to purchase gold. Selling gold is also easy. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: The Influence of Institutional Investors on Bitcoin

Sourced From: bitcoinmagazine.com/markets/the-impact-of-institutional-investors-on-bitcoin

Published Date: Fri, 30 Aug 2024 15:45:09 GMT