Introduction

On Friday, the price of bitcoin experienced fluctuations ranging from $41,937 to $43,347, with its market value reaching $846 billion. The day's trading activity amounted to $17.35 billion, indicating increased investor participation and market liquidity, which typically declines as the weekend approaches.

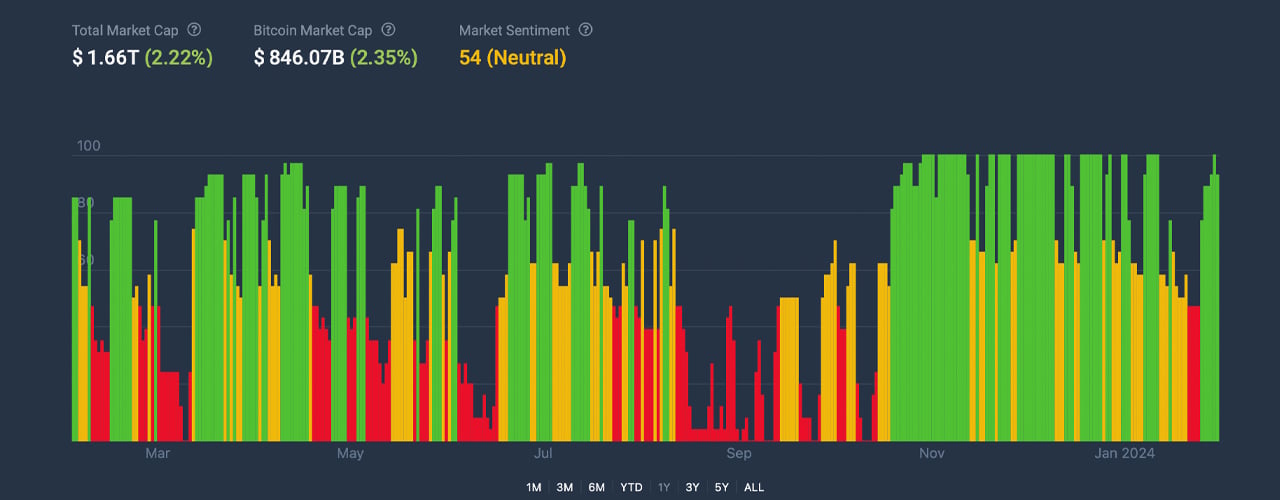

The Current Sentiment towards Bitcoin

The sentiment towards bitcoin (BTC) is currently well-balanced, with a sentiment score of 54. This equilibrium reflects cautious optimism among investors, as they navigate the fine line between bullish and bearish expectations based on technical analysis. Recent variations in the Crypto Fear and Greed Index (CFGI) further highlight this mood, with significant oscillations between levels indicating "greed" and "neutral".

Market Oscillators and Sentiment

Various market oscillators, including the relative strength index (RSI), Stochastic, and commodity channel index (CCI), reflect mixed feelings among market participants. The RSI, at a neutral point of 54, aligns with the sentiment portrayed by other indicators. However, the awesome oscillator suggests a bullish outlook, while the momentum indicator points to bearish tendencies, underscoring the polarized sentiment in the market.

Moving Averages and Support Levels

Both simple moving averages (SMA) and exponential moving averages (EMA) across different time frames consistently indicate bullish prospects. The ascending trend from the 10-day to the 200-day marker suggests strong support for bitcoin's current valuation, despite the day's price swings. The daily chart reveals a notable price dip following the approval of spot bitcoin exchange-traded funds (ETFs), followed by a significant downturn and subsequent rebound.

Resistance Levels and Recovery Phase

Heavy resistance near $49,000 has been identified, with prices currently fluctuating between $42,000 and $43,800. This signals a tentative recovery phase without definitive signs of a trend reversal. The hourly chart displays reduced volatility with a slight upward trajectory, while the 4-hour chart offers a more consolidated perspective, showing a mild upward trend. These resistance levels present potential short-term trading strategies based on breakout or reversal patterns.

Bull Verdict

The analysis of bitcoin's performance on Feb. 2, 2024, highlights its resilience amidst market volatility. The observed price recovery, coupled with decent trading volume, reflects investor confidence and continued liquidity in the market. With moving averages signaling a bullish trend across all periods and the awesome oscillator pointing towards a bull signal, bitcoin demonstrates a solid foundation for price growth. The neutral stance from the RSI, along with positive momentum in the hourly and 4-hour charts, suggests underlying strength in bitcoin's market position.

Bear Verdict

Despite bitcoin's show of resilience on Feb. 2, 2024, several indicators suggest underlying market caution. The significant price drop observed in the daily chart, followed by a hesitant recovery, indicates vulnerability to further sell-offs and the absence of a definitive bullish reversal. Mixed signals from oscillators, particularly the sell signal from the momentum indicator, reflect investor uncertainty and a divided market sentiment. The neutral RSI, combined with resistance levels that capped the day's gains, underscores the challenges ahead for bitcoin.

Register your email here to receive weekly price analysis updates straight to your inbox.

What are your thoughts on bitcoin's market action on Friday? Share your opinions in the comments section below.

CFTC

irs.gov

finance.yahoo.com

bbb.org

How To

The best way online to buy gold or silver

Understanding how gold works is essential before you buy it. Gold is a precious metallic similar to Platinum. Because of its resistance to corrosion and durability, it is very rare. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types today of gold coins. One is legal tender while the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They aren't circulated in any currency exchange systems. For example, a person who buys $100 worth or gold gets 100 grams. This gold has a $100 price. The buyer receives 1 gram of gold for every dollar spent.

You should also know where to buy your gold. There are many options for buying gold directly from dealers. You can start by visiting your local coin shop. Another option is to go through a reputable site like eBay. You can also look into buying gold online from private sellers.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers will charge you a 10% to 15% commission for every transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This is a great option for gold investing because you have more control over the item’s price.

You can also invest in gold physical. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank can offer you a loan for the amount that you need to buy gold. Customers can borrow money from pawnshops to purchase items. Banks tend to charge higher interest rates, while pawnshops are typically lower.

Another way to purchase gold is to ask another person to do it. Selling gold can be as easy as selling. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin Price Analysis: Resilience Amidst Market Volatility

Sourced From: news.bitcoin.com/bitcoin-technical-analysis-btcs-price-resilience-holds-steady-amidst-market-fluctuations/

Published Date: Fri, 02 Feb 2024 13:11:09 +0000