This article provides a heuristic analysis of GBTC outflows, aiming to help readers understand the current state of GBTC selling from a high level and estimate the scale of future outflows that may occur. Please note that this analysis is not intended to be strictly mathematical, but rather serve as a tool for insight.

Number Go Down

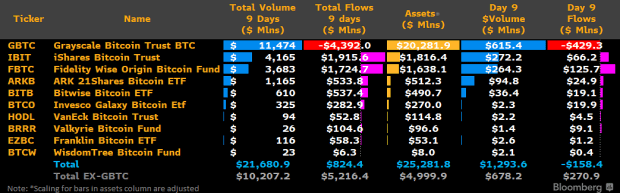

Since Wall Street entered the Bitcoin market through Spot ETF approval, the largest pool of bitcoin in the world, the Grayscale Bitcoin Trust (GBTC), has been continuously selling. At its peak, GBTC held over 630,000 bitcoin. However, after converting from a closed-end fund to a Spot ETF, GBTC's treasury, which accounts for 3% of all 21 million bitcoin, has experienced outflows of over $4 billion during the first 9 days of ETF trading. In contrast, other ETF participants have seen inflows of approximately $5.2 billion over the same period. Surprisingly, despite the negative price action since SEC approval, there have been net inflows of $824 million.

In order to forecast the near-term price impact of Spot Bitcoin ETFs, it is important to understand the duration and magnitude of GBTC outflows. This analysis will review the causes of GBTC outflows, identify the sellers, estimate their stockpiles, and determine the expected duration of outflows. Despite the large projected outflows, it is important to note that these outflows can actually have a medium-term bullish impact on bitcoin, despite the downside volatility that has been experienced post-ETF approval.

The GB

Frequently Asked Questions

What are the benefits of having a gold IRA?

You can save money on retirement by putting your money into an Individual Retirement Account. It will be tax-deferred up until the time you withdraw it. You can decide how much money you withdraw each year. And there are many different types of IRAs. Some are more suitable for students who wish to save money for college. Some are better suited for investors who want higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. But once they start withdrawing funds, those earnings aren't taxed again. This account is a good option if you plan to retire early.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. For people who would rather invest than spend their money, gold IRA accounts are a good option.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. This eliminates the need to constantly make deposits. You could also set up direct debits to never miss a payment.

Finally, gold remains one of the best investment options today. It is not tied to any country so its value tends stay steady. Even in economic turmoil, gold prices tends to remain relatively stable. Therefore, gold is often considered a good investment to protect your savings against inflation.

What is a Precious Metal IRA, and how can you get one?

A precious metal IRA allows for you to diversify your retirement savings in gold, silver, palladium and iridium. These metals are known as “precious” because they are rare and extremely valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals are sometimes called “bullion.” Bullion refers only to the actual metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This ensures that you will receive dividends each and every year.

Precious metal IRAs are not like regular IRAs. They don't need paperwork and don't have to be renewed annually. Instead, your gains are subject to a small tax. Plus, you get free access to your funds whenever you want.

Can I buy gold with my self-directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts are financial instruments based on the price of gold. These financial instruments allow you to speculate about future prices without actually owning the metal. You can only hold physical bullion, which is real silver and gold bars.

How can I withdraw from a Precious metal IRA?

First decide if your IRA account allows you to withdraw funds. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, figure out how much money will be taken out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. You'll have to weigh the pros of each option before you make a decision.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. You will need to count each coin individually. You can track their value by keeping individual coins.

Some people prefer to keep coins safe in a vault. Others prefer to place them in safe deposit boxes. You can still enjoy the benefits of bullion for many years, regardless of which method you choose.

What are the pros and cons of a gold IRA?

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. But, this type of investment comes with its own set of disadvantages.

You may lose all your accumulated savings if you take too much out of your IRA. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

You will also need to pay fees for managing your IRA. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management fees ranging from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. Most insurers require you to own a minimum amount of gold before making a claim. Insurance that covers losses upto $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. You may be limited in the amount of gold you can have by some providers. Others let you pick your weight.

It's also important to decide whether or not to buy gold futures contracts. Physical gold is more costly than gold futures. Futures contracts provide flexibility for purchasing gold. Futures contracts allow you to create a contract with a specified expiration date.

It is also important to choose the type of insurance coverage that you need. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does offer coverage for natural disasters. You might consider purchasing additional coverage if your area is at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs will not be covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

A qualified custodian is required to help you open a Gold IRA. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians cannot sell your assets. Instead, they must hold them as long as you request.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. The plan should also include information about how much you are willing to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will then review your application and mail you a letter of confirmation.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement account