If you want to invest in gold and you're not sure where to start, consider IRA gold. These accounts can help you save money and earn good returns on your investments. However, you must choose the right company for your gold IRA. Choosing the right one will ensure you enjoy maximum profits and minimize headaches. Remember that a company's track record speaks louder than its words. You should also check its testimonials and reputation for fairness.

IRA gold

One of the best ways to invest in precious metals is to open an IRA. These accounts are dedicated solely to precious metals and are tax-free. However, you should note that precious metals don't provide a safe haven, as their prices have historically fluctuated. If you are concerned about inflation, you might consider investing in a high-quality bond.

There are several providers that offer this option. You should check with the Better Business Bureau before making a decision. It is also a good idea to check online reviews of the company you are considering. While most companies have positive customer reviews, the odd negative one will pop up. It is essential to consider the reputation of a gold IRA provider before making the final decision.

It is possible to find a gold IRA company with a spotless reputation. However, you should remember that a gold IRA company's reputation can come under fire if its customers are unsatisfied. For example, a disgruntled customer might write a bad review when the value of his investment drops. It may be wise to work with a reputable gold IRA company that will handle the paperwork and purchases of precious metals for you.

IRA gold investments can be self-directed and can be either a Roth or Traditional IRA. Contribution limits for gold IRAs are the same as those for conventional IRAs. If you are 50 or older, you can contribute an additional $1,000 if you wish. Additionally, if you are investing in a Roth IRA, you can take advantage of a tax deduction for your contributions. However, you will have to pay ordinary income tax on your withdrawals.

Another benefit of owning gold in an IRA is that it offers compound interest. This means that, as your investment grows, the interest earned is added to the principal amount. This process continues until the investment reaches its final maturity or withdrawal date. This allows for a steady growth over time without short-term fluctuations.

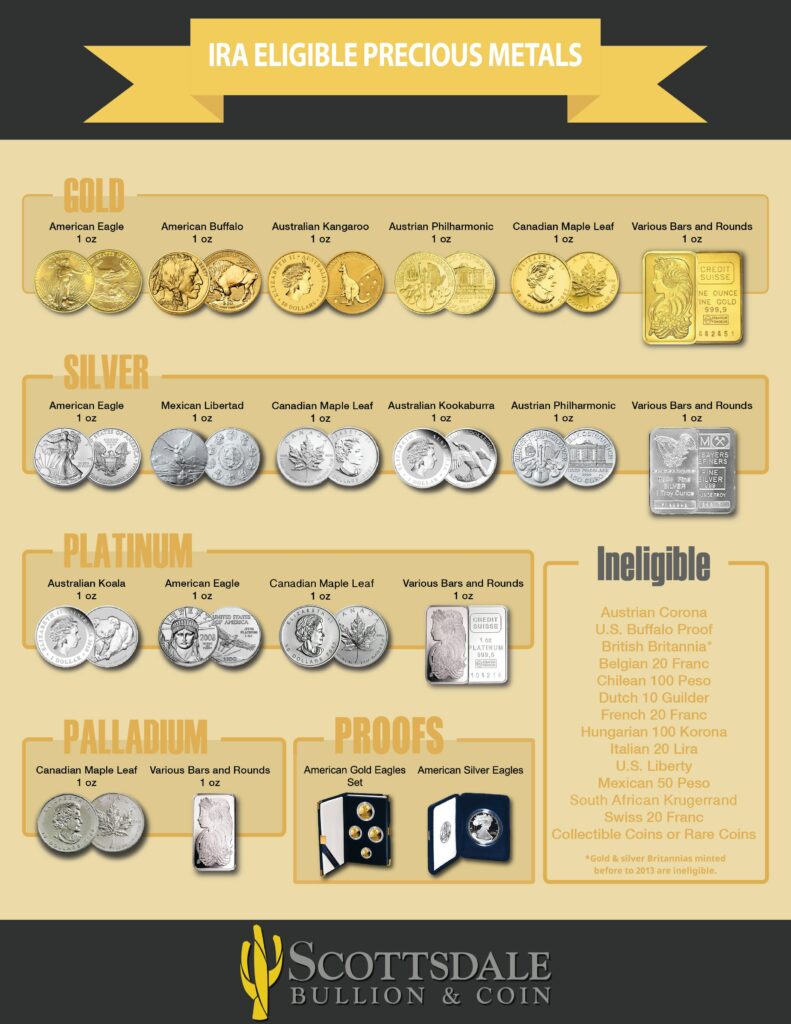

You can purchase gold for your IRA using a variety of methods, but you must make sure that the gold you buy is IRA-friendly and IRS-approved. You should also avoid South African Gold Krugerrand Coins as these are not IRA-approved. However, you should be cautious if a gold IRA company charges you excessively high premiums for bullion.

Another great way to invest in IRA gold is through a self-directed IRA. A self-directed IRA is best for small business owners or self-employed individuals who have access to pre-tax funds. These individuals can contribute on behalf of their workers, and they can choose from an IRS-approved coin, bullion, or bar. Investing in gold is a great way to avoid a financial market crisis and earn massive interest on your investment.

Another great benefit of a gold IRA is the tax-deferred status. This means that you will not have to worry about paying taxes or paying early withdrawal penalties if you take a distribution from it before retirement. As long as you are under age 59 1/2, you should avoid liquidating your gold before retirement.

Frequently Asked Questions

What are the benefits of a Gold IRA?

The best way to save money for retirement is to place it in an Individual Retirement Account. It's tax-deferred until you withdraw it. You have complete control over how much you take out each year. And there are many different types of IRAs. Some are better for those who want to save money for college. Others are intended for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. But once they start withdrawing funds, those earnings aren't taxed again. So if you're planning to retire early, this type of account may make sense.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. For people who would rather invest than spend their money, gold IRA accounts are a good option.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. You won't have the hassle of making deposits each month. You could also set up direct debits to never miss a payment.

Finally, the gold investment is among the most reliable. It is not tied to any country so its value tends stay steady. Even during economic turmoil the gold price tends to remain fairly stable. It is therefore a great choice for protecting your savings against inflation.

Is gold a good choice for an investment IRA?

For anyone who wants to save some money, gold can be a good investment. You can also diversify your portfolio by investing in gold. There is much more to gold than meets your eye.

It has been used throughout the history of currency and remains a popular payment method. It's sometimes called “the world's oldest money”.

Gold, unlike other paper currencies created by governments is mined directly from the earth. That makes it very valuable because it's rare and hard to create.

The supply and demand factors determine how much gold is worth. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. As a result, the value of gold goes up.

On the other hand, people will save cash when the economy slows and not spend it. This increases the production of gold, which in turn drives down its value.

This is why it makes sense to invest in gold for individuals and companies. You will benefit from economic growth if you invest in gold.

In addition to earning interest on your investments, this will allow you to grow your wealth. Additionally, you won't lose cash if the gold price falls.

How much do gold IRA fees cost?

$6 per month is the Individual Retirement Account Fee (IRA). This includes account maintenance fees and investment costs for your chosen investments.

If you want to diversify, you may be required to pay extra fees. These fees can vary depending on which type of IRA account you choose. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

In addition, most providers charge annual management fees. These fees range between 0% and 1 percent. The average rate per year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

investopedia.com

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

The History of Gold as an Asset

From the beginning of history, gold was a popular currency. It was universally accepted and loved for its beauty, durability, purity and divisibility. Because of its intrinsic value, it was also widely traded. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. The United States began minting large quantities gold coins at this time, which led to a drop in the price. The U.S. government needed to find a solution to their debt because there was too much money in circulation. They decided to sell some excess gold to Europe in order to do this.

Because most European countries did not trust the U.S. dollar, they started accepting gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The value of gold has significantly increased since then. Today, although the price fluctuates, gold remains one of the safest investments you can make.